Global banking developments over the past week painted a picture of transformation, tension, and tightening oversight as governments sold legacy holdings, cross-border acquisitions drew political ire, and regulators sharpened their focus on misconduct and systemic fragility.

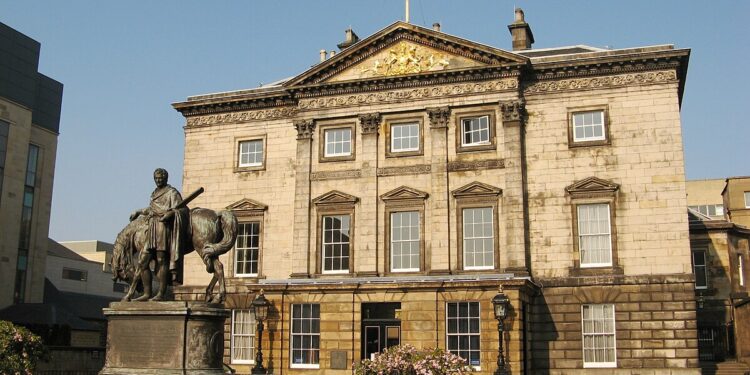

In the United Kingdom, the government completed the long-awaited sale of its final stake in NatWest, formerly known as Royal Bank of Scotland. This move ends a 17-year chapter that began during the 2008 financial crisis, when the state rescued the bank with a £45 billion bailout. The final sale marks a symbolic shift back to full private ownership but crystallises an estimated loss of around £10 billion for taxpayers. Chancellor Jeremy Hunt hailed the exit as a signal of economic strength and market normalisation, though critics note it also reflects the high cost of past financial mismanagement.

Meanwhile, international tensions surfaced in India as opposition lawmakers raised alarms over plans by Japan’s Sumitomo Mitsui Banking Corporation to take control of Yes Bank. Framed as a threat to India’s financial sovereignty, the proposed deal has become a flashpoint in a broader debate about foreign ownership of critical domestic assets. Politicians from the Congress party are demanding a legal review, arguing that the Reserve Bank of India must scrutinise the long-term implications for national security and economic independence.

Elsewhere, banking consolidation efforts continue to attract both ambition and scepticism. In Italy, UniCredit’s potential acquisition of Banco BPM is drawing close attention from the country’s central bank. Fabio Panetta, the newly appointed governor of Banca d’Italia, stressed that the primary goal of any merger must be to improve the quality of financial services for consumers, rather than simply seeking scale. He warned that unchecked consolidation could reduce competition and harm small businesses and depositors.

In the United States, HSBC confirmed it would wind down its small business banking division, impacting around 4,400 American clients. The move is part of a long-term retreat from the US retail market as the British bank pivots toward its strategic strongholds in Asia and the UK. This continues a years-long trend of large international banks recalibrating operations away from lower-margin or regulatory-heavy markets in favour of more lucrative regions.

Alongside strategic reshuffling, governance and market stability remained under scrutiny. Jamie Dimon, chief executive of JPMorgan Chase, issued a stark warning about the fragility of the US Treasury market. He claimed that existing regulations make it harder for banks to support bond liquidity during times of stress, raising the risk of panic-driven sell-offs. His comments arrive amid growing concern over the global bond market’s ability to absorb shocks as central banks tighten policy and government borrowing remains elevated.

In London, the Financial Conduct Authority is preparing new rules to combat workplace bullying, harassment, and discrimination within the financial sector. The forthcoming crackdown aims to address what the regulator calls “non-financial misconduct” and send a clear signal that toxic culture will no longer be tolerated in the City. Industry insiders expect the rules to be enforced through licensing requirements, making individual behaviour as critical to compliance as balance sheets and risk assessments.

As the global banking system navigates post-crisis exits, geopolitical complexity, and social accountability, the direction of change appears driven less by pure profit and more by public trust, resilience, and political will. The next chapter will test whether banks can adapt without losing sight of their broader role in economic stewardship.

newshub finance

Recent Comments