- The US could breach the debt ceiling and run out of money to pay its debts as soon as June 1.

- Other debt-ceiling crises have been solved through bipartisan deals, but this one is tense.

- Republicans want major spending cuts, and Democrats want a no-strings-attached increase.

When it comes to raising the debt ceiling and averting an entirely preventable economic catastrophe, the US is on a road to nowhere — and time isn’t on Congress’s side.

Treasury Secretary Janet Yellen has said the country could run out of money as soon as June 1. The White House has said that breaching the debt ceiling could lead to a recession on par with the Great Recession — but unlike with the 2008 downturn, this time the government wouldn’t have any money to help soften the blow.

Republicans want to use the debt ceiling as an avenue to cut spending; House Republicans narrowly passed a bill that would slash housing and environmental programs, strengthen work requirements for accessing welfare, and ban student-loan forgiveness. Democrats have said that plan is dead on arrival in the Senate. But alternative routes of averting a crisis — like minting and cashing a trillion-dollar coin or using a constitutional amendment — haven’t caught traction.

Republican lawmakers have insisted that reducing federal spending is necessary to control inflation, even as data has suggested that inflation has cooled throughout the pandemic.

The clock is ticking, and every day without an agreement to raise the debt ceiling brings millions of Americans closer to a catastrophic — and unprecedented — default on the nation’s debt. The Joint Economic Committee has estimated that a default could cost Americans $20,000 in retirement savings as well as increase mortgage payments and private student-loan payments.

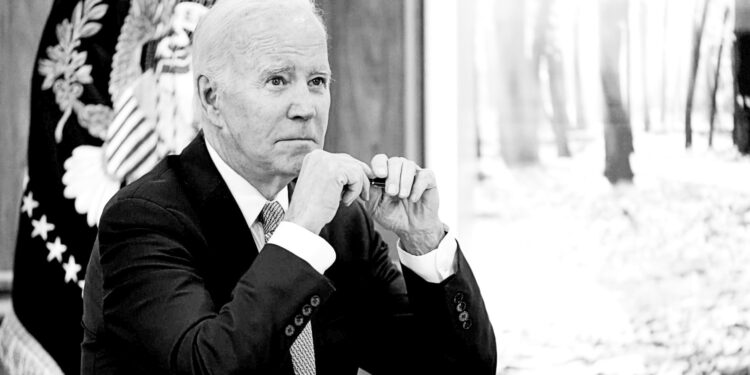

On Tuesday, the president is set to meet with House Speaker Kevin McCarthy, Senate Majority Leader Chuck Schumer, Senate Minority Leader Mitch McConnell, and House Minority Leader Hakeem Jeffries. A White House official previously told Insider that Biden would stress that Congress “must take action to avoid default without conditions.”

“If we go into recession, we can’t count on fiscal policy to help us out here,” said Mark Zandi, the chief economist at Moody’s Analytics. “That makes it more likely that whatever downturn we suffer is going to be more severe and more prolonged. So we desperately want to avoid that.”

Moody’s Analytics has estimated that even a short-term default could lead to a loss of 2.6 million jobs. It found that if the House GOP’s plan were signed into law, the attached spending cuts could lead to a loss of 780,000 jobs.

This might be the closest the US has gotten to a breach.

This debt-ceiling debate is different from 2011’s in a few ways

If the chaos surrounding the debt ceiling sounds familiar, that’s because Congress experienced a similar debacle in 2011. House Republicans, who held the majority under President Barack Obama, demanded spending cuts in exchange for a bill that would raise the debt ceiling and avoid a default.

Two days before the US was set to run out of money to pay its bills, Republicans agreed to raise the debt ceiling in exchange for a promise of future spending cuts, as seen in the Budget Control Act of 2011.

Though that Congress came to an agreement at the last minute, dynamics in Congress now are quite different. The House speaker in 2011, John Boehner, united his party behind an approach to raising the debt ceiling, but McCarthy doesn’t have the same support. McCarthy, who become the speaker after 15 votes in January, spent late nights persuading members of his own party to get on board with his legislation to raise the debt ceiling. He ended up changing his bill to appease some holdouts.

His next major hurdle is getting the bill past the Senate, where some Republicans are working to defend the cuts.

“The way this is being treated is that if we pass this budget, people are going to lose their healthcare, people are going to lose their housing, and it’s being positioned as congressional Republicans are heartless,” Sen. JD Vance, an Ohio Republican, told Insider. “The more heartless thing to do would be to do nothing, to allow the inflation to continue to spiral out of control.”

Sen. Ron Johnson, a Wisconsin Republican, challenged the definition of spending cuts, suggesting that proposing “a little less of an increase” in spending didn’t amount to a cut.

“What the House is doing in general is the minimum of what we need to do to get our fiscal house in order,” he said of the legislation.

Sen. Ted Cruz, a Republican from Texas, said on Wednesday: “The House bill reduces spending to the levels we had in 2022. The last I checked, 2022 was not a horrid apocalypse sweeping across our country.” He added, “The astonishing proposition the Democrats want everyone to believe is that if we don’t keep spending like it’s a pandemic, there will be suffering and misery and cats and dogs will live together in sin.”

Additionally, Wall Street’s response to the debt-ceiling crisis is different this time around. A New York Times report on Monday said that while the S&P 500 fell during the crisis in 2011, stocks haven’t had a similar slide recently, likely because investors are banking on a last-minute deal in Congress.

Some banks, like Goldman Sachs, have moved up the date they anticipate a default, suggesting that concerns about the lack of a debt-ceiling agreement could become amplified.

“I get it, the guys who day-trade may get a little skittish, but we have got to make the hard decisions that drive us toward fiscal responsibility,” GOP Rep. Dusty Johnson told The Washington Post, adding, “We cannot avoid a crisis without a deal, and we cannot cut a deal without a partner.”

Daniel Pfeiffer, who served as a senior advisor to Obama, argued in a New York Times op-ed article published on Monday that Biden was right not to negotiate. The 2011 situation, he said, “left both sides angry about the result and was damaging for the country.” He said that Obama’s approval rating plummeted and that when a similar situation arose in 2013, the GOP’s own approval ratings tanked.

“Allowing the Republicans to use the threat of default as extortion could cripple the remainder of Mr. Biden’s presidency,” Pfeiffer said. Even so, he added, this debt-ceiling crisis “seems much more dangerous” than the ones from the Obama years.

Biden has options to avoid a debt-ceiling crisis that don’t involve Congress

Tuesday’s meeting between Biden and congressional leadership aims to break through the logjam.

As the deadline grows closer and neither Democrats nor Republicans back down, the odds that one side will get its way dwindle.

“Ultimately, both sides are going to have to save face,” Brian Riedl, a senior fellow and economist at the conservative-leaning Manhattan Institute, told Insider. “The president wants to be able to say that he beat back most of the Republican proposals, but Republicans need to come away having said they got something. And so the idea of a clean debt-limit increase is just not tenable. Everybody needs something to save face and say they won.”

Biden doesn’t necessarily need Congress to solve this debt-ceiling crisis. Some options on the table include minting a $1 trillion platinum coin or invoking a clause in the 14th Amendment to declare the debt ceiling unconstitutional.

While those two options would allow the Biden administration to avoid congressional drama and avert an economic catastrophe on its own, some officials haven’t seemed thrilled with them. Yellen told ABC News on Sunday that “there is no way to protect our financial system and our economy other than Congress doing its job and raising the debt ceiling and enabling us to pay our bills.”

“We should not get to the point where we need to consider whether the president can go on issuing debt,” she continued. “This would be a constitutional crisis.”

Source: I N S I D E R

Recent Comments