Bernie Madoff, once a revered figure on Wall Street, became synonymous with financial fraud when his elaborate Ponzi scheme unraveled in 2008, leaving a trail of devastation in its wake. Madoff’s story is one of deceit, betrayal, and the shocking collapse of an investment empire.

In the early 1960s, Bernie Madoff founded his own brokerage firm, Bernard L. Madoff Investment Securities LLC, which eventually grew into a prominent and highly respected player in the financial world. His reputation as an astute investor and former chairman of the NASDAQ stock exchange bolstered the confidence of investors who believed they had found a surefire way to accumulate wealth.

Behind the scenes, however, Madoff was operating a colossal fraud. His investment strategy was a mirage; instead of making legitimate trades, he used new investor funds to pay returns to earlier investors. This classic Ponzi scheme thrived for decades, with Madoff skillfully maintaining the illusion of success through falsified financial statements and consistent, yet fabricated, returns.

Madoff’s scheme began to unravel in December 2008 when, in the midst of the global financial crisis, an increasing number of investors sought to withdraw their funds. Unable to meet these redemption requests, Madoff confessed to his sons that his investment strategy was a fraud. Shocked by the revelation, his sons turned him in to the authorities.

The aftermath of Madoff’s confession sent shockwaves through the financial world. Thousands of investors, including celebrities, charities, and financial institutions, lost an estimated $65 billion. Many of them faced financial ruin, with some forced to close their doors or reduce their charitable activities.

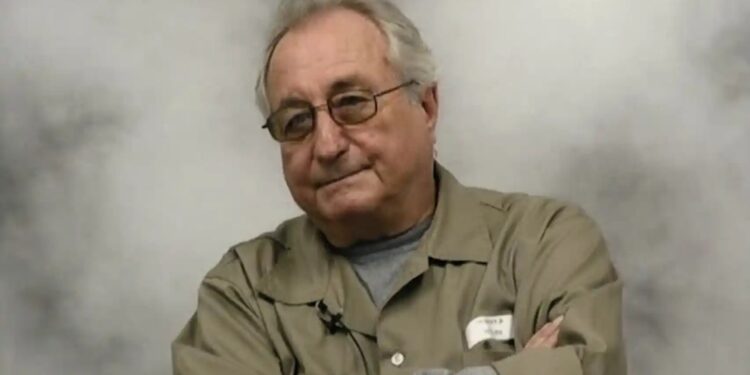

In June 2009, Bernie Madoff was sentenced to 150 years in prison after pleading guilty to 11 federal felonies, including securities fraud, money laundering, and perjury. His sentence served as a harsh reminder of the consequences of financial misconduct and the need for increased oversight in the financial industry.

The Madoff scandal also prompted a reevaluation of regulatory practices, as it highlighted the failure of regulatory bodies to detect and prevent such a massive fraud. The Securities and Exchange Commission (SEC) faced criticism for its inadequate oversight, leading to reforms aimed at enhancing the monitoring and enforcement capabilities of regulatory agencies.

Bernie Madoff’s legacy is one of infamy, representing the betrayal of trust in the financial system. His case remains a cautionary tale, emphasizing the importance of due diligence, transparency, and vigilance in the pursuit of financial success. The repercussions of his actions continue to echo through the financial industry, influencing both regulatory practices and investor attitudes toward risk.

newshub

Recent Comments