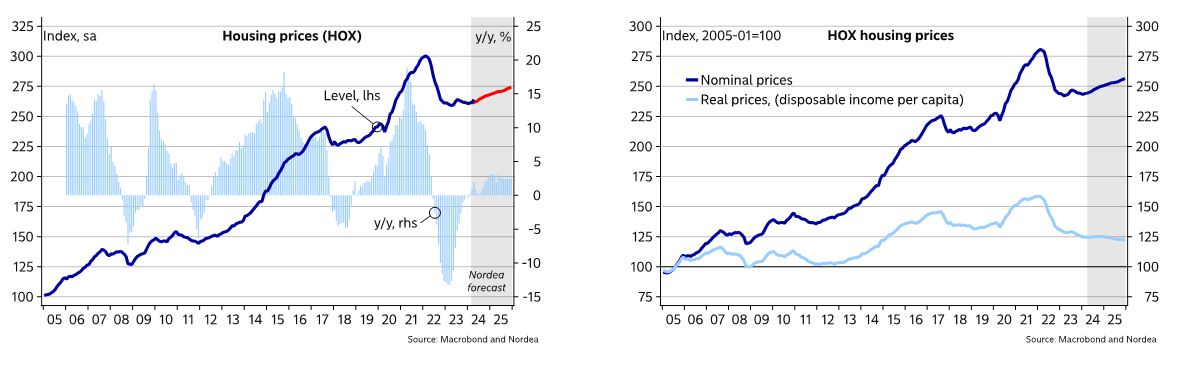

The decline in housing prices seems to be over as prices rose sharply this spring. We expect a contained recovery in housing prices going forward, with prices increasing by between 5-10% until the end of next year.

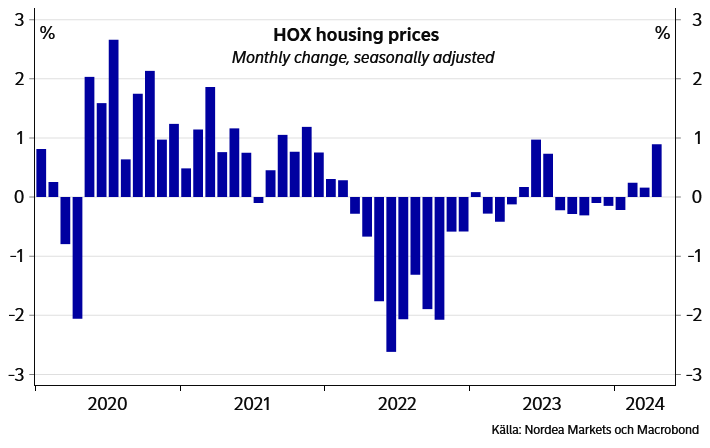

Sideways since the fall of 2022

Swedish housing prices have been close to unchanged ever since the end of the downturn 15 months ago. Prices rose slightly in the first quarter of this year and increased by almost 1 percent over the month in April, which strengthens our view that the housing market has turned a corner.

As we argued in January, there was a chance that falling interest rate expectations could lift prices before the first rate cut from the Riksbank, which also happened. We have since then made a slight upward adjustment to our forecast but stick to our general view that housing prices will increase on the back of the Riksbank’s rate cuts. We do not expect any surge however, as a record-high housing supply will dampen the uptrend. Compared to the trough, we see housing prices rising by 6% until the end of 2025. In real terms, prices are expected to be unchanged throughout the forecast period.

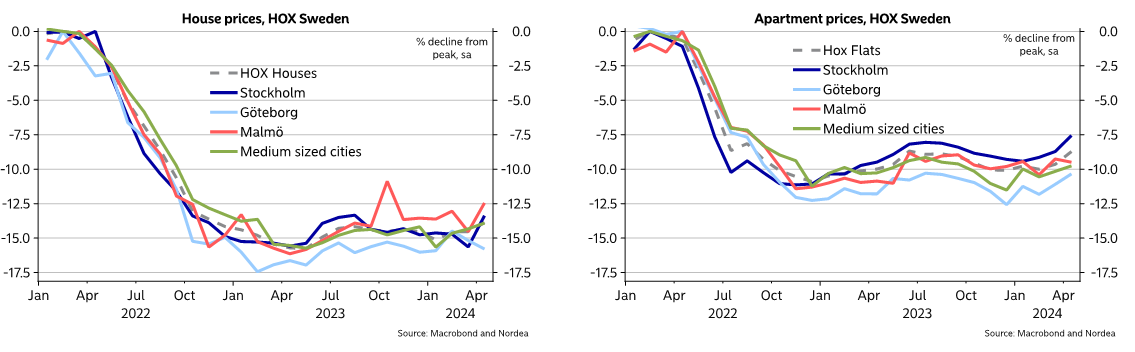

In total, national housing prices are 12% lower from the previous high in early 2022. The market for single-family houses remains the main drag on price development, posting a 14% decrease from the peak in February 2022. The apartment market has fared relatively better, with prices 9% lower compared to the previous peak. All three major cities have seen positive price growth in the start of this year.

Recovering demand but record-high supply

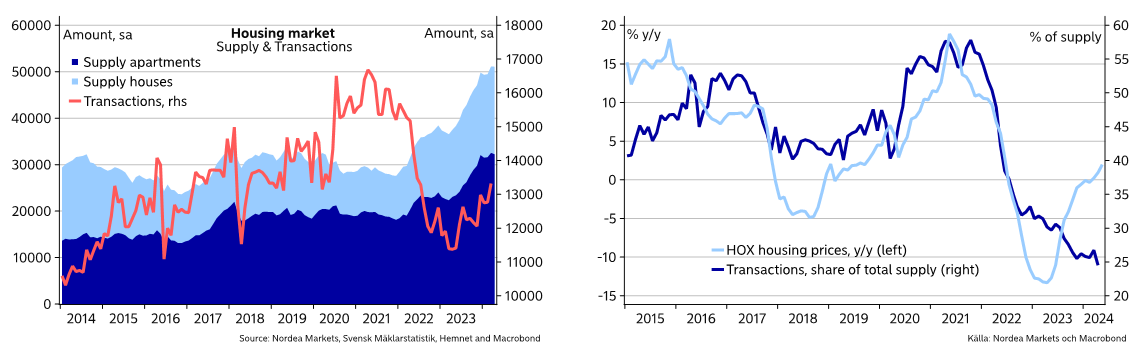

Despite lackluster price development in the start of the year, fundamentals suggest that imbalances on the housing market are starting to ease.

Transaction volumes bottomed out in the middle of 2023 and have since then trended higher to more normal levels. At the same time, the supply of both houses and apartments has continued to increase to new record-highs.

Even though the activity on the housing market has recovered, transaction volumes as a share of total supply has fallen to historically low levels, suggesting that there is room for the market to absorb an increased demand without large price increases. Therefore, even though there are upside risks to our forecast in the coming months, the large supply on the market could dampen price growth longer out.

Newfound optimism

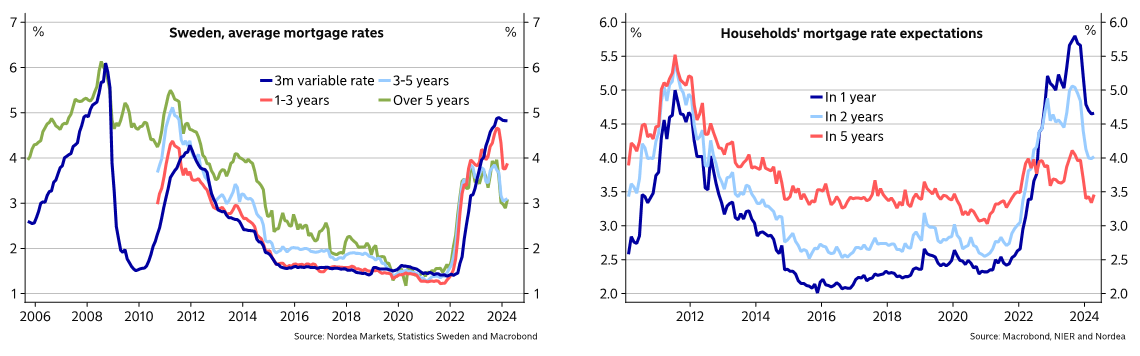

One of the key factors for the rebound in transaction volumes is that households are more optimistic on the prospects of lower interest rates. Households have taken note that rate cuts are in the cards and short term mortgage rate expectations have declined by more than one percentage point in the last six months.

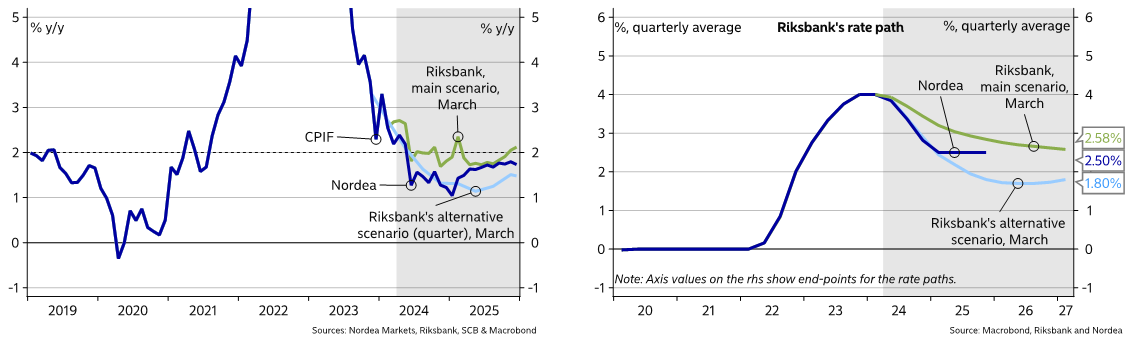

We expect the Riksbank to cut the policy rate at the five remaining meetings this year to 2.5%. However, both the Riksbank and market pricing signal only two more cuts this year. Admittedly, a June cut is less likely after the Riksbank’s signals last week, which could move one or more cuts into 2025 and and by extension pose downside risks to our housing market forecast. Nonetheless, we expect inflation to fall below the target this summer and remain too low during the rest of the forecast period, which calls for more easing than the two additional rate cuts the Riksbank has signalled for this year.

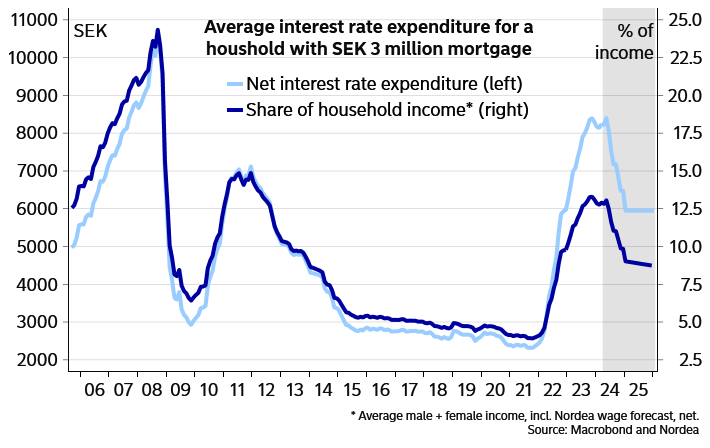

The interest burden for the average Swedish household, with a mortgage size of SEK 3 million, has tripled compared to before the pandemic. The chart below shows that if the Riksbank cuts rates in accordance with our relatively dovish forecast, about half of the added interest burden will be removed by the end of this year. We do however not expect further rate cuts in 2025, thus leaving the policy rate unchanged at 2.5%, which implies that the interest burden will remain higher than during the last decade.

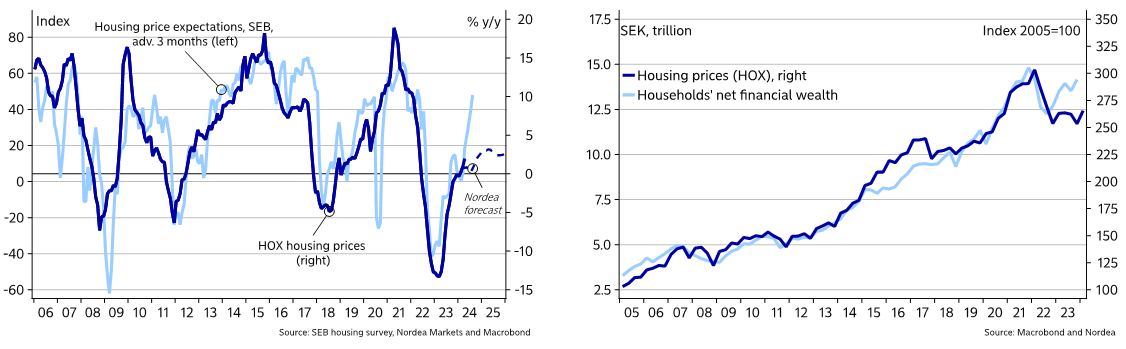

The prospects of multiple interest rate cuts this year has led households to become more upbeat about the housing market in various surveys. For example, home price expectations in the SEB housing survey has bounced sharply in the start of this year. The indicator has risen to the historical average and suggests that prices are set to increase in the coming months, illustrating upside risks to our forecast (see chart below). Furthermore, households’ financial situation remains solid; their financial wealth has risen since Q4 2022 and are close to record-high levels – mainly thanks to strong equity markets.

Households starving for rate cuts

Paradoxically, this newfound optimism constitutes risks on both the upside and downside for housing prices. In the near term, prices have already stabilized and are set to increase on the prospects of lower mortgage costs. However, if the Riksbank fails to meet households’ falling interest rate expectations, there is a risk for a backlash.

All told, the prospects for higher housing prices have clearly improved in the last months. Optimism is on the rise as the Riksbank’s hiking cycle has concluded and been replaced by expectations of rate cuts. Inflation has normalized and general uncertainty has decreased. However, a record-high supply should absorb an increased demand and thus counter any strong price growth in the forecast period. Moreover, we expect mortgage costs to remain relatively high during the forecast horizon. We therefore expect a rather gradual recovery on the housing market.

Source: Nordea Corporate

Recent Comments