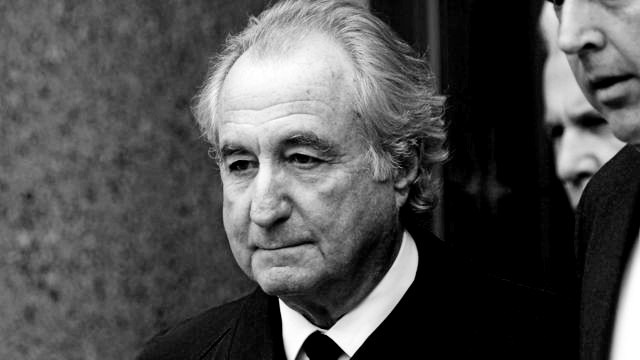

Bernie Madoff, a name that will forever be associated with one of the most infamous financial crimes in history, orchestrated a massive Ponzi scheme that defrauded thousands of investors out of billions of dollars. This article delves into the rise and fall of Madoff, shedding light on his deceitful actions and the profound impact they had on the financial world.

The Rise of Bernie Madoff

Born on April 29, 1938, in Queens, New York, Bernie Madoff was a charismatic and respected figure on Wall Street. In 1960, he founded Bernard L. Madoff Investment Securities LLC, which eventually grew to become one of the largest market-making firms in the United States. Over the years, Madoff’s firm gained a reputation for consistent and high returns, attracting numerous investors, including celebrities, charities, and even financial institutions.

The Unraveling of the Ponzi Scheme

It wasn’t until December 2008 that the world discovered the shocking truth behind Madoff’s success. As the global financial crisis unfolded, investors began to withdraw their funds from Madoff’s firm. Unable to meet their demands, Madoff confessed to his sons that his investment business was a Ponzi scheme, where new investors’ money was used to pay returns to existing investors. The scheme had been running for decades, and its total losses were estimated at an astonishing $65 billion.

Madoff’s Downfall and Legal Consequences

On December 11, 2008, Bernie Madoff was arrested and charged with securities fraud. In March 2009, he pleaded guilty to 11 federal felonies, including investment advisor fraud, mail fraud, and money laundering. In June 2009, he received a sentence of 150 years in federal prison, ensuring he would spend the rest of his life behind bars.

Impacts and Lessons Learned

The Madoff scandal sent shockwaves throughout the financial world, exposing the vulnerabilities and shortcomings in regulatory systems. The Securities and Exchange Commission (SEC) faced significant criticism for failing to uncover the fraud despite several red flags. The scandal also highlighted the importance of due diligence and skepticism when it comes to investment opportunities, even those seemingly endorsed by reputable figures.

Victims and Recovery Efforts

Thousands of investors, ranging from individuals to charitable foundations, suffered devastating financial losses as a result of Madoff’s scheme. In the aftermath, recovery efforts were launched to compensate the victims, although it proved to be a lengthy and complex process. The court-appointed trustee recovered billions of dollars through the sale of Madoff’s assets, but the losses were so extensive that many investors only received a fraction of their original investments.

Bernie Madoff’s name will forever be synonymous with financial fraud. His elaborate Ponzi scheme shattered lives, tarnished reputations, and highlighted the need for increased vigilance in the financial industry. The Madoff scandal serves as a sobering reminder of the importance of transparency, accountability, and ethical behaviour in the world of finance, and it continues to be studied as a cautionary tale for investors and regulators alike.

newshub

Recent Comments