The former FTX mogul said he asked Alameda Research, the trading firm that played a central role in the exchange’s demise and was run by his former girlfriend, to hedge risks.

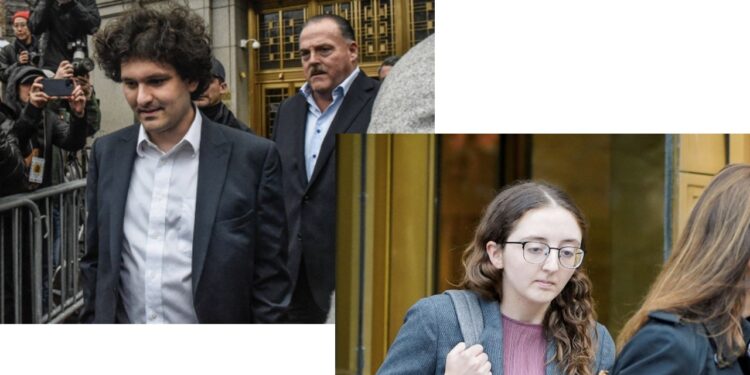

- Sam Bankman-Fried began to testify in front of jurors on Friday in his criminal fraud and conspiracy trial.

- Under questioning from his defense lawyer, SBF sought to deflect blame to his deputies.

- The former FTX CEO conceded to making mistakes at the crypto exchange – the biggest being not having a risk manager – and said “a lot of people got hurt.”

Sam Bankman-Fried doubled down Friday on the narrative that the FTX crypto exchange failed due to mistakes rather than malfeasance and that his underlings made the major bungles in his first day testifying before jurors.

For example, he told the court he had asked Alameda Research, the hedge fund he founded with close ties to FTX that was run by his on-and-off girlfriend Caroline Ellison, to hedge its risks.

However, when asked by his defense lawyer in the criminal case whether Ellison heeded his advice that Alameda should “get shorter” to mitigate its risks and shrink its multi-billion-dollar hole, Bankman-Fried replied tersely, “no.”

The fallen crypto mogul, who stands accused of fraud and conspiracy, began his testimony in front of jurors Friday by saying he made mistakes at his now-fallen crypto behemoth FTX – the biggest being not employing a risk manager – and “a lot of people got hurt.”

Mark Cohen, Bankman-Fried’s lawyer, spent the bulk of Friday morning walking his client through the early days of the FTX exchange and Alameda Research, Bankman-Fried’s trading firm. The focus was on spinning prosecutors’ narrative about the companies’ collapse into a story more favorable to the defendant – portraying the firms as legitimate and well-intentioned businesses, and providing context to explain the motivations behind controversial business decisions.

In the FTX founder’s telling, a much-scrutinized feature of the exchange’s software, which let Alameda avoid having its positions liquidated and let it have a negative balance, was implemented to patch a bug in the exchange’s risk-management system.

Prosecutors previously said Alameda’s ability to “go negative” was key to its ability to withdraw limitless amounts of FTX users’ money. At the core of prosecutors’ case against the FTX founder is that he used his trading shop to steal from customers.

As he explained the “allow-negative” feature, Bankman-Fried punted blame to his former colleagues: prosecution witnesses Gary Wang and Nishad Singh, who he says implemented the infamous system in response to Bankman-Fried’s unspecific guidance to fix the error.

A core element of Bankman-Fried’s strategy thus far has involved casting blame on former colleagues. In general, Bankman-Fried said he “supervised” Wang, FTX’s head of technology, and Singh, its chief technology officer, but alleged they were empowered to make their own decisions, with Bankman-Fried serving more as an adviser.

Bankman-Fried’s early testimony also sought to cast other goings-on at Alameda and FTX in a more benign light than the one shone by prosecutors. Whereas prosecutors, for example, suggested Bankman-Fried and his colleagues customarily deleted communications to avoid legal trouble, Bankman-Fried testified that he was merely following a rule he picked up during his days as a young quantitative trader at Jane Street.

That was the “New York Times test,” which, according to Bankman-Fried, was a frequent point of reference at the elite quant shop. “Anything that you write down,” he recalled, “there’s some chance it could end up on the front page of The New York Times.” He added: “A lot of innocuous things can seem pretty bad” without context.

Much of Bankman-Fried’s testimony zeroed in on the propriety of the massive borrowing Alameda did from FTX (Alameda, he said, could borrow money like anyone else) and the exchange’s ability to “claw back” funds from users to cover losses (covered in a portion of the FTX terms of service – albeit one specific to a margin trading feature used by relatively few users).

Source: Read more @ CoinDesk

Recent Comments