Gold prices fell sharply over the past week, marking a significant pullback from recent highs and erasing a substantial amount of value as investors reassessed risk, monetary policy expectations, and the strength of the US dollar.

A clear reversal after a strong run

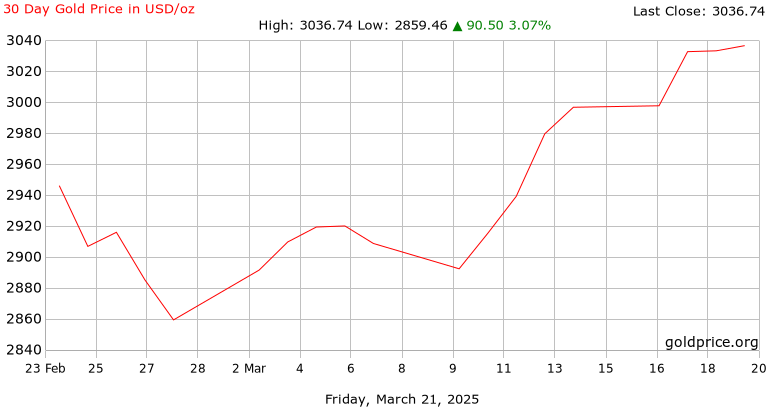

At the start of last week, gold was trading close to its recent peak levels, supported by safe-haven demand, geopolitical uncertainty, and lingering concerns over global growth. As the week progressed, sentiment shifted. Selling pressure emerged across precious metals, and gold moved decisively lower, ending the week well below its opening levels.

The decline represented one of the most pronounced weekly pullbacks in recent months, interrupting what had otherwise been a strong upward trend driven by defensive positioning and central-bank buying.

How much value has been lost

Over the course of the week, gold prices declined by several percentage points. In nominal terms, this translated into a drop of several hundred US dollars per troy ounce from peak to trough. For the global gold market, where the estimated total above-ground value runs into the trillions of dollars, even a moderate percentage move implies a very large loss of aggregate value.

Measured across futures markets, exchange-traded funds, and physical holdings, the weekly decline is estimated to have wiped tens of billions of dollars from gold’s market value worldwide. For investors who entered positions near last week’s highs, the pullback has been both rapid and material.

Drivers behind the sell-off

Several factors combined to pressure gold prices. A strengthening US dollar reduced the metal’s appeal for non-dollar investors, while rising bond yields increased the opportunity cost of holding a non-yielding asset. At the same time, parts of the market engaged in profit-taking after an extended rally, accelerating the downward move once key technical levels were breached.

Broader risk sentiment also played a role. As equity and currency markets adjusted to changing expectations around interest rates and global liquidity, gold temporarily lost some of its defensive appeal, behaving more like a crowded trade than a pure safe haven.

What this means for investors

Despite the sharp weekly decline, many analysts caution against interpreting the move as a structural reversal. Gold remains well above levels seen earlier in the year, and long-term drivers such as central-bank diversification, geopolitical risk, and concerns over sovereign debt sustainability remain intact.

However, the past week has served as a reminder that gold is not immune to volatility. Sharp corrections can occur even in strong long-term trends, particularly when positioning becomes stretched and sentiment shifts quickly.

Outlook after the correction

Looking ahead, market participants are expected to focus on interest-rate signals, inflation data, and currency movements to gauge whether gold can stabilise or whether further downside consolidation lies ahead. While the long-term case for gold remains intact for many investors, the events of the past week highlight the importance of timing, risk management, and realistic expectations in a volatile global market.

Newshub Editorial in Global Markets – 2 February 2026

If you have an account with ChatGPT you get deeper explanations,

background and context related to what you are reading.

Open an account:

Open an account

Recent Comments