One of Globe Life’s top insurance agencies is a toxic cesspool of sexual abuse, hard drugs, and violence, a lawsuit alleges

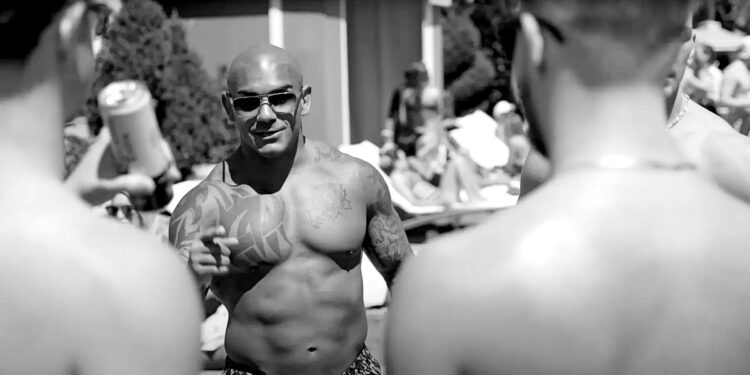

Drinks in hand, shirtless insurance agents cluster around the 5,000-square-foot Neptune Pool at glitzy Caesars Palace.

Prominent among them, sporting a blanket of tattoos on his bare sculpted chest is Simon Arias III, an agency owner and life-insurance sales machine. He makes the rounds among his subordinates. He puffs on a cigar with one group. He cradles a pineapple cocktail with another.

It’s May, and they’ve all come to Las Vegas for the year’s biggest sales convention. Inside the conference center, a corporate videographer captures showgirls in glittery headpieces and a king-size poster of Arias — this time, in a tailored suit — standing among a gallery of top performers who will be honored at a gala that night.

Just weeks earlier, a former agent filed an explosive lawsuit against Arias and other parties, alleging a pattern of unchecked sexual assault and harassment at his agency. The claims about one of Arias’ top lieutenants are graphic — scenes of him masturbating in front of a female direct report; an image he sent her of his own erection. But there is no sign of tension poolside. Young agents with freshly poured margaritas are focused on gratitude.

“Thank God for AIL and Globe Life,” one says to the camera.

The lawsuit describes a culture of abuse at a workplace that operated without guardrails. Agents at Arias, like those at many life insurance agencies, are treated as independent contractors, not employees. Contractors aren’t covered by federal laws protecting employees from discrimination and harassment, and they fall outside state laws that require sexual harassment training for employees. It’s a structure that may have helped Arias, and the industry as a whole, escape the wave of accountability sparked by #MeToo.

American Income Life, the convention sponsor, is a subsidiary of Globe Life Inc., a New York Stock Exchange-traded insurance company that markets life, accident, and supplemental health insurance. In the sports world, Globe is known for naming rights to the Texas Rangers’ Globe Life Field. In the business world, it is among the celebrity stocks in the portfolio of Warren Buffett’s Berkshire Hathaway, which holds 6.35 million shares of the McKinney, Texas-based company.

Globe Life sits at the top of a corporate pyramid, a holding company with five wholly owned insurance subsidiaries. AIL is by far the largest, whether measured by premiums collected or by the number of sales agents peddling Globe’s wares around the country. AIL, in turn, relies on a web of affiliated life insurance agencies that exclusively sell AIL policies to consumers.

While the corporate entities package the policies, the hard-driving agents are the jet fuel that powers AIL and Globe Life. Top agents are so critical to revenue that they are rewarded generously with commissions, bonuses, and stays at posh hotels in Cancún and the Bahamas. Only the most successful agents at the most successful agencies were invited by AIL to hang out poolside with company brass at the Las Vegas convention.

Among them, Arias Agencies. At 39, Arias has a profile like no other. His firm ranks among the most profitable agencies in the AIL system and achieves its success in an intense masculine culture that often steamrolls agents and customers alike.

Much of the lawsuit filed last April was forced into arbitration, but Insider obtained private arbitration documents, exclusive interviews with the plaintiff, and copies of inflammatory Snapchat messages.

In interviews with Insider, the plaintiff and 14 other former agents described Arias Agencies as a cesspool of sexual harassment, violence, and drug abuse — particularly at the headquarters in Pennsylvania.

They also alleged customer abuses and fraud. If a cigarette-smoking customer balked at a high life insurance premium, agents were known to run down a nonsmoking colleague to do the mandatory mouth swab, locking in a lower rate, several agents said. Sometimes, agents said, they would push products on people in financial straits, open accounts in the names of dead people, and put through charges without customers’ approval, the latter a theme that also surfaced in AIL customer complaints.

Several former female agents found the aggressive, masculine culture unnerving, especially given what they described as the open use of cocaine, steroids, male enhancement drugs, and other controlled substances — a culture that is also detailed in the complaint.

One former agent told Insider she was worried she’d made a big mistake early on, when her boss commented about her large breasts in front of colleagues, calling her “Jugs.” Another woman who worked there told Insider she was compared to dog puke. Senior managers called men in the office “studs” and “stallions,” according to the lawsuit; women were called “sluts,” “bitches,” and “whores.”

The agent who filed the lawsuit, Renee Zinsky, said her manager Michael Russin would talk about his erections during company meetings; once, she said, she was driving colleagues back from a business meeting in November 2019 when he began to have sex with a female subordinate in the backseat. The incidents are recounted in her federal complaint; in his response, Russin denied both allegations.

A fourth female agent, this one based at an office in another state, said there was so much open cocaine use at a May 2019 convention that she moved out of the company-paid room she shared with another agent. “I thought everyone was going to jail,” she said.

A month before she left for that convention, she told Insider, two of her bosses gave her a heads-up that men in the office would try to sleep with her on work trips; one told her to “keep your chastity belt on.” She said she wound up being sexually assaulted in the hotel pool.

She immediately reported the incident to her managers, she later claimed in a complaint to the Equal Opportunity Employment Commission, but no investigation ensued.

Top managers at AIL were aware of allegations of drug abuse and inappropriate sexual conduct as far back as 2015, when a claim of misbehavior by two top managers at Arias was escalated to AIL senior management, according to two sources who were at Arias at the time.

Insider sent seven pages of questions to Arias and his attorney Jean E. Novak, who is representing Arias and his agency in the sexual harassment and sexual assault lawsuit filed in April, which is now in arbitration. Novak responded by email, “We do not comment on pending litigation and arbitration matters.”

Rob Jackson, a former agent at Arias headquarters who is now a regional director of a Chicago agency partly owned by Simon Arias, was the only manager who spoke with Insider on the record. He said agents who “do something against moral grounds” would immediately be fired and said Arias Agencies’ ranks were filled with people who “all go to church together” and gave back to the community.

The Arias way

To find Arias headquarters, you turn off Perry Highway in the Pittsburgh suburb of Wexford, onto a short cul-de-sac. You’ll know the parking lot when you spot the late model BMWs, Audis, Maseratis — even a bright orange Mercedes C-43 — sprinkled among the more modest cars of the junior agents. After you walk past the group of young men in T-shirts and jeans gathered outside for cigarettes, you enter a waiting room with streaming rap music and a collection of awards the agency has received on display. Upstairs is what one former agent called “a young kid’s playpen” with a pingpong table, cornhole boards, and gaming systems, used to lure 20-year-old recruits.

Arias, the agency’s owner, is a mixed-martial-arts fanatic who commands a cult-like devotion from his sales force. At weekly meetings, a senior agent announces his arrival as if he’s a late-night talk-show host as loud rap music fills the room. Agents jump to their feet, clapping and cheering. “Every person in there goes apeshit crazy for him,” a former agent said

Many mornings, you can find Arias on the second floor, working out in the on-site wrestling room, its black floor emblazoned with the agency logo. During a video chat with AIL CEO Steve Greer in December, Arias praised his boss for picking up mixed martial arts in his late 40s. “Get you a CEO like that, man,” he said of Greer. “Super cool.”

Arias commands the top spot in AIL’s agency structure, a state general agent who oversees subordinates with titles such as regional general agent, master general agent, general agent, supervising agent, and, at the lowest level, agent. He also sits on AIL’s executive council and coaches other AIL sales leaders.

For years, Globe and AIL have treated Arias as a golden boy, honoring him at black-tie soirees such as his 2019 coronation as AIL’s State General Agent of the Year. Greer introduced him on a Las Vegas stage that night, rallying the crowd with a call to “show some love” for Simon Arias.

In late 2020, Globe’s then co-CEO Larry Hutchison traveled to Wexford to celebrate the agency’s biggest month ever, saying to Arias, “You’ve been an inspiration to me and everybody in the home office.”

Arias opened his first office in 2008 while in his 20s and today has offices in 21 locations stretching from Dallas to Portland, Maine. He trumpets his success with a heavy dose of conspicuous consumption, some days pulling into his private parking space in a Rolls-Royce, other days in a Maserati. His home, just 8 miles from the office, is a 5,000-square-foot, million-dollar English Tudor set on a 1-acre lot.

The Arias Agency is the life-insurance industry’s answer to the infamous boiler room depicted in “The Wolf of Wall Street,” a 12-hour-a-day grind of dialing for dollars where the rules don’t always apply. Some Arias agents are so captivated by the movie that they slap #wolfofwallstreet hashtags on social-media posts. Arias state general manager Tristan Dlabik once posted a photo of himself on Instagram, muscles bulging in mid-pushup, with a giant poster of the movie’s felonious lead character, played by Leonardo DiCaprio, in the background.

The agency targets malleable young people in their teens and 20s, recruiting at colleges, strip clubs, even the car wash down the street, according to former agents. Sometimes they’d head to Pittsburgh nightclubs, where team leaders would commandeer a VIP table, order bottle service, and wait for the inevitable curiosity seekers. Then the agents gave their pitch: Anybody can do the smiling and dialing necessary to be a life-insurance sales beast.

Spencer Kozej, the agency’s 2021 Rookie of the Year, tells Arias during an interview posted on YouTube that his high school grade point average was 1.8. But the 22-year-old, Arias boasts, makes $250,000 a year.

In interviews with Insider, former agents at Arias described misbehavior ranging from the sophomoric to the dangerous. One man who hadn’t met his targets had to let a colleague wax his legs. Two others who fell short were teamed up for punishment in April 2019: One was told to stretch out on a desk while the other was ordered to drip a smoothie into his belly button and slurp it out. That fall, in the Columbia, Maryland, office, a group of agents who’d missed their sales goals had to put on diapers and eat baby food out of a trough. “They looked humiliated,” said a former agent who witnessed the bizarre scene. “These were grown-ass adults.”

More troubling are the allegations of sexual harassment. One former agent who started in 2021, the one whose boss called her “Jugs,” said her manager told her in front of colleagues, “You need to put your tits away because they’re so distracting.” Another told Insider that when she entered her boss’s office in 2017, he would often greet her with an invitation to “come suck my dick.” It was “an everyday thing you kind of ignored,” she said.

A male manager who worked in the Wexford office said sexual misconduct was just a part of the culture: “It wasn’t anything you’d bat an eye at.”

Occasionally, there were open outbursts of violence in the Arias workplace, some of it promulgated by a coterie of bodybuilders. In 2019, an agent who was eating a plate of chicken nuggets and french fries became furious when a colleague helped himself to part of the meal. The first agent picked up the poacher and threw him into a door so hard it came off its hinges, according to sources who heard the ensuing crash. Renee Zinsky, the agent who filed the harassment and assault lawsuit last April, said she saw a video of the altercation because her direct supervisor, Michael Russin, got a copy and called his team in to watch it. “He showed everyone, saying how hilarious it was,” she recalled.

Though Arias declined to speak with Insider, there are signs that he was frustrated by the behavior. A former agent recalls him chewing out an agent who slugged a colleague during a 2019 trip to New York on a private jet.

In response to detailed questions from Insider, Globe’s executive vice president and chief marketing officer, Jennifer Haworth, said by email that AIL “takes seriously any allegation brought to its attention concerning sexual harassment, inappropriate conduct, or unethical business practices” and “makes clear that it does not tolerate” such behavior. Agents or others “are subject to contract termination if they engage in misconduct,” she said.

She said she was responding on behalf of AIL, not Globe. Asked whether Globe declined to comment, she didn’t respond.

A magnet for misconduct

There are scant constraints on the unreconstructed ’80s culture at Arias. AIL’s policy of requiring agents to work as independent contractors means Arias agents lack the federal workplace protections that employees enjoy — a system that could allow a culture of abuse to go unchecked. And the light touch of most insurance regulators makes it easier for bad actors to dodge responsibility and exposure.

“I don’t think it would ever get to this in a place where there are W2 employees,” one former agent said.

Unlike with stock brokers or other licensed securities-industry professionals, there is no national database where consumers can look up an agent’s track record, from customer complaints to criminal histories. That’s because stock brokers are regulated by the federal government, which requires extensive disclosures. Insurance is regulated only by the states, most of which require minimal disclosures from life insurance agents.

The industry has access to national data on agents’ criminal records, regulatory violations, and terminations by means of the National Insurance Producer Registry. But when I sent a query asking how consumers could access this information, they quickly set me straight. “This information is not available to the public,” Mike Turpin, a manager of customer experience, said in an email.

The public state databases, on the other hand, appear incomplete. Insider checked state licensing databases for current or former Arias agents who had been cited in an action by a state insurance regulator or had a criminal conviction. None of the databases surfaced these histories.

“Insurance producers face little risk of prominent public disclosure for their conduct,” said Colleen Honigsberg, a law professor at Stanford University who coauthored a 2022 study of regulatory failures in the insurance industry. “We talked to securities regulators who said they make referrals all the time to insurance regulators and they go nowhere.”

It’s not hard to get a license to sell life insurance. In Pennsylvania, where Arias is headquartered, you just have to be 18, finish 24 hours of classes, and score 70% on a multiple-choice exam. If you flunk, you can take the test again — and again. Rob Jackson, the regional director in Chicago, took eight tries to pass it.

Past criminal convictions are reviewed “on a case-by-case basis,” Pennsylvania Insurance Department spokesperson Lindsay Bracale said.

The light regulation makes the industry a magnet for rogue operators. The 2022 study found that Wall Street financial advisors with the worst histories of misconduct often switched to selling insurance after they got in trouble.

Even in the absence of a national database, Insider was able to examine compilations of consumer complaints that suggest an aggressive, even abusive, sales culture surrounding Globe and AIL. Globe had nearly six times as many complaints filed with state regulators in 2021 on its life insurance products — Arias’ specialty — as the average insurance company, according to the NAIC.

Websites that publish consumer complaints also include pages of missives from angry AIL customers, many of whom complain that their cancellation requests were ignored. “I am currently attempting to get a refund for the unauthorized charges that American Income Life took from my account and will file a small claims suit against them if I am unable to get a full refund,” a customer wrote to the Better Business Bureau on October 13, 2022. AIL ultimately refunded erroneous charges dating back more than a year. The BBB gave AIL an A+ rating. Yet the company had so many customer complaints, the bureau published only 25% of them.

The pressure to push products on customers who couldn’t afford them was heart-wrenching to one agent, who told Insider her supervisor urged her to sell a policy to a woman “in the middle of nowhere in Pennsylvania” who could barely afford to pay her phone bill. “I was losing my soul,” she said.

Just as Arias customers are failed by thin regulation, Arias agents enjoy few legal protections. AIL won’t hire agents unless they sign a contract that classifies them as independent contractors — leaving them with few safeguards against workplace discrimination.

As of 2003, AIL offered sexual harassment training only to employees, not to its 2,300 agents, according to a summary judgment in an earlier sexual harassment lawsuit. Haworth did not respond when Insider asked whether AIL agents today get such training; several agents who worked at Arias recently said they did not receive it.

A group of Arias agents are plaintiffs in a class-action lawsuit filed in federal court in Pittsburgh last July. The complaint alleges that Arias and AIL misclassified their agents as independent contractors. In reality, the agents argue, they are treated as employees — the company dictates agents’ hours, their dress, and where they work. The two sides have agreed to arbitration.

Unless the agents prevail, they are without federal protections, and there is little they can do if their bosses illegally harass or abuse them.

‘Misogynistic, hostile, unethical’

Renee Zinsky was making about $20,000 a year delivering pizzas when she got a call from a high school acquaintance who pitched her on “this amazing job” where she could make great money. She interviewed at Arias headquarters at age 24 and was “beyond excited,” she said. When an interviewer told her she’d make so much money she’d be able to retire in 10 years, she was hooked.

Zinsky started at Arias in March 2019, at the Wexford headquarters. Three years later, she filed suit. Her federal complaint against AIL, Arias Agencies, Simon Arias, and her boss Michael Russin and his companies Russin Financial and Russin Group details shocking allegations that included sexual assaults, drug use, and physical violence.

Zinsky signed a mandatory arbitration agreement with AIL and Arias Agencies, barring her from filing a lawsuit. She believed a federal law passed in early 2022 would allow her lawsuit to move forward anyway, but a federal judge thought differently, ruling in July that her allegations against Arias and AIL would move to arbitration instead. In Zinsky’s complaint, filed in September with the American Arbitration Association and obtained by Insider, and in her original lawsuit, she alleges that AIL and Arias Agencies “had knowledge of a highly misogynistic, hostile, unethical, unlawful, toxic and cult-like workplace culture.”

Only the case against Russin, who was not named in the arbitration agreement, would proceed in court.

Russin is a former big star at the agency, who bragged in a recent Arias recruiting video that he’d opened Arias offices in multiple states. He admitted in his answer to the complaint that he had used alcohol and drugs during work hours and work events but denied that his drug use was frequent. He denied Zinsky’s allegations of bullying, sexual harassment, and sexual assault.

His Pittsburgh lawyer, Benjamin Webb, said in an email that Russin would not respond to detailed questions from Insider due to the pending litigation. “However, he takes the claims asserted by Ms. Zinsky seriously,” Webb wrote, “and we are in the position to zealously defend our client’s position and bring to light additional facts regarding the plaintiff’s allegations via the appropriate legal process.”

Jackson, the agency director in Chicago, said he knew and liked Zinsky when they both were working as agents in the Wexford office and that Zinsky didn’t deserve “what she dealt with.”

“I had no idea that was going on,” he said. “I don’t think anybody really did.”

A promotion if you ‘blow me’

Over the din of Muzak and the banter of families foraging for back-to-school supplies at a mall near Pittsburgh in August, Zinsky is doing her best to tell her harrowing tale. Taped to the wall in the back office of the gift shop where she now works are two photos of her former boss, Russin: “If you see this man” in the store, a note reads, “please call Mall Security and ask him to leave.”

She greets me with a broad smile and bright brown eyes, projecting her upbeat, glass-half-full personality — all the qualities that made her a star agent at Arias. She savors her relationships with her old insurance customers and reaches for her phone to share a photo where she’s posing with two of her favorites, a husband and wife, in front of their home. “I became friends with all my clients,” she said. Many of them still stay in touch.

She got her insurance license in early 2019 and was so gung ho about the job that she initially dismissed the wild reports she heard from her trainer, a female agent who told Zinsky women were expected to sleep with their male bosses. Those warnings became real shortly after Zinsky first reported to work. Relaxing at home one day, she clicked on a Snapchat message that she says had just come in from Russin, her direct supervisor.

She glanced at her phone in shock. It was a photo Russin had taken of himself naked, with an erection, she says. She told several colleagues about the photo, but most encouraged her to “just let it go,” she says. She came away with the understanding that if she spoke up, she’d lose her job.

Zinsky tells me that after she asked Russin for a promotion, she received another lewd Snapchat message from him, this one saying she’d get promoted only if she and her fiancé, now her wife, would “blow me at the same time.”

Zinsky described both messages in her federal complaint; in court filings in August and November, Russin denied sending them.

She recounts a time when she says he got her alone in a room, pressed her against a wall, and tried to stick his tongue down her throat. She tells me about two occasions when she believes she was fed a date rape drug, in one case waking up in a hotel room at a company event in Cranberry, Pennsylvania, in a panic, only to see three colleagues — a woman and two men — having a threesome. “I was so scared,” she says. “I said, ‘I can’t feel my legs.'”

Her civil complaint accuses Russin and other Arias leaders of administering these drugs to her and other women; in a court filing, he has denied that claim.

But when she starts to tell me about the first time she says Russin masturbated in front of her in his car, her jaw clenches. She pauses, staring off into the distance.

Zinsky, then 25, had only recently signed on as an agent when, she says, Russin suggested they take a ride in his Maserati for a “one-on-one” business chat. She hoped a break from the clamor of the office would be her chance to pitch for the promotion. She says Russin had other ideas.

He drove to a quiet parking lot where, Zinsky says, the outing took an appalling turn. “He grabbed my arm very forcefully and put my hand on his crotch,” Zinsky tells me. She says she pulled her hand away and reminded her boss that she was in a serious relationship. Undeterred, she says, Russin picked up his phone, pulled up a porn video, and masturbated in the driver’s seat. “When he was done,” she says, tearing up, “he made me reach in the back and find something that he could wipe his — you know.”

I ask if there were other times he suggested “one on ones” and wound up sexually assaulting her. There was another encounter in the car, she says, when Russin “literally took the back of my head and shoved my face down into his crotch.”

Zinsky’s federal complaint said the abuse in the car, which Russin denied in a legal filing, happened “on multiple occasions.” She tells me that in the nearly 2 ½ years she worked at Arias Agencies, variations on the soul-killing routine in Russin’s car occurred at least eight times. The invites to “take a drive” also targeted “other female subordinates,” according to the complaint. They were so common for Zinsky and one female coworker that the two of them used to take turns, tapping in for the abuse when the other one just couldn’t face it, Zinsky said.

“There were days he would badger them all day long to take a drive,” a male colleague told Insider. “They would show me the Snapchat messages.”

Another of Zinsky’s colleagues described her opening up to him over time about several of these incidents. “She was very distraught,” he recalls. “She broke down and lost it and told me. We talked almost every day about it.”

With her boss, she says, she dealt with these episodes gingerly because she feared losing her job. Zinsky was earning $109,000 at Arias by 2020, five times what she’d made at the pizzeria.

Goddamnit, I’m a fucking psycho and anybody with half a fucking brain could see that.

In Russin, Zinsky had a manager who openly acknowledged his volatility. During one meeting that was audiorecorded, Russin can be heard telling his team, “I’m a fucking psycho and anybody with half a fucking brain could see that.”

Whenever Russin tried to engage with Zinsky sexually, she’d try to find a way out of the situation, she says, “but I also would try and make sure he wasn’t offended or pissed.”

“He controlled everything,” she says. “He controlled me having a job.”

Complaints appeared to go nowhere

Zinsky and other women who were harassed at Arias had to consider whether lodging a complaint would make any difference.

In a May 25 charge filed with the EEOC, the former Arias agent who said she was sexually assaulted at the pool wrote that she had informed three of her managers at Arias — a general agent, a supervising agent, and a master general agent — of the incident. “Nothing was done to investigate or address my concerns,” she wrote.

Amy Williamson, the Pittsburgh attorney who represents this woman and the plaintiffs in the class-action lawsuit against Arias, as well as Zinsky, shared the document with me on the condition that Insider not use her client’s name. The EEOC decided not to pursue the case and Williamson is preparing to file a complaint on the woman’s behalf.

Zinsky, too, tried to alert managers about Russin’s sexual harassment. In June 2021 she found a contact for Arias sexual harassment complaints, but the email bounced back. It turns out the contact was Simon Arias’ mother, who didn’t even work at the agency.

Zinsky then arranged a meeting with Arias on August 11. She says she described the ongoing harassment and assaults and showed him the two Snapchat messages from Russin — the one of Russin’s erection, and the one that said she’d have to perform oral sex to get a promotion. Arias said she could report directly to him instead of Russin. Wanting to take the complaint further, she asked Arias for a human-resources contact, but he told her the agency didn’t have HR personnel, she said.

The gravity of the matter didn’t seem to register with Arias, who, according to Zinsky, admonished her not to hire a lawyer because it would make him “look bad.” Two weeks after the meeting, Zinsky got an email from Arias’ assistant asking her to sign an “incident report” referencing “inappropriate language / Sexual content in the workplace” and indicating that Zinsky’s complaint had been “satisfied.” The document, which she refused to sign, said there would be a follow-up in 30 days, but Zinsky said none was forthcoming.

Frustrated with the response, Zinsky tracked down an HR official at AIL and contacted her on November 10, 2021. This time, people sprang into action.

The HR official, Debbie Gamble, escalated the matter to Globe Life’s assistant general counsel, Logan P. Blackmore. Insider obtained an email Blackmore sent to Zinsky on November 17, informing her that she would be hearing from an investigator who would look into her claims.

According to one of Zinsky’s legal filings, AIL completed its investigation last February and substantiated the claims of harassment. AIL did not respond to Insider about this matter.

Haworth, the Globe spokesperson, said in a statement that AIL doesn’t comment on pending litigation. But she said sales agents “have multiple ways” to raise concerns, “including with the State General Agent with whom the agent is affiliated, with a union representative if the sales agent is a union member, with AIL’s agency department, or via an independent third-party reporting service.” She said AIL has processes in place “to review, investigate, and address allegations it is aware of.”

Williamson told Insider she has spoken with dozens of current and former Arias agents, 25 of whom have become clients in complaints against the company. None had heard of policies or protocols on how to report concerns, she said. Many were loath to report concerns internally because they worried they’d face retaliation if they did, she said.

It’s notable that Haworth said state general agents could be approached with concerns, since Zinsky received no indication that her state general agent, Simon Arias, escalated her complaint. It was only after she went directly to AIL months later that Globe got in touch.

Inaction at the top

AIL fired Russin last February, according to Zinsky’s amended complaint. But it was too late.

Zinsky by then was crippled by anxiety. Unable to continue showing up to work at Arias, she was facing down the prospect of substantial income loss as she looked for new work with only a high school diploma. Russin had taken to posting bizarre and threatening messages — addressed to no one in particular — on his social-media accounts. In one, he said that if anyone interfered with his ability to care for the child he and his wife were expecting, he’d “peel the skin off their face” and feed their eyes to his dog, though he denied in a court filing that it was a reference to Zinsky. In a Facebook post, he said he’d be “chewing the whores up in court,” which Williamson read as a reference to her and Zinsky.

If you’re gonna try to take food out of my child’s mouth I will come to you, physically, and I will peel the skin off your face.

As the posts escalated, Williamson said, Zinsky “was a wreck.”

According to Williamson, at a September 1 telephonic court hearing, Judge Marilyn J. Horan instructed Russin’s lawyer to get his client under control. Horan said she was appalled by Russin’s conduct and suggested the lawyer tell Russin he was making Zinsky’s case for her. Two days later, Russin posted a photo of himself on Instagram, bare-chested, muscles bulging, cigar smoke swirling around his face, with the caption “War Ready.”

That post, too, he denied was related to Zinsky.

Williamson soon came across evidence that Russin had been fired in name only. In an amended complaint, filed November 1, 2022, Zinsky alleged that Russin “continues to participate in meetings, internal communications, and other work events both in person and virtually” for Arias Agencies. Webb, Russin’s lawyer, declined to comment on these claims. Haworth, the Globe Life spokesperson, did not respond to a query about Russin’s current status.

Several agents said it was hard to imagine that management at Globe and AIL were unaware of the toxicity at the Arias workplace.

Two sources told Insider that eight years ago, a lengthy unsigned email was sent to AIL’s leadership team, from the CEO down to the head of HR, detailing allegations of misbehavior at Arias headquarters. The email also went to senior Arias leaders. “It explained all the crazy shit going on,” said one of the sources, who was on the email chain. The anonymous writer alleged excessive drug use on the job by two senior men at Arias and sexual improprieties by one of them.

A recent check of the Pennsylvania insurance website showed that both men were still licensed with AIL. Haworth did not respond to questions about the email.

Much of the abusive behavior at Arias — the hazing humiliations, the physical brawls — played out in the open, in front of witnesses. A former agent told Insider that when she was in training in 2016, her supervisor called her into a glass-enclosed room and asked her to recite her lengthy sales script from memory. When she forgot some lines, she said, he grabbed her by the shoulders and slammed things around in the room. “He picked me right up and sat me on a table and said, ‘How come you don’t fucking know the script?'” she recalled. She said the scene played out in full view of agents just outside.

There were podcasts where agents talked about stealing cars, dealing drugs, and building bombs in a garage. There was a company gathering in Las Vegas in 2019 where, one former agent told Insider, agents did drugs and had sex with one another in a hotel suite as AIL’s most senior executives — Greer, the CEO, and the firm’s president, David Zophin — partied with the sales force nearby. Agents in the Wexford office would suggest to colleagues that they step outside to “do a bump” of cocaine in the parking lot.

“It is like winning the Academy Award from Globe Life,” a former Arias agent said. “It brings respect from everybody.”

Susan Antilla

Recent Comments