MSTRpay is not being built from a boardroom. It is being built from the street. In The Gambia and Senegal, company executives are physically present on the ground, conducting direct market due diligence to understand real needs, real risks and real opportunities inside economies where financial exclusion is a daily reality.

From boardroom theory to street-level execution

There is a fundamental difference between designing fintech remotely and building it where the system is meant to operate.

MSTRpay has chosen direct execution.

In both The Gambia and Senegal, senior company representatives and executives are on location, engaging directly with local communities, informal businesses, institutions and everyday users. Their mandate is not ceremonial. It is operational and analytical: to perform real-world due diligence on how money moves, where it breaks down, and what structures are required to make digital finance work in practice.

This is not a pilot observed from afar.

It is hands-on market validation carried out by decision-makers.

Friendly people and enormous potential

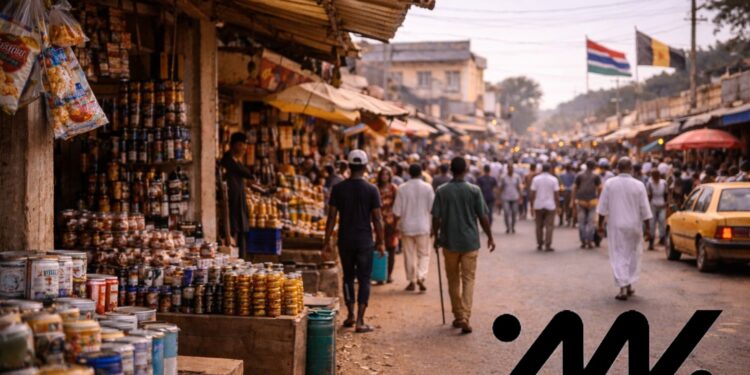

Walking through Serrekunda or the outskirts of Dakar, one observation becomes immediately clear to anyone on the ground: people are open, welcoming and entrepreneurial — yet materially poor.

Average incomes fall far below Western poverty thresholds. Cash dominates daily transactions. The informal economy is not marginal; it is central. Most people work outside formal structures, without access to regulated financial services or reliable credit.

At the same time, smartphones are widespread. Mobile devices are already embedded in everyday life. What is missing is not technology, but financial infrastructure capable of turning that technology into productive economic tools.

Price structures further expose the imbalance. Local street markets are affordable and flexible, while supermarkets and imported goods are disproportionately expensive. Credit is typically available only through informal lenders on predatory terms.

This is not a lack of ambition.

It is a lack of infrastructure.

Executive-led due diligence in real markets

MSTRpay’s presence in The Gambia and Senegal is driven by company executives tasked with understanding conditions firsthand.

This includes:

- Direct observation of household and micro-business cash flows

- Meetings with informal traders and entrepreneurs

- Assessment of mobile usage versus financial access

- Evaluation of credit behaviour and debt risks

- Identification of income-generation bottlenecks

- Analysis of regulatory, cultural and operational constraints

This ground-level due diligence informs product design, rollout sequencing and risk management. Decisions are not based on assumptions or secondary reports, but on direct exposure to local economic realities.

Why MSTRpay is needed here — now

MSTRpay was not designed for overbanked societies competing on marginal user experience improvements.

It was designed for environments like The Gambia and Senegal.

Here, the need for digital finance is immediate and practical. People require secure ways to send and receive money. They need paths to earn income rather than accumulate debt. They need education that transforms a smartphone into a productive asset. And they need instalment models that are transparent and fair.

This is where MSTRearn and MSTRuniversity move from optional features to core infrastructure.

The model: Phone to skills, skills to income, income to instalments

The model implemented on the ground is deliberately simple and rigorously tested through executive oversight.

Access to smartphones is provided through controlled instalment programmes. Users are immediately onboarded into the MSTRpay ecosystem, including a digital wallet, earnings modules and a learning platform.

MSTRearn enables income generation through micro-tasks, digital services and online earning pathways adapted to local conditions. These are structured opportunities aligned with connectivity, skill availability and demand.

MSTRuniversity delivers applied education focused on execution: how to earn with a smartphone, how to manage money responsibly and how to build economic independence.

Crucially, instalments are paid only after income is demonstrably generated inside the platform. Payments are not required upfront and are not based on promises. They are linked directly to verified economic activity.

This reverses the traditional credit model and materially reduces user risk.

Not charity, not speculation — infrastructure

MSTRpay’s presence in West Africa is not aid-driven and not speculative.

It is the deliberate construction of financial infrastructure, informed by executive-led due diligence and built for environments the global financial system has historically neglected.

People in these markets are not seeking handouts. They are seeking opportunity, tools, fair rules and a legitimate chance to participate.

MSTRpay begins with what people already have and trust: the smartphone in their hand.

A reality check for investors and observers

From Europe or the United States, fintech often means loyalty programmes, lifestyle banking and marginal convenience.

From The Gambia and Senegal, fintech means food security, school fees, independence from informal lenders and dignity through earned income.

This is where MSTRpay operates.

Boots on the ground.

Executives in the field.

Inside the real economy.

Where impact is measured in lives — not clicks.

Newshub Editorial in Africa – 18 January 2026

If you have an account with ChatGPT you get deeper explanations,

background and context related to what you are reading.

Open an account:

Open an account

Recent Comments