US equity futures climbed on investor bets that a peak in interest rates is near and bank turmoil will ease further. European stocks rose and the dollar declined in the risk-on mood

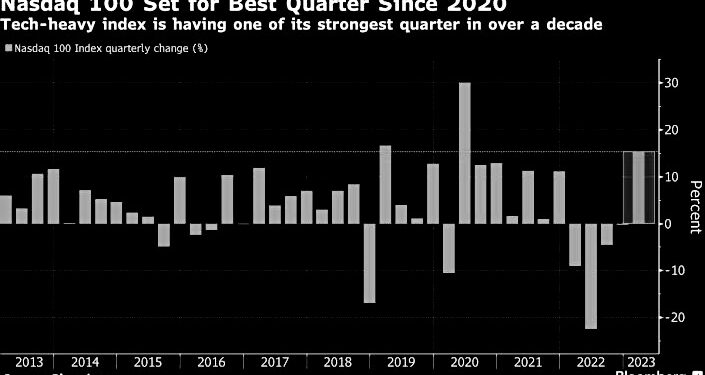

S&P 500 contracts and those on the tech-heavy Nasdaq 100 advanced at least 0.4% after a rally on Wednesday that pushed the latter into a bull market. Retail shares led gains in the Stoxx Europe 600 Index, with Hennes & Mauritz AB soaring after the Swedish clothing company’s first-quarter results beat expectations.

Stocks have been drifting higher in recent days as the worst of the bank selloff recedes, even with a lack of fresh news on the direction of interest rates. Attention in the US turns next to jobless data, GDP numbers and the core personal consumption expenditure reading for insights on the Federal Reserve’s policy moves. Investors now expect US rates to sit around 4.3% by the end of the year, around 70 basis points lower than the current level.

“Market sentiment remains relatively positive, and investor confidence remains high despite the recent turmoil brought by the financial sector, as appetite for risk gets supported by the prospect of dovish pivots from central banks, providing a good excuse to push stock indices higher just before the end of the quarter,” said Pierre Veyret, a technical analyst at ActivTrades.

The current rally is built more on expectations than actions, leaving the market vulnerable should central banks — epecially the Fed — disappoint investors, Veyret added.

Treasury yields were steady, following muted trading on Wednesday when the 10-year benchmark moved by the smallest margin in more than a month. The greenback gave up an earlier advance after strengthening as investors digested the latest remarks by Fed officials.

In Wednesday’s New York trading, the Nasdaq 100 rose 1.9%, which cemented its 20% rebound from a low in December. The gauge, which includes Apple Inc., Microsoft Corp., and Amazon.com, closed at the highest level since August in a sign investors are preparing for the Fed to end its interest rate hiking cycle and potentially pivot to looser policy later this year.

On the European economic front, Spanish inflation plummeted as energy costs retreated, though persistent underlying price pressures underscored the dilemma for the ECB as it weighs how much to raise interest rates. March’s headline reading came in at 3.1% — down from February’s 6% and much lower than the 3.7% median estimate in a Bloomberg survey of economists.

Core inflation, however — which excludes volatile items like fuel and fresh produce — only dipped a touch, to 7.5%. Policy sensitive German two-year bonds fell as much as 14 basis points, while money markets lowered bets on the peak ECB rate to 3.40% from 3.49% on Wednesday.

Elsewhere in markets, oil rebounded amid the continued disruption to shipments from Turkey. Gold steadied and Bitcoin rose, trading above $28,000.

Meanwhile, expectations of an easing in central-bank policy and the potential of a recession see global stocks and bonds moving more closely in line with each other than they have in nearly three decades, providing a headache for fund managers seeking to spread their risk.

The rolling one-year correlation between the asset classes is near its highest since 1997, according to data compiled by Bloomberg. The narrowing difference in performance makes it “tricky to diversify equity exposure,” Sanford C. Bernstein strategists Sarah McCarthy and Mark Diver wrote in a note.

Key events this week:

- US GDP, initial jobless claims, Thursday

- Boston Fed President Susan Collins and Richmond Fed President Thomas Barkin speaks at event. Treasury Secretary Janet Yellen also speaks, Thursday

- China PMI, Friday

- Eurozone CPI, unemployment, Friday

- US consumer income, PCE deflator, University of Michigan consumer sentiment, Friday

- ECB President Christine Lagarde speaks, Friday

- New York Fed President John Williams speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.4% as of 6:33 a.m. New York time

- Nasdaq 100 futures rose 0.4%

- Futures on the Dow Jones Industrial Average rose 0.5%

- The Stoxx Europe 600 rose 1%

- The MSCI World index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.2% to $1.0864

- The British pound rose 0.2% to $1.2343

- The Japanese yen rose 0.1% to 132.71 per dollar

Cryptocurrencies

- Bitcoin rose 0.5% to $28,531.53

- Ether fell 0.3% to $1,799.01

Bonds

- The yield on 10-year Treasuries was little changed at 3.57%

- Germany’s 10-year yield was little changed at 2.32%

- Britain’s 10-year yield declined one basis point to 3.46%

Commodities

- West Texas Intermediate crude rose 1% to $73.70 a barrel

- Gold futures were little changed

Source: Yahoo

Recent Comments