The rise of neobanking in fintech

Neobanking refers to a type of financial institution that operates entirely online, with no physical branches. These banks offer all the traditional banking services, such as checking accounts, savings accounts, and loans, but with a digital-first approach that leverages technology to provide a faster, more convenient, and more personalized experience for customers.

One of the biggest advantages of neobanking over traditional banking is the ease and accessibility it provides consumers. With neobanking, customers can manage their finances from anywhere, at any time, using their mobile phones or computers. This is particularly beneficial for those who have busy lifestyles and don’t have the time or inclination to visit a physical bank branch.

Neobanks also aim to deliver a more personalized user experience, allowing users to organize their money in novel ways and personalize their app experience to suit their financial goals. From a customer service perspective, neobanks set themselves apart from traditional banks by delivering timely support and messaging using social media and in-app chat rather than requiring users to phone a call centre or wait days for an email response.

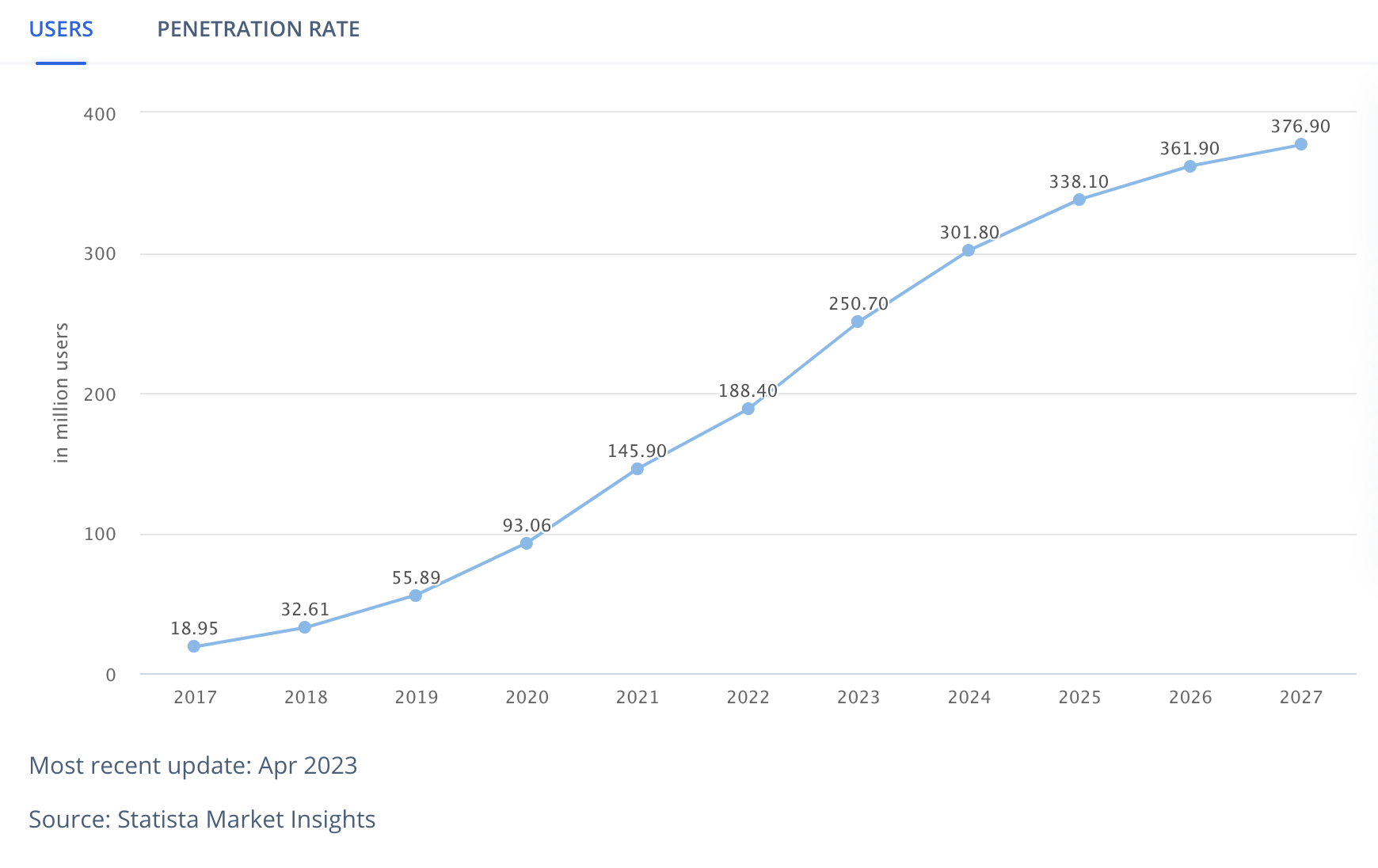

This fresh approach to banking has helped the neobanking industry see significant growth in recent years.

The global neobanking market was valued at $66.82 billion in 2022 and is expected to grow at a compound annual growth rate of 54.8% from 2023 to 2030

Latest trends and innovations in neobanking

Neobanking is a dynamic and rapidly evolving sector. As of March 2023, there are currently 278 neobanks in the world, putting pressure on them to innovate continuously to offer their consumers more than the next latest competitor.

New trends and innovations are emerging in neobanking all the time. Here are some of the most significant that are transforming the industry:

1. Artificial intelligence and machine learning

Neobanks are increasingly leveraging AI and machine learning to provide more personalized and customized banking insights to their customers. Some neobanks use AI algorithms to analyze customer spending patterns and make personalized budgeting recommendations, helping their customers save and learn how to budget their money more efficiently.

By leveraging spending data in ways that provide their customers with maximum value, neobanks are changing the way that consumers view the use of data, leading to a more positive perception of neobanks over the traditional banking system.

2. Personalized digital experience

Neobanks are also offering a more personalized digital experience to their customers, such as the ability to choose the colour of their debit card, set up custom spending categories, and even add personal imagery to their savings pots.

Through greater personalization and the inclusion of simple customization options, neobanks can make their platforms sticky, developing a stronger personal and emotional connection with their customers that will help them retain business in the long term.

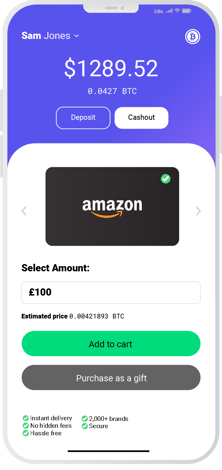

3. Cryptocurrencies and blockchain technology

Some neobanks are even embracing cryptocurrencies and blockchain technology, allowing customers to manage their cryptocurrency from their neobanking app. One such neobank is Revolut which allows its users to buy, sell, and send crypto at the touch of a button with no hidden fees.

As the crypto market continues to grow and evolve, and with neobanks constantly looking for a competitive advantage, we’ll likely see more neobanks embracing cryptocurrencies in the near future.

4. Environmental and social sustainability

Neobanks are increasingly taking a more socially responsible approach to banking, and some are now enabling their users to schedule and make donations to a charity of their choice from within their banking app.

With 57% of consumers admitting to being more loyal to brands that show a commitment to addressing social inequities, neobanks are becoming the bank of choice for the younger generation looking to align their personal values with the businesses and financial institutions they choose to support.

5. Digital wallets and payments

In addition to providing basic banking services such as checking and savings accounts, neobanks have revolutionized the way consumers make payments and transfer money.

With features such as digital wallets, customers can store their payment information securely and use it to make transactions with just a few clicks, and peer-to-peer payments allow users to transfer funds instantly to friends and family members, even if they don’t have an account with the same bank.

For users who regularly travel, neobanks also offer low-cost international money transfers and low exchange rates when withdrawing or spending money in other currencies. This makes it easier and more affordable for neobank users to continue using their neobank card abroad rather than taking out large sums of cash and needing to exchange it back at the end of their vacation.

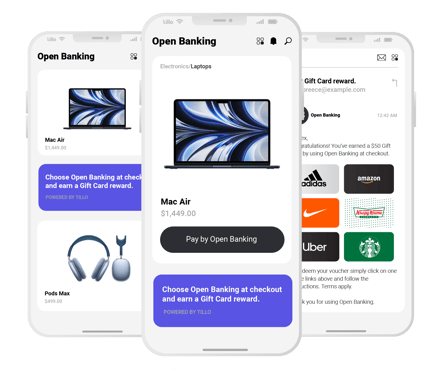

6. Open banking and API integrations

Thanks to open banking and the simplicity of API integrations, neobanks can expand their in-app offering without disrupting the user experience.

Neobanks are taking advantage of open banking to offer seamless integrations with other financial services, such as investment apps and Buy Now Pay Later (BNPL), but perhaps one of the most interesting uses of open banking by neobanks is in aggregating account information.

By utilizing open banking, neobanks can give their users visibility across all their bank accounts without needing to handle the customer authentication process directly or worry about complying with the revised Payment Services Directive (PSD2) and the General Data Protection Regulation (GDPR).

7. Instant loans and credit

Taking out a loan with a traditional bank can be a long and tedious process. In an attempt to make this process easier for consumers, some neobanks are now offering instant loans and credit approvals to their customers, which can see them access funds in minutes, not days.

By utilizing spending data, neobanks can fast-track the approval process, making it easier for their customers to access additional funds, take out a loan and handle their debt all from within their banking app and, in some cases, without taking into consideration their credit score.

Offering popular banking services such as these encourages users to utilize their Neobank cards more, helping to generate revenue for Neobank while simultaneously providing a better experience for the end user.

Staying ahead of the curve by utilizing the power of digital gift cards

In the increasingly crowded neobanking market, neobanks must do more to attract, engage, and retain their customers. Fortunately, digital gift cards enable neobanks to do just that by providing them with a cost-effective, convenient, and versatile tool that can quickly and easily be implemented across any acquisition, engagement, or loyalty program.

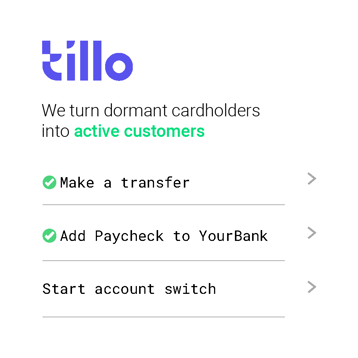

By offering digital gift cards as a sign-up bonus or for completing specific actions, such as making a first deposit or referring friends, neobanks can incentivize their users to engage with their banking app and build a regular habit of using their bank cards. Gift cards are also one of the best ways for neobanks to reward existing fans, ensuring they don’t switch to an emerging challenger bank.

With a single API connection to Tillo’s innovative platform, neobanks can tap into 2,000+ brands that people love, ensuring they have the right incentive to offer each and every one of their customers, regardless of their preferences. They’ll also gain access to unbeatable commercial terms, helping to make their programs more cost-effective.

Source: Tillo

Recent Comments