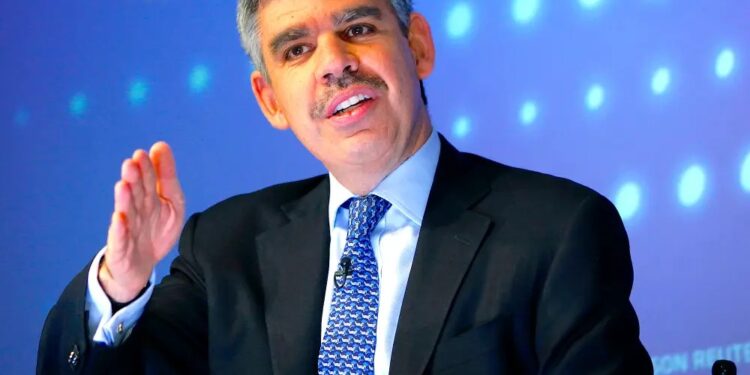

The global economy is headed for a severe recession, Mohamed El-Erian has warned.

The economist expects “more uncertainty in the future as shocks grow more frequent and more violent”.

The recession will be drawn-out rather than “short and shallow”, he added.

Markets should brace for a severe recession that might forever change the world economy, Mohamed El-Erian has warned.

The economist said on Tuesday that a combination of pressures on supply, central bank tightening, and market “fragility” were all likely to weigh on growth.

“Three new trends in particular hint at such a transformation and are likely to play an important role in shaping economic outcomes over the next few years: the shift from insufficient demand to insufficient supply as a major multi-year drag on growth, the end of boundless liquidity from central banks, and the increasing fragility of financial markets,” El-Erian wrote in a Foreign Affairs op-ed.

“These shifts help explain many of the unusual economic developments of the last few years, and they are likely to drive even more uncertainty in the future as shocks grow more frequent and more violent,” he added. “These changes will affect individuals, companies, and governments – economically, socially, and politically.”

El-Erian’s warning comes as institutions including the International Monetary Fund and the Institute of International Finance forecast an economic slowdown next year.

Russia’s invasion of Ukraine in February has led to a tightening of global supply chains, with prices of commodities from crude oil to wheat soaring.

Meanwhile, central banks such as the US Federal Reserve have started to aggressively raise interest rates, which could be starting to tame inflation but will also hit economic growth.

Rate hikes have also exposed vulnerabilities in particular markets, with the S&P 500 falling 15.5% this year and last year’s crypto success story turning sour after major exchange FTX suffered a solvency crisis and eventually filed for bankruptcy.

El-Erian said that analysts need to shift away from the mindset that the downturn will be a short, sharp recession – a way of thinking he warned had driven the Fed’s characterization of inflation as merely “transitory” even as prices crept up last year.

“From the US Federal Reserve’s initial misjudgment that inflation would be ‘transitory’ to the current consensus that a probable US recession will be ‘short and shallow,’ there has been a strong tendency to see economic challenges as both temporary and quickly reversible,” he said.

But “these changes will affect individuals, companies, and governments – economically, socially, and politically,” El-Erian added. “Until analysts wake up to the probability that these trends will outlast the next business cycle, the economic hardship they cause is likely to significantly outweigh the opportunities they create.”

Source: I N S I D E R

Recent Comments