During the Asian session, the Bitcoin price is on a bullish streak, rising more than 4% to $20,260. In contrast, Ethereum is on a tear, rising more than 10% in the last 24 hours to trade at $1,485.

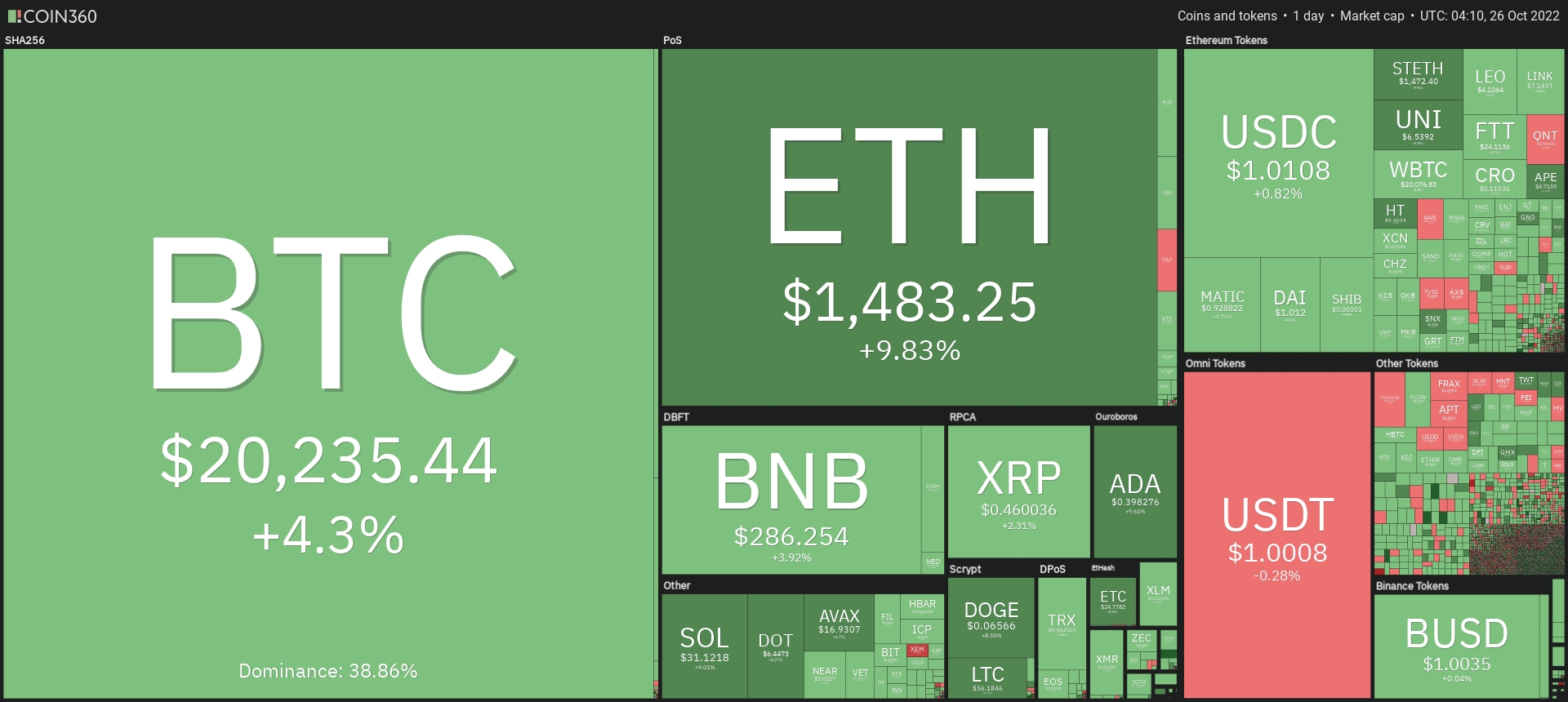

Major cryptocurrencies were trading in the green early on October 26 as the global crypto market value gained nearly 5% in the previous day to $976 billion. The overall crypto market volume, on the other hand, increased over 69% in the last 24 hours to $89.24 billion.

DeFi’s total volume is currently $3.66 billion, accounting for 4% of the overall crypto market 24-hour volume. The overall volume of all stablecoins is now $80.85 billion, accounting for 90% of the total 24-hour volume of the crypto market.

Let’s take a look at the top winners and losers so far today.

Top Altcoin Gainers and Losers

The top performers in the Asian session were Toncoin (TON), Lido DAO (DAO), and Ethereum Classic (ETC). Toncoin price is up more than 21% to $1.80, while DAO is up nearly 10% to $1.67. At the same time, ETC has surged more than 10% to trade at $25 in the last 24 hours.

In the last 24 hours, the price of Aptos (APT) has plunged more than 4% to $8.8. The price of Klaytn (KLAY) has dropped more than 4% to around $0.19.

UK Votes to Regulate Crypto

As of Tuesday, the UK’s lower house of parliament, the House of Commons, had voted in favour of the Financial Services and Markets Bill, which included provisions to regulate crypto assets as financial instruments.

The lower chamber of Parliament, the House of Commons, met to read the proposed Financial Services and Markets Bill, which generally outlines the UK’s economic plan post-Brexit, line by line.

Parliamentarian Andrew Griffith recommended amending the measure so that digital currencies and tokens would fall under the purview of the country’s financial regulators.

Stablecoins are a type of cryptocurrency that is tethered to the value of another asset, such as the US dollar or gold, and the draft bill already included provisions to extend existing restrictions to payments-focused stablecoins.

The higher chamber, the House of Lords, will now have the opportunity to vote on the bill before it can officially become law.

This comes after Rishi Sunak took office as the country’s prime minister on Monday; in his previous role as finance minister, Sunak expressed support for cryptocurrencies. Hence, the news is driving optimization in the market, and keeping cryptocurrencies supported.

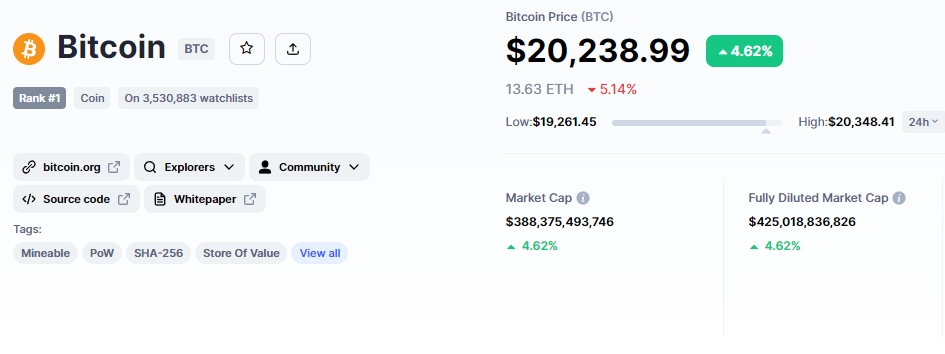

Bitcoin Price

The current Bitcoin price is $20,245, and the 24-hour trading volume is $151 billion. Bitcoin has increased by over 4% in the last 24 hours. CoinMarketCap currently ranks first, with a live market cap of $388 billion.

On Wednesday, the BTC/USD pair is trading sharply higher after breaking out of the symmetrical triangle pattern at $19,250. As predicted in the Bitcoin price prediction for October 26th, the BTC/USD has traded bullish, crossing immediate resistance levels at $19,600 and $19,900.

For the time being, it is encountering immediate resistance at $20,430, which is being extended by a triple-top pattern.

The RSI and MACD remain in a buying zone, supporting the possibility of a bullish run; similarly, the 50-day moving average supports buying above the $19,300 level. As a result, a breakout of the triple-top pattern could extend the buying trend to $21,000 or $21,900. However, if the uptrend continues, BTC could reach the $23,000 level.

On the downside, Bitcoin’s immediate support remains close to $20,000 (psychological level) and $19,600. Today, investors should look for buy positions worth more than $19,900.

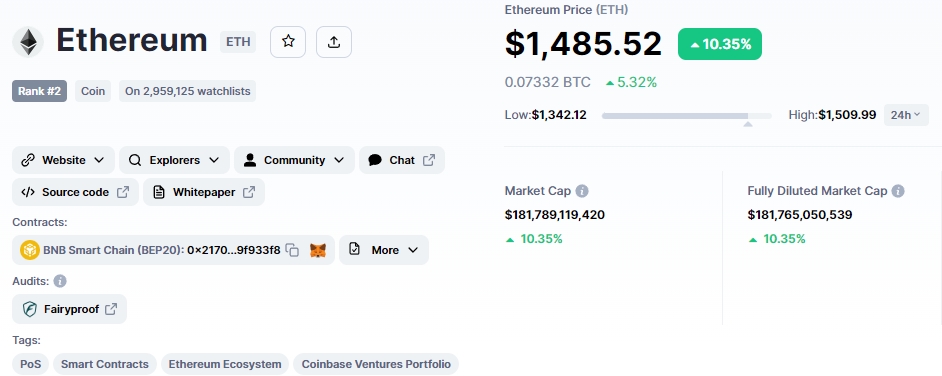

Ethereum Price

The current price of Ethereum is $1,485, with a 24-hour trading volume of $31 billion. In the last 24 hours, Ethereum has gained over 10%. CoinMarketCap currently ranks #2, with a live market cap of $181 billion.

On the technical front, the ETH/USD pair is on the rise, having already completed a 38.2% Fibonacci retracement and is now approaching the next resistance level of $1,550, which is extended by a 61.8% Fibo level. On the daily timeframe, ETH closed a bullish engulfing candlestick, signaling a strong uptrend and potentially driving additional buying in Ethereum.

Leading indicators like the RSI and MACD are pointing up. As a result, the chances of a bullish trend continuation above $1,404 remain high. A break above $1,550 may expose the ETH price to $1,650 or $1,785 levels.

New Crypto Presales

With over $2.5 million raised in less than a week, the Dash 2 Trade presale is well on its way to becoming one of the largest token sales of the year. As the sale progressed from stage one to stage two, the increase in D2T price from 0.0476 to 0.05 USDT did not appear to have significantly slowed down the pace of the transaction.

Dash 2 Trade is an Ethereum-based platform that aims to provide a variety of real-time analytics and social trading signals to its users; the total amount raised so far is a huge vote of confidence in the platform.

After the completion of its presale, the company plans to launch its platform in the first quarter of 2019, at which time it anticipates seeing its D2T token listed on various exchanges. You can still participate in Dash 2 Trade presale and can buy D2T tokens for $0.05 USDT.

Source: cryptonews

Recent Comments