The conditions that came together to incubate the neobank movement are giving way. A new world order is coaxing the challengers to evolve, and they increasing look like, well, banks — but with different attitudes. Growth consultancy Simon-Kucher believes that some neobanks will take their place at the top of national financial services industries. Others, unfortunately, may simply be absorbed into traditional providers’ transformation strategies.

The neobank age has given traditional banking institutions a good competitive shake up, and delivered some harsh lessons about customer experience.

And the impact is undeniable.

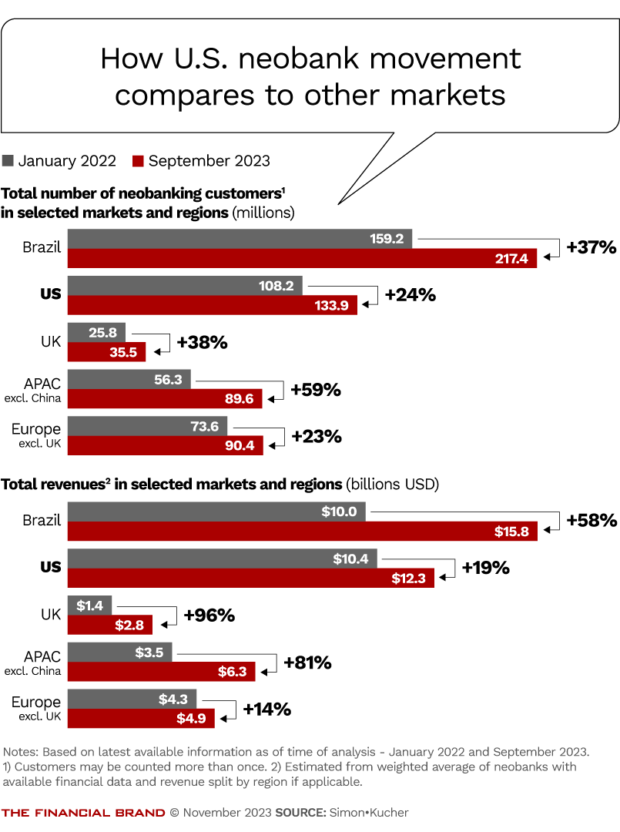

Research by Simon-Kucher & Partners estimates that the total number of neobanking customers worldwide has passed 1 billion — an increase of over 30% in just 18 months. Meanwhile, as we’ll explore, some neobanks are also (finally) cracking the profitability challenge.

Today’s bank and credit union executives have lived through a time when the neobank challenge loomed large. But history has a way of turning major events into footnotes.

“Probably 10 years down the road, I’m not sure we will still distinguish between a neobank and a traditional bank,” says Christoph Stegmeier, senior partner at Simon-Kucher & Partners. Some tremendous success stories will thrive and become very significant parts of their national financial systems. But of the 399 neobanks that the firm has been tracking worldwide over recent years, Stegmeier says perhaps 50 will survive in the long term.

Further, he says the firm’s research indicates that as spawning of new neobanks slows, launches may soon be overtaken by closures. From January 2022 to July 2023, Simon-Kucher found that 36 new neobanks started globally, with 34 giving up and shuttering. In the U.S., eight opened and five closed, according to the consulting firm’s 2023 report, “Profits at the End of the Tunnel,” and related materials.

A drastically changed world economy and the resulting pressure on funding has much to do with this. Neobanks have been shifting from an emphasis on fast and high growth to a need to demonstrate profitability. Not all have been able to hack the change in the dance music.

But the stronger neobanks have already demonstrated long-running stamina, as measured by customer base, according to Simon-Kucher. Chime ranks 11th among banking providers in the U.S., for example, while Brazil’s Nubank ranks fourth. Revolut ranks sixth in the U.K., and it’s in the top three U.K.-based players for global customers.

Referencing the previous edition of the study, the firm reports that “18 months after stating that only 5% or less of the neobanks were profitable, the number of non-profitable banks still by far exceeds the number of profitable banks. The good news is that there is evidence of a growing number of neobanks who appear to have cracked the code or are getting very close to doing so.”

Among neobanks that are achieving both strong customer growth and profitability are Nubank, Revolut, Starling Bank, Kakao Bank and Wise, according to the firm’s new Neobanking Profitability Matrix. The keys are continuing innovation and diversification — including offering more products and (specifically) credit products — and homing in on what customers need.

In time, Stegmeier thinks that each country in which neobanks operate will see at least one of the survivors become as big or bigger than incumbent institutions. Eventually, these one-time newcomers may reach revenue-per-customer levels that rival the traditional institutions, he predicts.

In Brazil, he says, there’s no reason Nubank couldn’t become the largest institution by customers. It might take another decade, but Chime or Varo Bank might reach that level in the U.S.

One could argue that the evolution of neobanks could, in some ways, parallel the development of search engines years ago. Few remember the likes of Lycos, AltaVista, and Ask Jeeves. But out of that melee came Google — which not only survived and thrived, but in many ways redefined society.

One spoiler coming along is Elon Musk’s plans for X, formerly known as Twitter. Musk wants to turn it into a banking and payments machine. X wasn’t a factor in Simon-Kucher’s study, but Stegmeier says now that Musk has begun to show his cards, X is going to look a great deal like a neobank. If X will succeed remains to be seen.

Meanwhile, U.S. banking institutions must also be alert for beachheads by robust neobanks from other countries.

Revolut is already active in the U.S. and opened a New York City headquarters in mid-November. Stegmeier thinks Revolut will hit a tipping point in the near future, and he says he would not be surprised to see Nubank attempt a landing in the U.S. as well. Banking-as-a-service arrangements would make this possible for Nubank, as it has for Revolut, which relies on three banking partners right now in lieu of a U.S. charter. (Revolut has banking licenses in its other markets.)

Source: The Financial Brand

Recent Comments