The Federal Reserve may lower its target rate, and it may not. How can banking institutions set themselves up to thrive amidst uncertainty about inflation, the economy, and deposit competition? Here are five approaches you may not have considered.

What does the future hold for inflation and interest rates? And how can banking institutions manage their interest expense and attract depositors at a time when the Federal Reserve could raise or decrease its target rate?

Financial institution executives need the tools to attract and retain deposits by structuring their pricing more effectively and by changing the discussion with depositors entirely.

In a recent conversation, Neil Stanley, CEO of The CorePoint, and Gabriel Krajicek, CEO of Kasasa, explored innovative strategies for acquiring and retaining appropriately priced core and discretionary deposits. Their insights show how banking institutions can utilize attainable innovations and technologies to personalize their approach to depositor needs and the shifting economic environment.

Q: What’s the current state of the deposit competition landscape?

Neil Stanley: Deposit competition is fierce. Over the past 15 years, interest rates have been historically low, leading many financial institutions to downplay deposit strategies. But as rates have risen sharply, that approach is no longer tenable. Non-interest-bearing deposits are declining as customers demand higher returns, and financial institutions must re-examine their strategies.

To give you an idea of the urgency, industry-wide interest expenses have surpassed the combined costs of salaries, facilities, and technology. This is a historic shift, and it underscores the need to manage deposit expenses carefully. Financial institutions that cling to outdated strategies risk losing ground to more agile competitors.

Q: How can financial institutions balance competitive rates with profitability?

Gabriel Krajicek: It’s all about designing products that deliver value to both the customer and the institution. At Kasasa, we’ve developed high-yield checking accounts that offer above-market rates, but only when customers meet specific criteria, like completing a certain number of debit card transactions or signing up for e-statements. This model not only incentivizes account usage but also controls the overall cost of funds.

For example, when rates began rising, we advised our clients to make their high-yield checking accounts the highest-rate product in their portfolios. The results were clear: while the broader market saw total deposits shrink by 0.56%, institutions offering Kasasa accounts grew deposits by 4.1%. Thanks to their blended rate structure, these accounts achieved growth with lower overall costs.

Here’s how it works: while qualified balances earn the advertised rate (say, 5.5%), balances that exceed a certain cap might earn only 1%, and non-qualified accounts earn a nominal rate, such as 0.05%. This approach allows institutions to offer eye-catching rates while keeping average costs around 3.5%, a significant savings compared to CDs or other high-cost deposit products.

Personalization as a Critical Key to Success

Q: How important is personalization in deposit strategies?

Stanley: Personalization is no longer optional. Customers are diverse, and their financial needs vary widely. Some are passive savers who prioritize safety and convenience, while others are aggressive rate shoppers or curious heirs managing family wealth. A one-size-fits-all strategy simply doesn’t work in today’s competitive environment.

One approach we’ve seen succeed is offering companion accounts, which bundle CDs with high-yield savings accounts. This creates a sticky, multi-product relationship that’s hard for competitors to break. By linking these accounts, institutions incentivize customers to consolidate their finances with your institution, building loyalty and increasing account longevity.

Institutions are also considering a new approach to early withdrawal for CDs that allows the depositor to withdraw funds early when advantageous for both the bank and the depositor.

An example is a depositor with 12 months remaining on a CD at 5.2% with a current balance of $100,000. If the CD reaches maturity, the interest expense to the institution will be $5,200. Suppose the depositor needs the funds, and wholesale rates are now at 4.2%. If the depositor withdraws early, the total possible benefit to your institution is about $1,000 because you can replace the funding at 4.2%.

Institutions have used that interest expense savings to encourage early withdrawal when it’s advantageous for both parties.

Krajicek: We’ve also introduced tiered qualification systems for our high-yield checking accounts. For instance, a base qualification might require 10 debit card swipes to earn a 3% rate, while a higher qualification level with 30 swipes unlocks a 5% rate. This system allows institutions to appeal to different customer segments while managing costs effectively, especially in a volatile rate environment, because it allows institutions to adjust qualification thresholds without disrupting the customer experience.

Q: What role does technology play in deposit innovation?

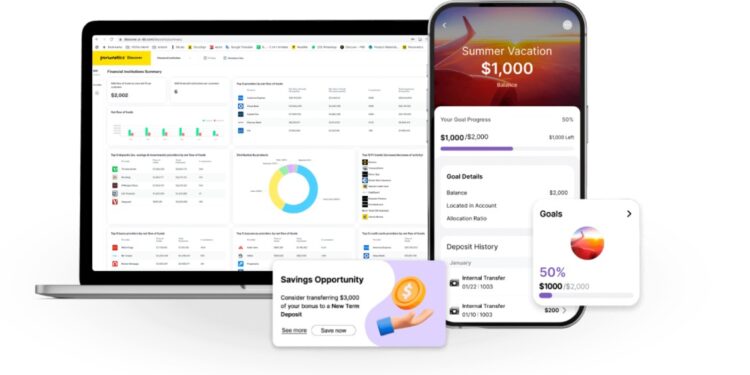

Krajicek: Technology is a game changer. Customers increasingly expect seamless digital experiences, and financial institutions that deliver on this front gain a significant competitive edge. At Kasasa, we’ve integrated account management tools directly into online and mobile banking platforms. This means customers can track their rewards, monitor their progress toward qualification criteria, and manage linked savings accounts all from a single dashboard.

This digital integration enhances the user experience and encourages consistent account engagement. For example, customers receive monthly notifications of their qualification status, which drives them to use their debit cards or make ACH transactions to earn rewards.

We’ve also applied this concept to loans. Our Take-Back® Loan allows borrowers to withdraw extra payments they’ve made if they face financial difficulties. This feature has been a hit, earning a 72% net promoter score and doubling the likelihood of customers adopting a checking account. It’s a perfect example of how innovative products can deepen relationships and drive cross-sell opportunities.

Q: How can institutions effectively compete on rate without eroding margins?

Stanley: Competing on rate doesn’t mean sacrificing profitability when an institution establishes guidelines benchmarked to objective standards, such as wholesale funding. For maturing CDs, consider products that offer competitive rates, but only as a last resort to retain depositors pushing for the best rate. These accounts can provide them with what they want: High yields with short-term commitments. It also keeps funds within the institution without repricing the entire book – often without paying the best rate.

Another strategy is to customize CD terms and rates based on customer preferences. Instead of offering static terms like 6, 12, or 24 months, allow customers to select their preferred maturity dates. This personalized approach enhances customer satisfaction and differentiates your institution from competitors.

Krajicek: I’ll add that institutions should ensure their highest-rate product is a checking account, not a CD. Why? Because checking accounts generate significant non-interest income from debit transactions and ACH activity, which offsets higher interest costs. Data from Kasasa’s portfolio shows that these accounts deliver twice the profit per account compared to traditional checking products, making them a more sustainable way to compete on rate.

Q: What’s the outlook for the deposit market?

Stanley: The deposit landscape will remain competitive for the foreseeable future. Even as rates stabilize, customers’ expectations for personalized, high-value products won’t change. Financial institutions must adopt dynamic pricing models, invest in training, and modernize their platforms to stay ahead.

The days of relying solely on rate sheets and ad hoc pricing are over. Institutions must embrace change and think creatively to meet the needs of today’s customers. As Gabe often says, “Innovation is no longer optional; it’s a necessity.”

Q: What are the most actionable strategies for institutions right now?

Krajicek: Here are a few immediate steps institutions can take:

- Review pricing strategies: Ensure your checking accounts offer the most competitive rates in your portfolio, leveraging tiered qualification systems to manage costs.

- Leverage technology: Integrate account management and qualification tracking into your digital platforms to drive engagement.

- Focus on personalization: Use products like companion accounts or loyalty accounts to meet diverse customer needs.

- Promote high-yield products strategically: Use high-yield checking as a gateway to deeper relationships, increasing cross-sell opportunities for loans and savings accounts.

Stanley: I’d also recommend educating your teams about the economic context. Many customers don’t understand why interest rates are rising or how inflation impacts their deposits. Equip your frontline staff with the knowledge and tools to explain these dynamics and guide customers toward the best solutions.

Tactical Banking Takeaways

Here are the five tools financial institution executives can use to attract and retain deposits, according to Krajicek and Stanley:

- Consider checking accounts with a blended rate structure that grows deposit relationships while managing lower overall costs.

- Provide a tiered qualification system for high-yield checking accounts with notifications to aid depositors in achieving rewards.

- Research opportunities to bundle CDs with high-yield savings accounts, such as depositors with a CD and no other product.

- Engage the CD segments about early withdrawal options when advantageous for both the institution and the depositor.

- Allow depositors to customize their CD to their preferred maturity date.

Navigating the current deposit landscape will require leadership skills and banking approaches that structure deposit pricing more effectively or shift the focus to value instead of rate. Adopting these tactics will allow executives to position their organizations for success in 2025 because they will have the tools to earn depositor loyalty.

Source: THE FINANCIAL BRAND

Recent Comments