Global shares dithered and the dollar edged higher on Monday after U.S. President Donald Trump warned more tariffs were imminent including on steel and aluminium, an inflationary move that could limit the scope for rate cuts.

Speaking to reporters on Air Force One, Trump said he would announce on Monday 25% tariffs on all steel and aluminium imports into the U.S., and reveal other reciprocal tariffs on Tuesday or Wednesday.

The comments came just after German Chancellor Olaf Scholz said the European Union was ready to respond “within an hour” if the U.S. levied tariffs on European goods, highlighting the risks of an escalating trade war.

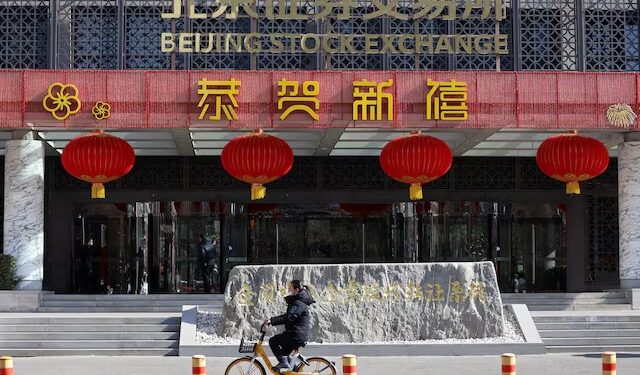

China’s retaliatory tariffs on some U.S. exports are due to take effect on Monday, with no sign as yet of progress between Beijing and Washington.

“These could be a strategic negotiating tool for President Trump or the beginning of a prolonged trade war,” said Stephen Dover, head of the Franklin Templeton Institute.

“Nearly half of U.S. imports serve as inputs for domestic companies, meaning businesses will either have to pass higher costs to consumers, absorb lower margins or adjust supply chains entirely.”

Analysts assume currencies from those countries targeted by Trump will tend to fall against the dollar to help compensate in part for the taxes, keeping their exports competitive.

Tariffs could also put upward pressure on U.S. inflation and further limit room for the Federal Reserve to ease policy.

Markets had already scaled back expected rate cuts this year to just 36 basis points, from around 42 basis points, following an upbeat payrolls report on Friday.

Fed Chair Jerome Powell is due to appear before the House of Representatives on Tuesday and Wednesday and the impact of tariffs on policy is sure to be a hot-button issue.

His Wednesday testimony will also follow consumer price data for January which might hint at early pressure given anecdotal evidence of firms raising prices in anticipation of the taxes.

A survey of consumers out on Friday showed a sharp rise in inflation expectations for the year ahead, though the longer-term outlook was steadier.

DOLLAR UP WITH YIELDS

Investors reacted by pushing the dollar higher, with its index firm at 108.26. The euro dipped 0.1% to $1.0314 , while the trade-exposed Australian dollar eased to $0.6274 .

The dollar bounced 0.3% on the yen to 151.85 , regaining some of the ground recently lost to speculation the Bank of Japan will raise rates in the next few months.

MSCI’s broadest index of Asia-Pacific shares outside Japan lost 0.09%, while Japan’s Nikkei inched up 0.08%. South Korea’s main index reversed early losses to gain 0.16%, though steel makers logged losses.

Chinese blue chips rose 0.3%, with worries about deflation soothed by data showing consumer inflation accelerated to its fastest in five months in January.

Beijing again set a firm fix for its yuan currency, but it still eased to a three-week low around 7.3082 .

EUROSTOXX 50 futures added 0.3%. FTSE futures gained 0.14%, while DAX futures rose 0.14%.

Wall Street futures started lower but soon rallied as investors looked ahead to another busy week of earnings. S&P 500 futures firmed 0.26%, while Nasdaq futures added 0.5%.

Shares had been roiled by some mixed earnings numbers last week, though overall earnings per share growth is running at 12% and above early expectations of 8%.

“Tariffs are a key downside risk to our 2025 EPS forecasts,” warned analysts at Goldman Sachs, who estimated that the effective U.S. tariff rate would likely rise by five percentage points, knocking 1% to 2% off earnings per share.

“Heightened policy uncertainty represents downside risk to valuation because it raises the equity risk premium and implies downward pressure on fair value,” they said in a note.

The risk of reigniting inflation also slugged Treasuries, and yields on 10-year notes were at 4.4826%, from last week’s low of 4.400%.

The strength of the dollar and higher yields have not prevented gold prices from reaching record highs at $2,886 an ounce , helped in part by talk Trump might impose tariffs on the metal.

This has led to stepped up demand for physical gold in London to be shipped to the U.S. to avoid any new taxes, reflected by selling of LME gold futures to buy Comex futures.

The metal was up 0.8% at $2,884 per ounce on Monday.

Oil prices have not fared so well given worries a trade war will hurt global economic growth and thus demand for energy.

Still, the market was due a bounce after three weeks of losses and Brent rallied 44 cents to $75.10, while U.S. crude rose 43 cents to $71.43 per barrel.

Source: Reuters

Recent Comments