Balances with utilities are £5bn higher than April 2022 despite cost of living crisis after customers cut usage

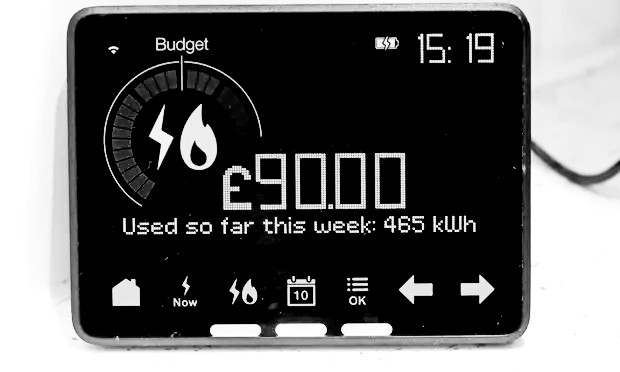

Energy suppliers are hoarding nearly £7bn of customers’ money despite a cost of living crisis that has left some households forced to choose between heating and eating.

More than 16m UK households are collectively in credit by £6.7bn to their suppliers, with half of those holding balances of more than £200, research from comparison site Uswitch.com has shown.

The study said that a combination of mild winter weather and extra consumer effort to reduce energy usage has left companies holding £5bn more in credit than this time last year.

Typically energy customers on direct debits will build up credit during summer, when usage is low, and suppliers will run that down over the winter months when consumption is higher.

However, consumers have complained that energy firms are hoarding hundreds of pounds of their money this winter.

The practice threatens to stretch budgets already tested by the cost of living crisis and further damage the reputation of an industry that has suffered nearly 30 casualties since the energy crisis began in 2021.

Energy companies study wholesale prices and consumers’ historical usage to calculate their annual bills, setting their monthly payments based on this.

The Uswitch research showed that the number of households in credit has risen by 5m, up from 11m households in April 2022, and that more than eight million bill payers are now more than £200 in credit.

The analysis showed the number of consumers in debt had fallen from six million to four million, and the total amount of debt owed had fallen from £1.2bn to £920m. The average amount owed by households who are in debt has risen, however, from £188 to £234.

The Uswitch research showed that customers in Plymouth had the highest average credit balance, at £603, while those in Norwich were most in debt, at £348 on average. Leeds was the city with the highest proportion of households in energy debt, at 19%.

Consumers are entitled to request that money held by their energy supplier is returned to them although just 14% of 2,003 UK energy bill payers said they intended to do this. More than half intend to leave those funds with their supplier to reduce future bills.

Richard Neudegg, director of regulation at Uswitch.com, said: “This high level of any credit suggests that energy-saving awareness campaigns and cost-of-living support have played a part in protecting consumers from what could have been an even more difficult winter.

“It could also raise the question of whether direct debits set by suppliers in reaction to the energy price hikes have been much higher than they needed to be.

“Normally we’d expect to see people exit winter with little or no credit balances, but a substantial number of households have weathered the storm, leaving suppliers sitting on nearly £7bn.”

Neudegg noted that, while wholesale prices have fallen since December meaning bills should soon begin to fall, they would remain high compared with historical averages.

Gas and electricity bills began to rise in 2021 and soared last year as the war in Ukraine led to a surge in wholesale energy prices. The government intervened last autumn to cushion the worst of the effects, subsidising bills through schemes administered via energy companies.

The new research could reignite an industry row over whether customer deposits should be ringfenced. Ofgem, the energy regulator, accused suppliers of using customers “like an interest-free company credit card” but later stopped short of ordering full ringfencing.

Earlier this year, the Guardian reported on the approach to credit balances by each company after accusations from consumers that they were being bullied by their energy suppliers.

Recent Comments