Asian stocks sank and the dollar climbed to more than five-month highs on Tuesday as stronger-than-expected U.S. retail sales for March further reinforced expectations that the Federal Reserve is unlikely to be in a rush to cut interest rates this year.

Geopolitical tensions in the Middle East kept risk sentiment in check, lifting prices of gold and oil, while data showed China’s economy grew 5.3% in the first quarter year-on-year, easily beating analysts’ expectations.

While the GDP data from China was a welcome sign for policymakers, a raft of March indicators released, including property investment, retail sales and industrial output showed that demand remains weak, weighing on investor sentiment.

Yeap Jun Rong, market strategist at IG in Singapore, said markets could still have some reservations, given that areas of weakness persist. “This may inject some uncertainty as to whether the growth momentum can be followed through, as recovery is still very much uneven.”

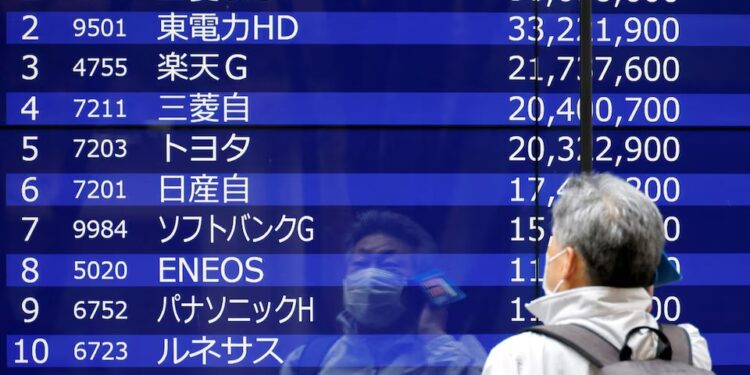

China stocks fell, tracking broader markets, with the blue-chip index down 1%, while Hong Kong’s Hang Seng Index slid 2%.

Stock bourses across Asia fell sharply, with MSCI’s broadest index of Asia-Pacific shares outside Japan plunging more than 2% to two-month low of 518.03.

The sombre mood is set to continue in Europe, with Eurostoxx 50 futures down 1.30%, German DAX futures down 1.15% and FTSE futures down 1.28%.

U.S. stocks closed sharply lower on Monday as a jump in Treasury yields weighed on sentiment amid concerns about rising tensions between Iran and Israel. E-mini futures for the S&P 500 fell 0.14%.

Israelis awaited word on how Prime Minister Benjamin Netanyahu would respond to Iran’s first-ever direct attack on their country. Netanyahu on Monday summoned his war cabinet for the second time in less than 24 hours to weigh a response to Iran’s weekend missile and drone attack, a government source said.

“The markets have come alive with the sound of derisking, deleveraging, hedging and broad managing of risk exposures,” said Chris Weston, head of research at Pepperstone.

“There is certainly not much in the news flow to inspire risk-taking and there is a growing list of factors to refrain from buying and to manage exposures.”

U.S. retail sales rose 0.7% last month, the Commerce Department’s Census Bureau said on Monday, while economists polled by Reuters had forecast retail sales, which are mostly goods and are not adjusted for inflation, would rise 0.3%.

The stronger-than-expected data comes after a report last week underscored inflation remains stickier than markets had expected, leading to a drastic scaling back of rate cuts this year.

Traders now anticipate 45 basis points of cuts this year, down from more than 160 bps in expected easing at the start of the year. Markets are now pricing in September, instead of June, to be the starting point for rate cuts, according to CME FedWatch Tool.

“There is “no urgency” to cut U.S. interest rates, Mary Daly, the president of the San Francisco Federal Reserve Bank, said on Monday, with the economy and labour market strong, and inflation still above the Fed’s target of 2%.

The yield on 10-year Treasury notes was at 4.612% in Asian hours having surged to a five-month high of 4.663% on Monday.

The elevated yields boosted the dollar and kept the yen near 34-year lows it has been rooted at in the past few days.

The dollar index , which measures the U.S. currency versus six rivals, touched a five and half month high of 106.39 earlier in the session and was last at 106.29. The yen weakened to 154.42, leading to fresh worries over intervention and comments from officials. Currencies in emerging markets also slumped.

Carol Kong, a currency strategist at Commonwealth Bank of Australia, said elevated oil prices and expectations of higher- for-longer U.S. interest rates are underpinning the dollar/yen exchange rate.

“The dollar/yen remains at risk of pulling back sharply should the Ministry of Finance decide to step into the FX markets and buy JPY. The weaker the JPY stays, the higher the risk that the Bank of Japan will deliver an earlier rate hike in our view.”

In commodities, U.S. crude rose 0.64% to $85.96 per barrel and Brent was at $90.65, up 0.61% on the day on rising tensions in the Middle East.

Spot gold added 0.2% to $2,387.05 an ounce.

Recent Comments