Coca-Cola (NYSE: KO) has been one of Warren Buffets Berkshire Hathaway’s longest holdings and is currently 9.5% of its stock portfolio. Coca-Cola has two things that Buffett loves: an attractive dividend and an economic/brand moat that can’t be replicated by its competitors.

Let’s start with the dividend because that’s why most investors are attracted to Coca-Cola’s stock. Its quarterly dividend is $0.51, with an average yield of around 2.9% in the past 12 months. That’s more than double the S&P 500 average over that same time.

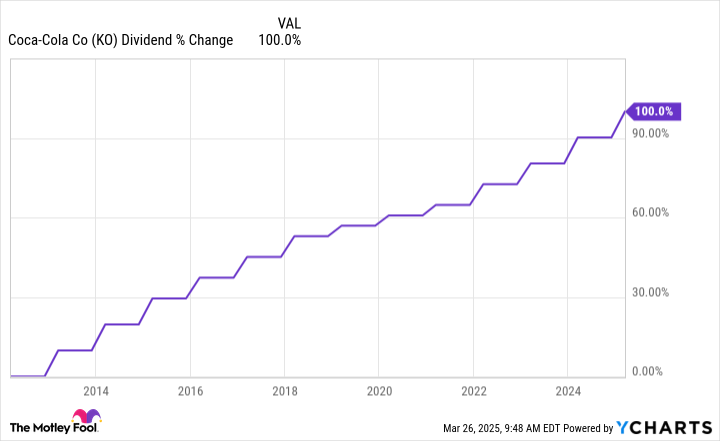

More impressive than its current dividend is Coca-Cola increasing its annual dividend for 63 consecutive years, earning it the title of a Dividend King. Its annual dividend has doubled in the past 13 years, outpacing many other Dividend Kings.

If you’re looking for a business that can survive virtually any economic condition thrown its way, Coca-Cola is it. Its products sell regardless of the economy, and it has pricing power, making it one of the more recession-resistant companies you can find.

That doesn’t mean Coca-Cola won’t hit slumps or that its stock won’t sometimes underperform, but it’s an investment you can bet on returning value over the long term.

One thing that separates Coca-Cola from its competitors is its vast distribution network. Coca-Cola products are sold in over 200 countries, and its focus on just beverages (unlike PepsiCo, which also sells snacks and other foods) allows it to operate more efficiently. That’s partly why PepsiCo’s revenue is more than double that of Coca-Cola’s, but Coca-Cola’s net income far exceeds that of PepsiCo.

Buffett once said of Berkshire Hathaway, “Our favorite holding period is forever,” and Coca-Cola is a stock I’d feel comfortable holding onto for the long haul.

Source; yahoo!finance

Recent Comments