The Rise and Fall of Bernie Madoff: Wall Street’s Greatest Fraudster

Bernie Madoff, once a respected financier and chairman of the NASDAQ stock exchange, perpetrated the largest Ponzi scheme in history, defrauding thousands of investors of billions of dollars before his arrest in December 2008.

Born in 1938 in Queens, New York, Madoff began his Wall Street career in 1960 with just $5,000 saved from working as a lifeguard and sprinkler installer. He founded Bernard L. Madoff Investment Securities LLC, initially trading penny stocks. The firm grew steadily, eventually becoming one of the largest market makers on Wall Street, executing a significant portion of NYSE trades.

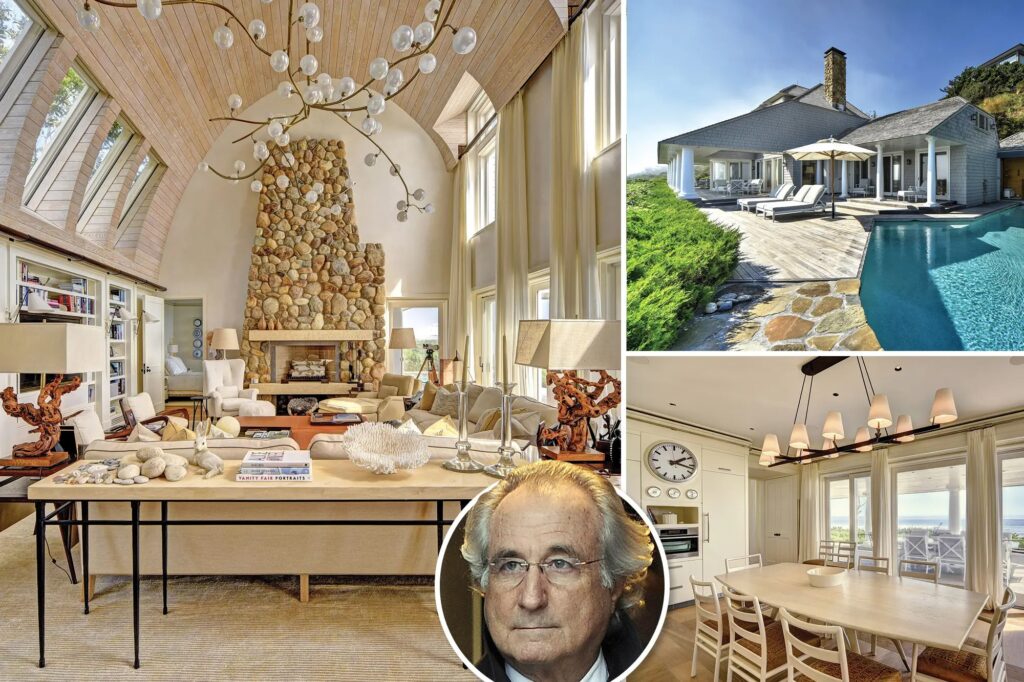

Madoff’s reputation soared as he served on prominent industry boards and committees. He cultivated an air of exclusivity around his investment services, often refusing new clients to create the impression of a private club for the privileged few. This strategy attracted wealthy individuals, charitable foundations, and financial institutions eager to access his seemingly consistent returns of 10-12% annually, regardless of market conditions.

Behind the prestigious façade, however, operated a massive fraud. Rather than executing legitimate investment strategies, Madoff simply deposited client funds into a single bank account, using new investments to pay “returns” to existing clients. The classic Ponzi scheme structure created an illusion of profitability while generating no actual investment gains.

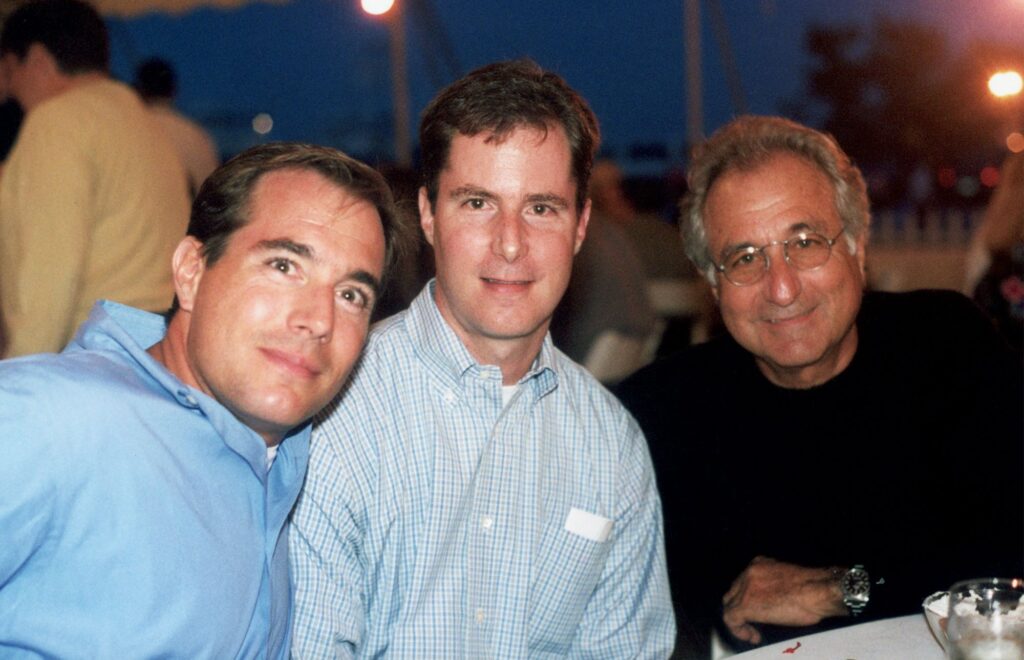

The scheme began to unravel during the 2008 financial crisis when clients, facing liquidity pressures, attempted to withdraw approximately $7 billion. With only $200-300 million remaining in accounts, Madoff could not meet these redemption requests. On December 10, 2008, he confessed to his sons that the investment advisory business was “all just one big lie.” They reported him to authorities the next day.

The scale of Madoff’s fraud was staggering. Court filings indicated approximately $65 billion in losses, affecting thousands of investors worldwide. Victims included prominent individuals like Steven Spielberg and Kevin Bacon, charitable foundations that were forced to close, and countless retirees who lost their life savings. The ripple effects devastated communities, particularly within Jewish circles where Madoff had cultivated many relationships.

In March 2009, Madoff pleaded guilty to 11 federal crimes and was sentenced to 150 years in prison. Judge Denny Chin called his crimes “extraordinarily evil,” noting the breach of trust that affected so many lives. Madoff claimed to have acted alone, though several associates were eventually prosecuted for their roles in the scheme.

The Madoff scandal prompted significant regulatory reforms, including the restructuring of the SEC, which had failed to detect the fraud despite numerous red flags and explicit warnings from financial analyst Harry Markopolos years before Madoff’s confession. The case highlighted critical weaknesses in financial oversight systems and the dangers of unchecked trust in financial advisors.

Madoff died in prison on April 14, 2021, at age 82. His legacy remains one of unprecedented financial destruction and broken trust. The court-appointed trustee, Irving Picard, has recovered more than $14 billion for victims, but many never recovered financially or emotionally from their losses.

The Madoff scandal serves as a cautionary tale about the dangers of financial fraud, the importance of due diligence, and the devastating consequences when regulatory systems fail. His name has become synonymous with financial fraud, representing one of the most extraordinary falls from grace in Wall Street history.

newshub history

Recent Comments