CropEnergies AG, Mannheim is one of the interesting companies at the Eigenkapitalforum in Frankfurt this week.

The company reached record revenues of EUR 450 (previous year: EUR 249) million in the 2nd quarter of the financial year 2022/23 (1 June – 31 August). EBITDA tripled to EUR 103 (previous year: EUR 34) million and operating profit also reached a new record high of EUR 93 (previous year: EUR 23) million.

The main reason for this was a significantly higher sales volume for ethanol and, in particular, a significant increase in the sales prices obtained. Volumes and sales prices for protein food and animal feed products have increased significantly.

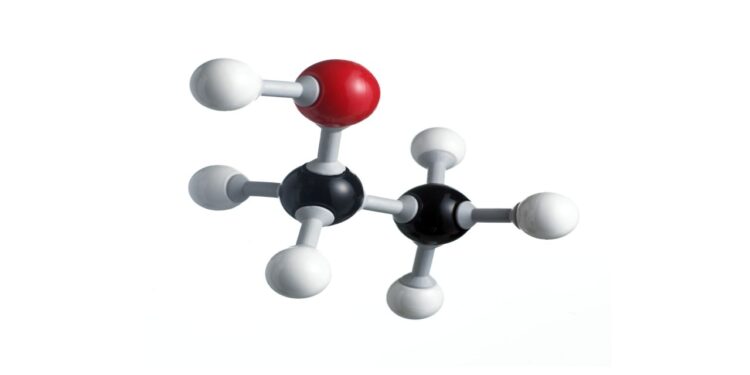

“Our vision is a climate friendly world in which renewable resources are key to ensuring the welfare of today’s and future generations.”

The vision of a climate-friendly world – CropEnergies

The higher sales prices more than compensated for the burdens from increased prices on the raw material and energy markets. EBITDA in the 1st half of 2022/23 increased significantly to EUR 201 (previous year: EUR 59) million. Operating profit also multiplied compared to the previous year and reached EUR 180 (previous year: EUR 38) million. Ethanol production in the 1st half of 2022/23 was higher than in the previous year at 583,000 (previous year: 520,000) cubic meters and revenues increased to EUR 849 (previous year: EUR 463) million.

On 11 August 2022, CropEnergies raised its outlook for the 2022/23 financial year and continues to expect an operating profit of EUR 215 to EUR 265 (previous year: EUR 127) million on revenues of EUR 1.47 to EUR 1.57 (previous year: EUR 1.08) billion. This corresponds to an EBITDA of EUR 255 to EUR 305 (previous year: EUR 169) million. The main reason for the improved earnings expectation is the high ethanol prices since the beginning of the financial year. However, in view of the multiplication of energy and electricity prices in conjunction with the persistently high raw material prices, the pressure on the cost side is increasing. In September, CropEnergies had therefore announced that it would continuously review the capacity utilisation of the plants. At the same time, CropEnergies appeals to decision-makers in politics to support companies with energy-intensive production and to ensure a level playing field in the European ethanol market.

Source: CropEnergies

Recent Comments