The gap between secured funding and policy rates keeps widening

Dislocation is making it harder to fight inflation, ING says

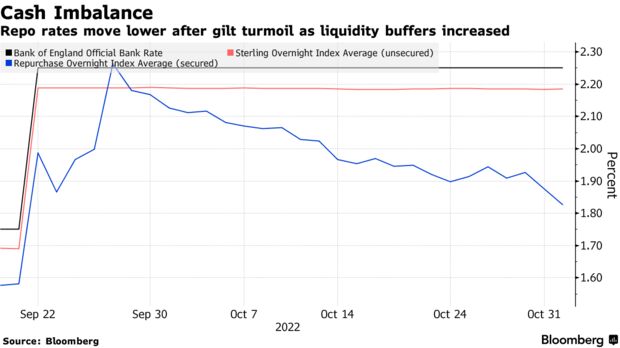

The cost of borrowing sterling against high-quality collateral is sliding away from the Bank of England’s key rate, a distortion that risks impeding the central bank’s ability to tighten policy effectively.

The price investors pay to borrow cash overnight by pledging gilts to counterparties, the so-called Repurchase Overnight Index Average or RONIA, is trading 43 basis points below the BOE’s rate. That’s a record discount after excluding quarter- and year-end aberrations when regulatory requirements tend to distort funding markets.

Normally, the two rates should move broadly in tandem as traders take their cues from changes to the policy benchmark. But investors including pension funds are hoarding cash after the bond market turmoil last month, and the flood of liquidity is exacerbating the impact of an existing collateral shortage keeping repo rates depressed.

While the BOE is expected to deliver a 75 basis-points hike Thursday — its biggest since 1989 — the risk is that the move doesn’t filter fully through to the market.

“Ultimately this means that not all hikes are transmitting to the economy and so it is making their fight against inflation more difficult,” said Antoine Bouvet, senior rates strategist at ING Groep NV. “Pressure is building on the BOE and Debt Management Office to intervene.”

For its part, the BOE says it monitors market interest rates to assess the effectiveness of monetary policy implementation. It noted in a June report that both SONIA, the unsecured Sterling Overnight Index Average, and RONIA “responded to the increases to Bank Rate in an orderly fashion.”

Collateral Shortage

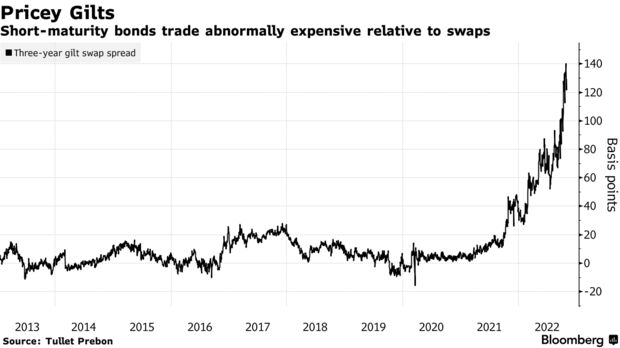

Years of quantitative easing have limited the pool of safe government securities freely available to trade, a shortage that other major central banks including the European Central Bank have to contend with. The BOE put an end to its own bond-buying program and even sold gilts from its portfolio for the first time Tuesday, yet demand for high-quality liquid assets still outstrips supply.

“I think the BOE should sell more short-end debt. The shorter the maturity, the better,” said Rishi Mishra, an analyst at Futures First. “Every central bank which is late to start quantitative tightening will have the same issues.”

The dash for the short-maturity paper was on full display Tuesday when almost 40% of total bids at a BOE auction were placed on a single sought-after security. The premium that bonds trade at relative to equivalent interest-rate swaps has surged this year across shorter maturities.

“I expect this level of precautionary liquidity to be maintained for some time as the scars of the Sept. to Oct. gilt crisis take time to heal, and as the macro backdrop is anyway conducive of more conservative risk allocation,”

Bouvet – ING

Source: Bloomberg

Recent Comments