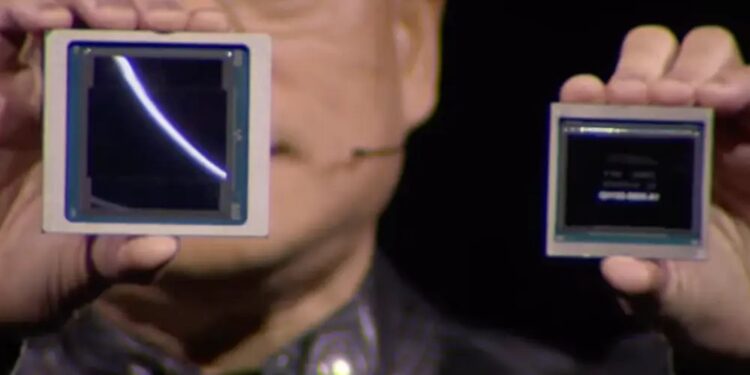

- Nvidia’s CEO Jensen Huang unveiled its next-generation chip today.

- The Blackwell chip, named after statistician David Blackwell, is much faster than its predecessor.

- The chips will “realize the promise of AI for every industry,” he said.

Nvidia CEO Jensen Huang unveiled the Blackwell chip — a next-generation AI chip succeeding its massively in-demand H100, which has served as a backbone of sorts amid an AI gold rush.

The Blackwell chip, named after statistician and mathematician David Blackwell, is at least two times faster than its predecessor, Huang said in his keynote at the GPU Technology Conference (GTC) Monday in San Jose, California.

“It’s now twice as fast as Hopper, but very importantly, it has computation in the network” — which amplifies its speeds even further, Huang said. It will be able to do things like turn speech into 3D video, he added.

The chip is packed with 208 billion transistors — 128 billion more than the Hopper.

Compared with the Hopper, the Blackwell chip boasts five times the AI performance and reduces cost and energy consumption by up to 25x, Nvidia says of the product.

“There’s no memory locality issues, no cache issues — it’s just one giant chip,” Huang said. “And so, when we were told that Blackwell’s ambitions were beyond the limits of physics, the engineers said, ‘so what’? So this is what happened.”

Huang didn’t disclose the price of the chip, which the company calls the start of a “new era of computing,” but he joked onstage that its functioning board was “quite expensive.”

“Blackwell GPUs are the engine to power this new industrial revolution,” he said. “Working with the most dynamic companies in the world, we will realize the promise of AI for every industry.”

The current H100 chips can sell for upwards of $40,000 apiece. Amid shortages precipitated by supply issues during the pandemic, tech giants are scrambling to get their hands on them, with Mark Zuckerberg stockpiling about 350,000 by year’s end.

As a result, Nvidia sales are soaring. In its fourth-quarter earnings call in February, Nivida reported quarterly revenue of $22.1 billion. That said, the company has faced headwinds in China due to tough export controls. And other tech giants — including Meta, Microsoft, Google, and AMD — are readying rival chips as well.

Source: I N S I D E R

Recent Comments