Stocks saw out the week on the backfoot once again. Initially buoyed at the start of the week by the better-than-expected inflation data, come Wednesday and the Fed signaling rates are set to go higher until it is clear inflation has been tamed, the mood soured again, shifting back to the bearish trends on offer most of the year.

So, these are uncertain times. Volatility is the ruling force in the markets, and investors are looking for some signal that will indicate just which stocks are attractive buys.

Fortunately, the corporate insiders are giving a clear signal – even now, some are making significant buys, of $1 million or more, in their own firms’ stocks, and that’s a signal that should get any investor’s attention.

We’ve use the Insiders’ Hot Stocks tool at TipRanks to find several stocks that have recently been the subject of multi-million dollar insider buys, and we’ve looked up their details along with some recent analyst commentary. So, let’s see what makes these names attractive buys right now.

First up on our list of insiders’ choices is Celcuity, a clinical stage biotech company working on new targeted therapies for the treatment of various cancers. The company is focused on using insights to oncogenic pathways to create drug candidates with a more accurately targeted cancer inhibition activity.

The company has two main research tracks, one based on its drug candidate gedatolisib, and the other based on the proprietary CELsignia platform. Gedatolisib is a potentially groundbreaking therapeutic agent, a first-in-class pan-PI3K and mTOR inhibitor, and it has shown efficacy in several clinical trials. The CELsignia technology uses the patient’s own cancer tumor cells to identify the pathway that drives that particular disease, and allows a precision treatment based on individual patients.

In the pipeline, the most recent update came from the Phase 1b study of gedatolisib as a treatment for advanced breast cancer. A data release earlier this month showed that, no matter their PIK3CA mutation status, patients demonstrated high response rates, and median progression free survival rates of 42.3 months for patients described as ‘treatment naïve’ in the advanced setting.

Also earlier this month, Celcuity announced it had dosed the first patient in the Phase 3 VIKTORIA-1 trial, a study of gedatolisib as a treatment for HR+/HER2 advanced breast cancer. The patient dosing was the primary condition to unlock a $100 million private placement PIPE financing, and made Celcuity eligible to draw down a $20 million tranche on a $75 million debt facility.

Prior to that financial development, Celcuity had $57.5 million in cash and liquid assets and combined G&A and R&D expenses of $10.6 million as of the end of 3Q22.

On the insider front, Celcuity’s largest recent buy was made by CEO Brian Sullivan, who spent a hair under $1.5 million to pick up 260,869 shares of the stock. This ‘informative buy’ brings his total holding in the stock to more than $30 million.

Craig-Hallum analyst Alexander Nowak also takes a bullish stance on Celcuity and highlights the improved cash position. He writes, “The extra liquidity should provide the company more than enough runway to get Geda through its pivotal and likely FDA approval… With the company launching a pivotal trial for what could be a high-potential drug in 2nd line+ breast cancer patients with potential avenues in other cancers, plus in combination with CELsignia, we continue to like the combination and recommend owning the stock through Geda + CELsignia data readouts.”

This recommendation comes along with a $20 price target, suggesting the shares will double in value over the coming year.

This biotech gets a Strong Buy consensus rating from the Street, based on 3 unanimously positive recent analyst reviews. The average price target, of $22.50, implies a robust gain of 125% from the current trading price of $10.01.

Wolverine World Wide, Inc. (WWW)

Next up is Wolverine World Wide, a Michigan-based shoe manufacturing firm known for its Wolverine boots and shoes – as well as its Hush Puppies, Saucony, and Keds brands, among others. Wolverine is also the licensed maker of Caterpillar and Harley-Davidson footwear. The company’s products are truly available worldwide, in more than 200 countries.

In the last quarterly release, for 3Q22, the company posted revenue of $691.4 million, with particular strength in the firm’s Merrell brand which showed sales of $198.6 million. Adjusted diluted EPS came in at 48 cents. Revenues were up 8.5% y/y, while the EPS number was down 14%. Both results came in below expectations, and the stock fell sharply, by 34%, on the release.

The company attributed the top-and bottom-line misses to several headwinds, including a general deterioration in macroeconomic conditions, increased retail promotion costs, and ongoing disruptions in the supply chain.

Nevertheless, with the shares having retreated by 64% year-to-date, one insider must think they now offer excellent value.

The insider trade news on WWW comes from company Board of Directors member Jeffrey Boromisa, who this week bought 100,000 shares for almost $1.05 million. This was a significant buy for the Director, as it increased his total holding in the company to $1.68 million.

This stock has caught the eye of Piper Sandler analyst Abbie Zvejnieks, who sees reason for optimism here, saying of Wolverine, “Not only does WWW’s new brand structure which consists of active, work, and lifestyle make more sense, but we see opportunities for synergies within the brand groups in addition to more clear reporting structures. We think WWW is now investing prudently behind the growth brands (active) while maintained the stable FCF generating brands (work), and we see an opportunity for either divestiture or turn around initiatives in the lifestyle category.”

In-line with these comments, Zvejnieks rates the stock as Overweight (a Buy), with a price target of $23 to indicate confidence in a strong 125% upside for the year ahead.

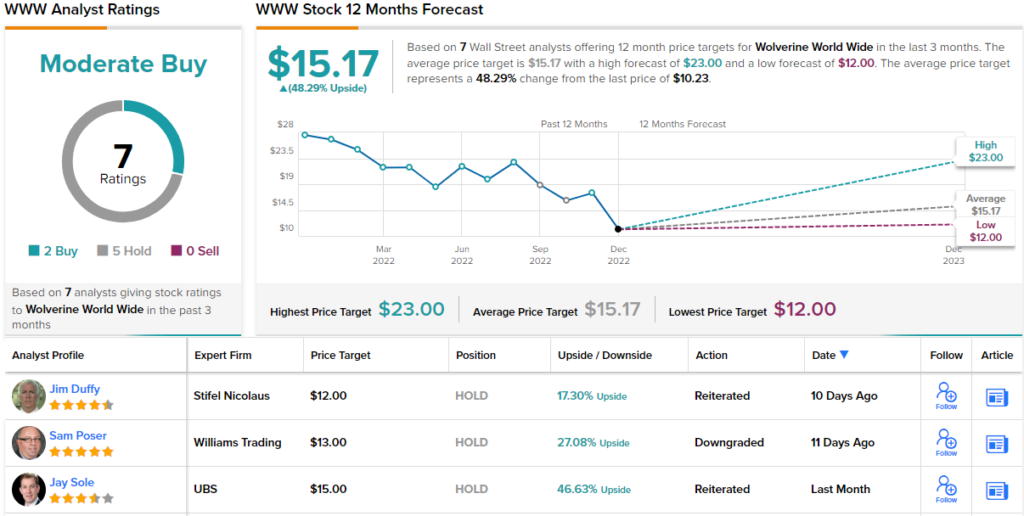

Of the 7 recent analyst reviews here, 2 are to Buy and 5 to Hold, for a Moderate Buy consensus rating. The stock has a current trading price of $10.23 and an average price target of $15.17, implying it can grow as much as 48% by the end of next year.

SoFi Technologies (SOFI)

We’ll wrap up this list with SoFi Technologies, a personal finance company based in San Francisco. The company’s moniker is short for ‘Social Finance,’ which describes SoFi’s approach to banking. The company works online, serving 4.7 million customers with a full range of banking services, including home and personal loans, credit cards, investment banking, refinancing of existing student and car loans, and credit scoring and budgeting.

In its recent Q3 report, SoFi reported a top line of $424 million in net revenue, up 56% from 3Q21 and a company record. This was driven by strong gains in the company’s three business segments, lending, tech platform, and financial services, as well as a 61% year-over-year increase in total member numbers.

At the same time, SoFi, saw a net loss of $74.2 million, or 9 cents per share. The net EPS loss was almost double the 5-cent loss recorded in the year-ago period.

Looking forward, the company raised its full-year revenue guidance, for the third quarter in a row. The raise was modest, from the $1.508 billion to $1.513 billion range to a new range of $1.517 billion to $1.522 billion – but investors should note that the company still sees upward revisions to the full-year revenue despite negative impacts from the extension of student loan payment moratoriums.

The insider sentiment on SOFI has swung positive, in large part due to CEO Anthony Noto’s recent $5.005 million purchase of 1,134,065 shares. The purchase was by far the largest of several Buys that Noto has made in recent months, and pushes his stake in the company up to over $23.8 million.

Noto is hardly the only bull here. Piper Sandler’s 5-star analyst Kevin Barker takes an upbeat stance on the financial company’s prospects, writing following the Q3 print, “We were particularly encouraged to see accelerating deposit growth that will improve the company’s funding profile and decrease reliance on gain on sale to drive revenue. This funding tailwind coupled with an uplift in revenue from student loan refis should keep momentum going into 2023… We expect SOFI to outperform peers as it continues to grow EBITDA and make progress towards GAAP profitability by 4Q23.”

Looking ahead for the stock, Barker puts an Overweight (Buy) rating on SOFI shares, along with an $7.50 price target that implies a potential gain of 62% in the next 12 months.

SoFi Technologies has 11 recent analyst reviews on file, with a breakdown of 7 to 4 favoring Buy over Hold for a Moderate Buy consensus rating. The stock is priced at $4.64 and has an average price target of $7.18, suggesting a 55% one-year upside potential.

Source: TipRanks

Recent Comments