The global neobank market was worth USD 18.6 billion in 2018 and is expected to accelerate at a compounded annual growth rate (CAGR) of around 46.5% between 2019 and 2026, generating around USD 394.6 billion by 2026.

The substantial growth potential for neobanks is driven by their low-cost model for end consumers with no or very low monthly fees on banking services such as minimum balance maintenance, deposits and withdrawals. Adoption by millennials, micro, small and medium enterprises (MSMEs), and those having sporadic incomes and earnings, embracement of innovative technologies and rising consumerism are some of the catalysts for the success for neobanks. The high adoption rates and successful business models of neobanks has piqued the interest of investors, venture capitalists and corporates, who contributed USD 586.7 million of the total funding of USD 3.49 billion received by FinTechs globally in March 2018.

In 2018, the business sector accounted for majority of the global market revenue of neobanks4, due to growing acceptance of digital payments in both multinational companies and organisations in their nascent stages. MSMEs received services such as accounting, budgeting, taxation, analytics from neobanks at fractional costs. Such services were earlier accessible only to larger establishments, owing to the costs involved.

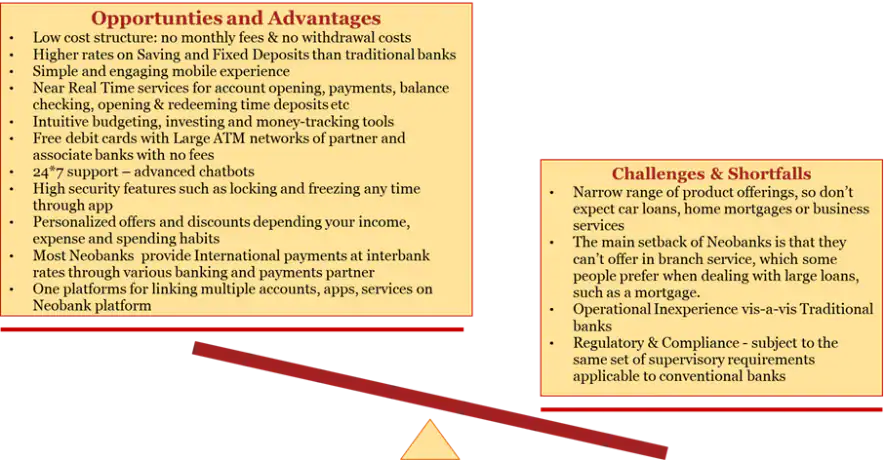

Advantages and shortcomings of neobanks

Advantages of neobanks over traditional banks for MSMEs

- Customer experience: neobanks don’t offer novel banking services. Their services are similar to those of traditional banks but with a hyper-enhanced and personalised customer experience. Neobanks have significantly leaner business models and superior technologies at their disposal compared to traditional banks, providing ease and efficacy in services, such as seamless account creation, round-the-clock customer service supported by chatbots, near real-time cross-border payments, and artificial intelligence (AI) and machine learning (ML)-enabled automated accounting, budgeting and treasury services.

- Automated services: Apart from providing primary banking services, neobanks offer automated and near real-time accounting and reconciliation services for bookkeeping, balance sheets, profit and loss statements and taxation services such as GST-compliant invoicing, tax payments record keeping and reconciliation, on mobile platforms for affordable costs..

- Transparency: Neobanks are transparent and strive to provide real-time notifications and explanations of any charges and penalties incurred by the customer.

- Easy-to-use APIs: Most neobanks provide easy-to-deploy and operate APIs to integrate banking into the accounting and payment infrastructure.

- Deep insights: Most neobanks provide dashboard solutions with highly enhanced interfaces and easy-to-understand and valuable insights for services such as payments, payables and receivables, and bank statements. It’s beneficial for businesses with significant expenditure and an appropriate number of employees, to be provided with such insights, reduce expenditure and boost productivity and revenue.

Source: pwc

Recent Comments