Wall Street was poised to open trading with more losses as investors braced for higher interest rates and inflation worries for the foreseeable future

Wall Street was poised to open trading with more losses Thursday as investors braced for higher interest rates and inflation worries for the foreseeable future.

Futures for the Dow Jones Industrial Average slipped 0.3% as did futures for the S&P 500.

Major U.S. indices have suffered four straight days of declines since Federal Reserve Chair Jerome Powell said last Friday that the central bank will likely need to keep interest rates high enough to slow the economy “for some time” in order to beat back four-decade high inflation.

Through Wednesday, the Dow is down 2.4%, the S&P has lost 2.5% and the Nasdaq is off 2.7%.

“At some point, central banks will discover inflation is remaining high despite their interest rate hikes and they will stop,” said Clifford Bennett, chief economist at ACY Securities. “Unfortunately, for the economy on Main Street, that point is too far off in the distance. It is difficult to see any near-term end in sight for increased caution by consumers and businesses across Europe, China, and the U.S.A.”

The latest pullback for stocks came as Treasury yields rose broadly. The yield on the 10-year Treasury, which influences interest rates on mortgages and other consumer loans, rose to 3.2% from 3.11% late Tuesday.

Bond yields have been rising along with expectations of higher interest rates, which the Federal Reserve has been increasing in a bid to squash the highest inflation in decades.

The last time stocks mounted a big rally was in July and early August, when bond yields came off their highs as expectations of higher rates eased. Higher interest rates also hurt investment prices, especially for pricier stocks such as technology companies.

Traders are now trying to get a better sense of how far and how quickly the Fed’s rate hikes will go. The Fed has already raised interest rates four times this year and is expected to raise short-term rates by another 0.75 percentage points at its September meeting, according to CME Group.

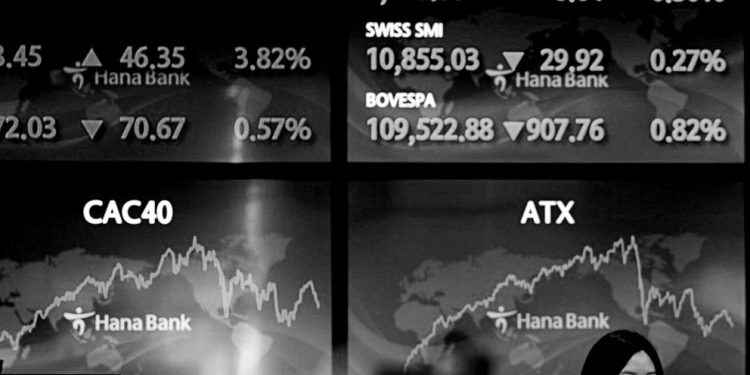

It’s much the same in Europe, where inflation in countries using the euro currency hit a record 9.1% in August, fueled by soaring energy prices mainly driven by Russia’s war in Ukraine.

At midday Thursday, France’s CAC 40 declined 1.2%, while Germany’s DAX slipped 1.1% and Britain’s FTSE 100 fell 1.3%.

Benchmarks finished lower in Asia. Japan’s benchmark Nikkei 225 dipped 1.5% to finish at 27,661.47. Australia’s S&P/ASX 200 dropped 2.0% to 6,845.60. South Korea’s Kospi shed 2.3% to 2,415.61. Hong Kong’s Hang Seng lost 1.8% to 19,597.31, while the Shanghai Composite declined 0.5% to 3,184.98. Oil prices fell.

The slide in the Nikkei came despite signs of improvement in the Japanese economy. A study by the Finance Ministry on corporate financial statements for April-June showed a 17.6% improvement from the same period the previous year.

In energy trading, benchmark U.S. crude fell $1.29 to $88.26 a barrel. Brent crude, the international standard, slipped $1.37 to $94.27 a barrel.

In currency trading, the U.S. dollar rose to 139.23 yen from 139.04 yen. The euro cost $1.0008, down from $1.0054.

Source: abcNEWS

Recent Comments