Nubank’s plans to secure a US banking charter mark a pivotal moment in the American fintech landscape, with the Brazilian giant preparing to export its AI-driven playbook into the world’s most competitive financial market. The move signals a direct challenge to incumbent digital banks and mid-tier lenders, as Nubank positions its low-cost, high-automation model for a major US entry.

An AI-native operating model reshapes the competitive field

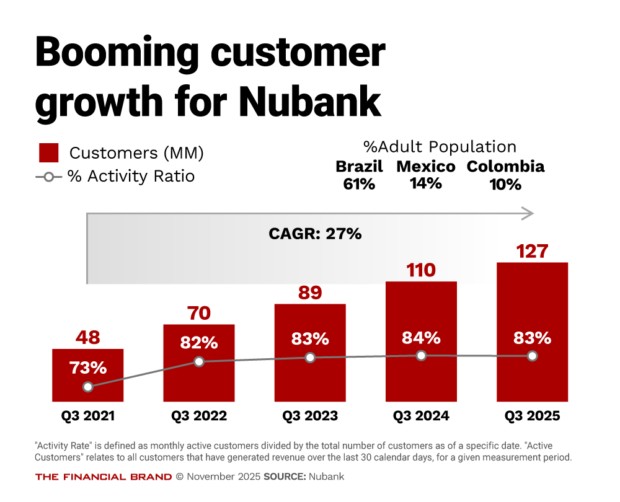

Nubank, now one of the world’s largest digital banks by customer count, has built its global expansion strategy on an architecture few American institutions can match. Its operating model is designed as AI-first, meaning that decision-making, risk modelling, customer interactions, product pricing, and credit underwriting run through advanced machine-learning systems rather than human-centric workflows.

This architecture has allowed Nubank to keep costs exceptionally low while scaling to tens of millions of customers across Latin America. By seeking a US charter, the bank intends to replicate this model in a market where legacy institutions still struggle with high operational costs, fragmented data systems, and slower innovation cycles.

Why US institutions see this as an immediate threat

American digital banks, despite strong branding and niche followings, typically rely on partner banks for core licensing. This limits their margins, slows product rollout, and exposes revenue models to regulatory bottlenecks. A fully chartered Nubank would bypass these constraints entirely

— and enter the market with the cost base of an emerging-market fintech and the capital resources of a global player.

Traditional mid-tier banks are particularly exposed. Their customer acquisition costs, operational overheads, and manual underwriting processes leave them vulnerable to a competitor capable of onboarding millions of users through algorithmic decisioning and AI-driven servicing. Analysts note that Nubank’s credit risk engines, tested in Brazil’s highly complex consumer-credit environment, may give it a notable edge in the US subprime and near-prime segments.

A US charter would unlock a powerful long-term strategy

A charter would enable Nubank to hold deposits, issue credit directly, and manage US customer data under its own regulatory framework. That unlocks a series of strategic levers:

• end-to-end control over product pricing

• faster margin expansion

• deeper integration of AI into compliance and risk management

• the ability to scale US operations without relying on partner banks

The bank’s track record in Latin America suggests that once regulatory approval is secured, product rollout tends to accelerate quickly, with lending, savings, and card services expanding in parallel.

Regulators face pressure to evaluate an AI-run bank at scale

Nubank’s application confronts US regulators with a relatively new challenge: assessing the safety, fairness, and transparency of banking models where AI drives most operational decisions.

While US agencies have been tightening rules on algorithmic bias and data governance, the scale at which Nubank operates could force a wider debate on AI resilience, cross-border data practices, and consumer protection in the digital age.

Implications for the broader US fintech market

If Nubank secures the charter, the competitive landscape could shift rapidly. Domestic fintechs may be compelled to accelerate their own AI deployments, while mid-sized banks may struggle to defend market share against a high-speed, low-cost rival capable of nationwide reach.

Analysts expect increased consolidation in the US digital-banking sector, with weaker neobanks potentially seeking partnerships or acquisitions to survive the resulting pressure.

Newshub Editorial in North America – 25 November 2025

Recent Comments