Financial organizations are gaining a better understanding of AI’s limitations compared to human interaction as they grow more acquainted with the technology.

Financial marketers are increasingly recognizing the value of artificial intelligence as it transforms the workforce. Banks and credit unions are progressively embracing AI tools such as chatbots and automated customer service systems to enhance efficiency and improve customer experiences.

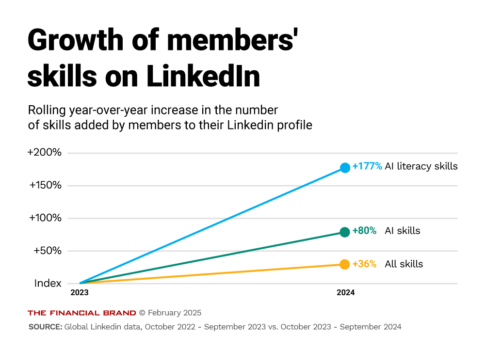

Across industries, employees at all levels are increasingly highlighting their AI skills and literacy on their resumes to attract the attention of companies eager to adopt this technology. Since 2023, the number of professionals adding AI literacy skills to their LinkedIn profiles has surged by 177%, according to data from LinkedIn.

As companies and employees become more familiar with AI, they are also gaining a clearer understanding of its limitations. No matter how many customer questions a chatbot can handle in a day, it can never replicate the connection that comes from interacting with another human person.

“AI helps us to be more efficient to help us with prioritizing things that we need to do, to accomplish our tasks, but at the end of the day we are the ones who have that creativity, who have that self-awareness, and also collective relational awareness,” says Christine Samuel, founder and co-creator at Inner Work Matters, which provides leadership and career coaching.

Employees in roles that traditionally didn’t require strong soft skills are now increasingly expected to master empathy and listening. The importance of “human-skills” has grown 20% since 2018, according to LinkedIn’s “Work Change Report: AI is Coming to Work.”

“The things that connect all of the humans together is relational intelligence,” Samuel says. “Intelligence that allows us to tune into one another, and derive something from that interaction. How we can listen to one another so that we can come up with new solutions. That’s very important for customer service.”

Soft skills are expected to become even more vital in both customer service and leadership positions, particularly as more customers shift toward digital banking—though in-branch services may experience a resurgence in 2025.

But despite the growing demand for soft skills, a Wiley report reveals that only 35% of employers offer training in these essential areas for their workforce, which are critical for long-term customer engagement and retention. So how can leaders easily boost these vital skills among their workers? Leaders should offer opportunities for learning and development, open dialogue, and place value on these soft skills in the workplace.

Defining the Value of Soft Skills at Work

Soft skills typically encompass interpersonal and communication abilities such as empathy, active listening, creativity, teamwork, problem-solving and leadership. Strengthening these skills can significantly enhance an employee’s professional growth. For instance, LinkedIn data reveals that members showcasing a combination of hard and soft skills on their profiles are promoted 8% faster than those highlighting only hard skills.

“Soft skills are crucial for fostering effective communication, collaboration, and adaptability in the workplace,” Mark Scullard, senior director of product innovation at Wiley says in a press release. “Organizations that neglect to invest in these areas could hinder employee growth, diminish team dynamics and potentially limit the organization’s ability to thrive in an ever-changing business landscape.”

These skills are vital not only for effectively engaging with customers but also for fostering collaboration among colleagues and developing strong leaders. However, soft skills are often undervalued in the workforce. For instance, a McKinsey study found that jobs requiring hard skills, such as C++ and Python, tend to pay twice as much as those emphasizing soft skills like teamwork and communication.

Leaders looking to enhance these skills within their workforce should actively communicate their commitment to prioritizing interpersonal skills while also investing in the continuous improvement of their own communication and leadership abilities.

Offer Soft Skills Training

Offering soft skills training may seem like an obvious solution, but it remains a vital and effective strategy for tackling this issue. Samuel emphasizes the importance of taking a deeper approach when teaching skills like active listening, particularly in high-stress situations. It’s important to make the training as engaging as possible and to encourage an open discussion between participants.

“I think there should be innovation in leadership training,” Samuel says. “Different from the class where it’s just all this theory and we are so overloaded with information and it’s hard to embody it.”

Samuel introduces an exercise called a “deep listening circle,” designed to help participants hone their listening and response skills in customer interactions. In this activity, a facilitator plays a recording of a customer complaint call and asks employees to analyze what they hear. Participants are encouraged to identify the customer’s emotions and share their interpretations.

As team members contribute their perspectives, the group develops a deeper understanding of the diverse ways colleagues perceive situations, highlighting the critical role of thoughtful and empathetic responses in effective communication. Companies can also rely on learning management systems like LinkedIn Learning or Workday, which offer a variety of training on these topics.

“It should include experiential training where they can practice what it means to be relational, what does it mean to have emotional intelligence, what does it mean when we have discussions and it’s open and can be attuned to one another,” she says.

Give Employees Room to Contribute

To foster an environment where employees feel comfortable to develop these skills, leaders need to be open to dialogue, Samuel says.

“We all have diverse perspectives, opinions, and experiences,” Samuel says. “People come to work, they want to contribute, they want to give their best. We all know we’re not going to give our best if you’re not creating a safe space.”

Banks must identify communication pain points within their organization to foster a more efficient and collaborative environment. One effective approach is conducting anonymous surveys with employees and managers to gather valuable insights and pinpoint areas for improvement. Upper management should remain receptive to both giving and receiving feedback, actively seeking input from their workforce about where additional support is needed.

Leaders should also focus on enhancing their own soft skills and pass on their knowledge to team members, helping to cultivate a culture of continuous improvement.

“Self growth and self awareness are qualities that leaders need to have an embody,” Samuel says. “The way we know if a leader embodies it is by the sense of safety they can create in their environment and team. If the team can feel safe to be themselves, bring themselves, bring their ideas, you can kind of see that ripples to the customers.”

Source: THE FINANCIAL BRAND

Recent Comments