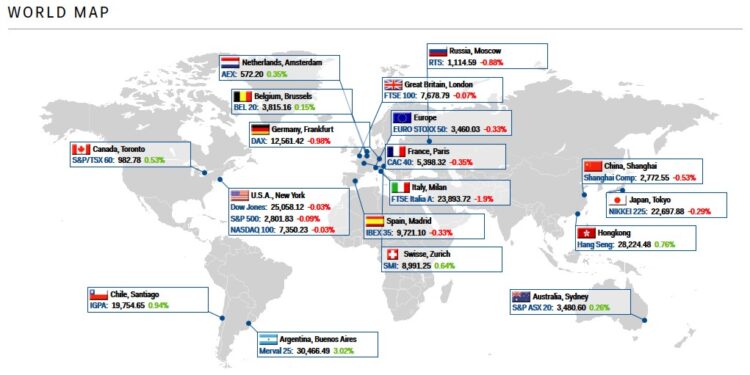

Global markets ended the week with a mixed and cautious tone, as investors assessed diverging monetary paths, weakening consumer signals and geopolitical uncertainty. While Wall Street edged higher on resilient tech performance, European indices faltered and Asia closed broadly lower, reflecting a lack of conviction ahead of key inflation data and central bank meetings later this month.

Wall Street steadies despite uneven macro signals

US equities closed the week in modestly positive territory, supported by large-cap technology and renewed interest in defensive sectors. The S&P 500 finished marginally higher, while the Nasdaq outperformed as investors rotated back into AI-driven growth stocks. Treasury yields drifted lower after softer labour-market indicators, reinforcing expectations that the Federal Reserve may keep policy steady for longer. However, persistent concerns over consumer spending and corporate profit margins kept overall sentiment subdued.

Europe slips as energy and industrials weigh on performance

Major European markets ended the week in negative territory, with the Stoxx 600 pressured by declines across energy, industrials and consumer discretionary sectors. The eurozone’s inflation outlook remains uncertain, and traders continue to debate whether the European Central Bank can ease policy without reigniting price pressures. Germany’s DAX lost ground on weaker factory-order data, while France’s CAC 40 saw broader selling as investors took profits after recent gains.

Asian markets retreat on growth concerns

Asia-Pacific equities posted a largely weaker finish. China’s markets declined after new data signalled slower industrial momentum and softer housing demand. Japan’s Nikkei fell as the yen strengthened, putting pressure on exporters and raising speculation that the Bank of Japan may be preparing for policy adjustments. Meanwhile, emerging Asian markets faced outflows as investors adopted a risk-off stance, particularly in sectors tied to global trade.

Currencies and commodities reflect defensive positioning

Currency markets showed a flight-to-quality trend, with the US dollar stabilising and the Japanese yen strengthening modestly. Commodity prices painted a mixed picture: Brent crude eased as traders weighed supply concerns against signs of weakening global demand, while gold ended the week higher on safe-haven buying.

An uneasy close to a volatile week

Across regions, the overarching theme was caution rather than conviction. Investors are navigating an environment marked by uneven growth, shifting rate expectations and an increasingly fragile geopolitical backdrop. As the coming week brings fresh data on inflation, consumer confidence and corporate earnings, markets are likely to remain sensitive to any signals that could redefine central bank trajectories or global demand expectations.

Newshub Editorial in Global – 6 December 2025

Recent Comments