London and Stockholm opened Monday trading with modest gains, while continental European indices also started in positive territory. Arab and African exchanges saw a more mixed picture, reflecting regional calendars and local economic drivers.

London leads with steady tone

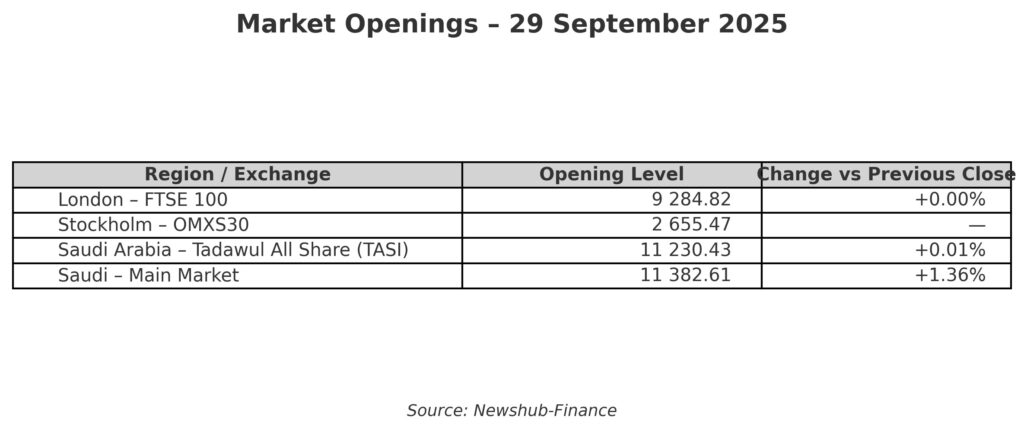

The FTSE 100 opened at 9,284.82 points, almost unchanged from Friday’s close but supported by strength in healthcare and industrials. The mid-cap FTSE 250 mirrored the cautious optimism. Analysts noted that while the index is broadly flat, investor sentiment is holding up in the face of uncertainty surrounding a possible U.S. government shutdown.

Stockholm shows positive momentum

In Sweden, the OMXS30 index began the week at 2,655.47 points, continuing a run of stable performance. Market observers said the opening reflected resilience in Nordic equities, with investors positioning for upcoming corporate updates and regional inflation data.

Continental Europe tracks London

Major indices in Europe, including Germany’s DAX and France’s CAC 40, opened higher, with industrials and defensive sectors providing stability. Gains were modest but pointed to improving investor confidence as the week began.

Arab markets trade mid-week

Arab Gulf exchanges, operating on a Sunday–Thursday calendar, opened with subdued momentum. The Tadawul All Share Index in Saudi Arabia started at 11,230.43 points, registering a marginal uptick of about 0.01%. Broader Saudi indices were slightly stronger, though overall regional liquidity was lighter at the start of the trading week.

African markets open cautiously

In Africa, the Johannesburg Stock Exchange (JSE) opened broadly in line with global peers, with resources and financial stocks showing early strength. Nigerian and Egyptian markets were muted, weighed down by currency and inflation concerns. Analysts said African exchanges remain closely tied to commodity trends and capital flows from abroad.

Outlook shaped by global uncertainty

Across all regions, investors are balancing early optimism with caution. The risk of a U.S. government shutdown, persistent inflation pressures, and geopolitical uncertainties continue to frame sentiment. Markets opened on a steadier footing, but volatility may intensify as the week progresses.

REFH – Newshub, 29 September 2025

Recent Comments