4

Dow crosses 7,000 for the first time, marking a defining moment for US markets

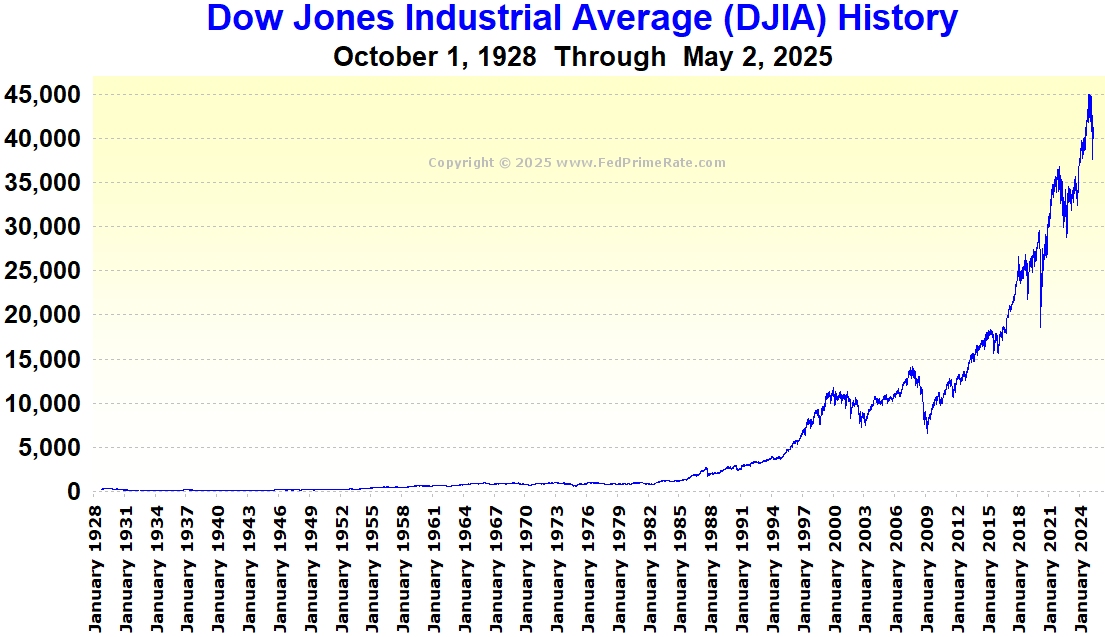

The Dow Jones Industrial Average closed above the 7,000 mark for the first time in history, a milestone that captured the confidence of late-1990s America and signalled a powerful shift in investor sentiment. The achievement reflected booming corporate earnings, rapid technological change, and a broad belief that the US economy had entered a new phase of sustained growth.

A psychological barrier finally broken

Crossing 7,000 was more than a numerical event. For traders on Wall Street, it represented validation of a multi-year bull market driven by productivity gains, global capital inflows, and an expanding consumer economy. Financial media framed the close as proof that equities had become the primary engine of household wealth creation, while retail participation in markets continued to rise.

Momentum built on earnings and innovation

The advance was underpinned by strong corporate results across manufacturing, finance, and a fast-emerging technology sector. Companies were benefiting from efficiency improvements, deregulation in parts of the economy, and accelerating adoption of personal computing and early internet infrastructure. Trading volumes at the New York Stock Exchange surged as institutional investors added exposure, convinced that profit growth would outpace inflation.

Policy confidence and the ‘soft landing’ narrative

Monetary stability also played a central role. The Federal Reserve, under Chairman Alan Greenspan, had carefully balanced interest-rate policy to contain price pressures while allowing expansion to continue. This nurtured the popular idea of a “soft landing” — an economy growing briskly without overheating — giving investors greater comfort to allocate capital to equities.

Global implications and capital flows

International markets took note. The 7,000 close reinforced the United States’ position as the world’s financial anchor at the time, attracting overseas investment and strengthening the dollar. Portfolio managers in Europe and Asia increasingly benchmarked performance against US indices, while emerging markets viewed the rally as evidence of resilient Western demand.

A milestone with lasting lessons

In hindsight, the moment stands as a snapshot of late-cycle optimism. The late 1990s would deliver further gains before volatility returned in the early 2000s, reminding investors that structural change and innovation do not eliminate risk. Still, the first close above 7,000 remains a landmark in market history — a clear illustration of how sentiment, policy, and productivity can converge to push valuations into new territory.

For modern investors, the episode offers perspective. Market milestones often arrive during periods of strong narrative confidence, but they also underscore the importance of discipline, diversification, and understanding macro drivers beyond headline numbers.

Newshub Editorial in North America – 13 February 2026

If you have an account with ChatGPT you get deeper explanations,

background and context related to what you are reading.

Open an account:

Open an account

Recent Comments