Around two years ago, Victor Cardenas and Kevin Bai — college dropouts from Stanford University and the University of Waterloo, respectively — built a fintech platform called Slash that lets users create shareable virtual cards to split recurring expenses. Slash quickly became popular with teenagers because its virtual cards were debit-based, available to people 13 or older and didn’t limit spending based on credit history.

In the subsequent months, Cardenas and Bai say that they saw an opportunity to got after a larger market: young, commerce-focused entrepreneurs.

“The goal is for Slash’s suite of products to be so robust that it gives people who otherwise wouldn’t have taken the leap toward self-employment the confidence to work for themselves,” Cardenas told TechCrunch in an email interview. “Slash’s goal is to capitalize on people’s growing tendency to make a living on the internet and give as many people as possible the confidence to start their own business.”

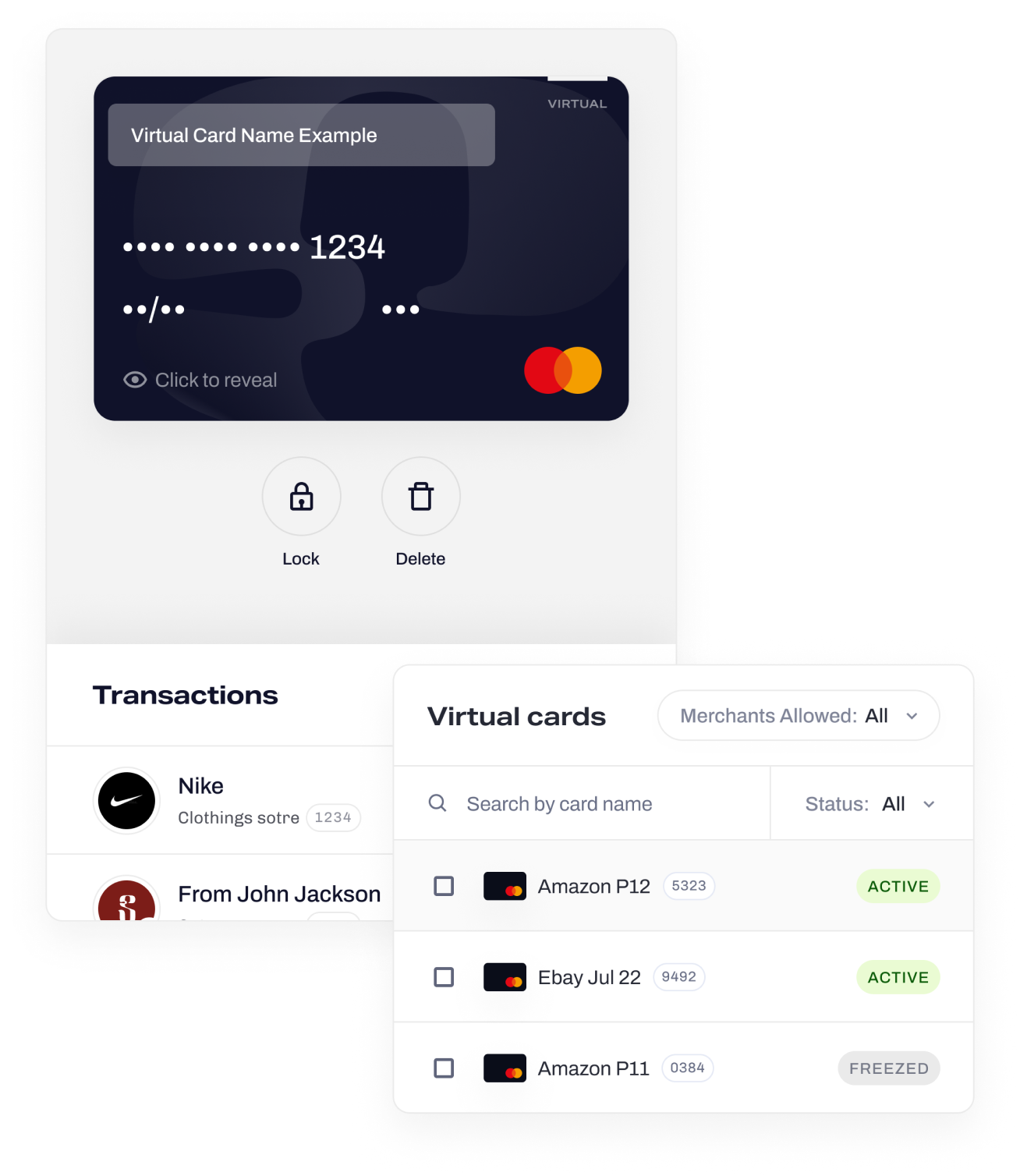

Today, Slash — which is FDIC-insured via Piermont Bank, its partner bank — offers something of a hybrid business/personal banking product that allows users to silo their personal and business funds but manage them from a single dashboard. Customers get two Mastercard-branded debit cards and see two transaction feeds, with controls for whitelisting — or blacklisting — merchants for purchases.

Slash bundles nonbanking software with its core product, providing daily advances for merchants selling on platforms like Alias and Amazon, a virtual card product with fine-grain spend limits and a feature that automatically generates profit and loss statements from transaction data. As before, any user over the age of 13 can sign up with Slash — credit checks aren’t required.

Those under 18 must have a legal guardian participate in the Slash account setup process, however. Guardians have a specialized view of the user’s account with full control and can track and make changes at any point, Cardenas says.

“Slash isn’t built for enterprise — it’s built for self-employed Gen Z entrepreneurs,” Cardenas said. “Eventually, Slash would like to help young entrepreneurs file their taxes, issue invoices and incorporate new businesses all in one place.”

Slash is a part of a crop of intriguing neobanks targeting the Gen Z market, particularly Gen Zers with side hustles like drop-shipping and livestreaming. Juni, which launched several years ago, offers capabilities designed to appeal to young e-commerce businesses. Meanwhile, Zelf launched a banking integration with Discord to make it easier to trade virtual assets, like collectibles, through real-money transactions.

Image Credits: Slash

Cardenas argues that their success indicates a “mindset shift” in young entrepreneurs away from conventional financial institutions.

“Banks’ strategies for growth, trust-building and retention that have proven effective in the past may not be equally fruitful in the future,” he said. “The way Slash delivers support, communicates with customers and ships new features resembles a ‘WallStreetBets-like’ Reddit community more than a traditional, buttoned-up brick-and-mortar bank.”

Investors seem keen on the idea — at least in Slash’s case. Perhaps persuaded by Slash’s 20,000-person-strong customer base, NEA, Menlo Ventures, Connect Ventures, Y Combinator, Soma Capital, Global Founders Capital and angel investors poured $19 million into Slash’s Series A and seed rounds. Plaid founder William Hockey and Tinder co-founder Justin Mateen were among the participants.

Of course, even for the best-positioned of neobanks, it’s an unforgiving macroeconomic environment at present. Neobanks often struggle to turn a profit, with an estimated fewer than 5% breaking even, per a report from Simon-Kucher & Partners.

Last June, roughly two years after Xinja collapsed, Volt Bank also went under, returning $100 million to customers after failing to secure enough funds through a capital raise. Two other neobanks, 86 400 and Up, have been acquired by the big banks over the last two years.

Can Slash do better? We’ll have to wait and see.

Brighter days might be on the horizon for the industry, fortunately. Insider Intelligence forecasts that the number of U.S. neobank account holders will grow 46.4% between 2022 and 2026.

In any case, Slash is choosing to be conservative with spending at the start, refraining from expanding its 23-person workforce for the foreseeable future.

“With the money raised, Slash plans to eventually grow its engineering, design and customer success teams while continuing to build features that delight customers and keep up with demand,” Cardenas said.

NEA Rick Yang expressed his approval in an emailed quote:

“We are excited to support Slash’s mission to create a zero-friction banking experience for the hustle economy. Victor, Kevin, and team have created a unique approach to bridging the gap between personal and business banking. Their focus on serving the needs of the next generation of entrepreneurs is impressive, and we look forward to seeing their continued growth and success.”

Source: TechCrunch

Recent Comments