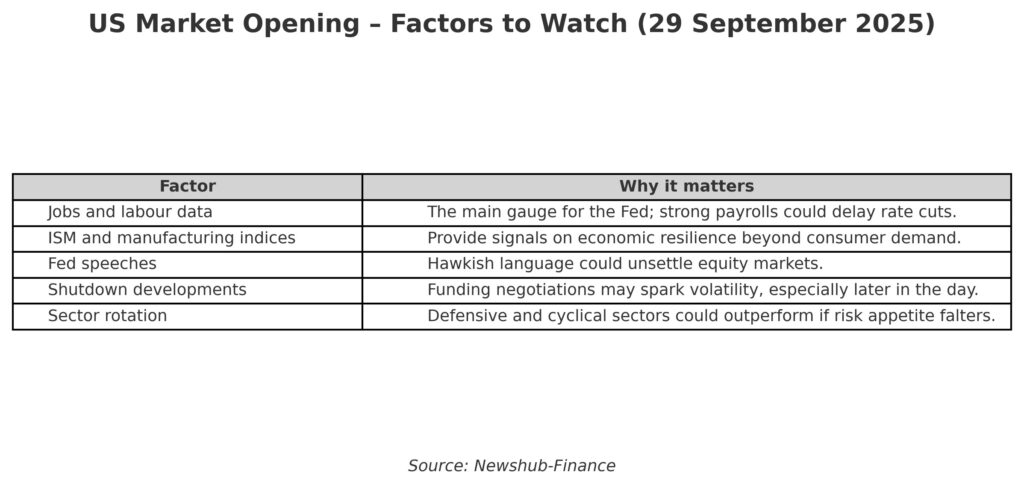

U.S. equity futures edged higher ahead of Monday’s market open, with investors balancing optimism over potential Federal Reserve easing against the looming threat of a government shutdown. The trading session is expected to be shaped by economic data releases, central bank commentary, and political developments in Washington.

Futures suggest cautious optimism

Stock futures signalled a steady start, helped by inflation data last week that aligned with expectations and supported hopes of policy easing later this year. Gains were modest, however, as investors remained alert to headlines on federal funding negotiations.

Shutdown threat casts a shadow

The risk of a U.S. government shutdown continued to dominate sentiment. If Congress fails to approve a funding bill, government agencies could face disruptions as early as Tuesday. Analysts warned that this could delay the publication of critical economic data such as non-farm payrolls, complicating the Federal Reserve’s decision-making process.

Central bank signals in focus

Several Federal Reserve officials are scheduled to speak today, and markets are sensitive to any shift in tone regarding interest rates. A more hawkish stance could weigh on equities, particularly in rate-sensitive sectors such as technology, while dovish remarks would reinforce expectations for easing later in the year.

Currency and bond moves matter

The dollar eased slightly ahead of the open, while U.S. Treasury yields softened in early trade. These moves could encourage flows into equities, though higher yields remain a risk for richly valued growth stocks if rate expectations reverse.

Outlook scenarios

The base case is for modest gains as markets ride rate-cut expectations, barring major negative headlines. The bearish scenario involves heightened volatility if shutdown risk escalates or inflation indicators show renewed strength. Conversely, a swift resolution in Washington combined with dovish central bank remarks could spark a stronger rally.

REFH – Newshub, 29 September 2025

Recent Comments