The recovery owes to perception rather than economic strength, strategists said.

The stock market delivered a plot twist last month that rivals any show on TV.

After a near-historic decline over the first half of the year, the S&P 500 — a popular index to which many 401(k) accounts are pegged — bounced back in July with its strongest month since November 2020. The other major indices, the tech-heavy Nasdaq and the Dow Industrial Average reversed their performance, too.

The sudden shift arrived despite little change in the economy. In keeping with recent months, the government released mixed economic data and the Federal Reserve escalated a series of borrowing cost increases meant to slow economic activity, slash demand, and dial back inflation.

The explanation behind the bounce back, investment strategists told ABC News, is the reason why investors should not expect it to endure: expectations.

It hardly sounds like the makings of a stock boom, which relies on investor optimism about the outlook for corporate profits.MORE: What the stock market could look like for the rest of 2022, according to experts

Over the first half of the year, as the market plummeted and pessimism reigned, investors lowered their expectations, the strategists said. Last month, when the Federal Reserve signalled it would someday ratchet down rate increases and many corporations reported better-than-anticipated earnings, investors saw a reason for a turnabout in sentiment, they added.

The strong returns in July raise expectations, however, the market is setting up for underperformance amid persistent economic challenges, such as inflation, the Russia-Ukraine war, and the pandemic-induced supply chain disruptions, the strategists said.

“It’s not about good or bad,” Ryan Detrick, the chief market strategist at Carson Group, told ABC News. “It’s about better or worse.”

“Expectations were so low — the wick was there,” he said. “We needed anything to light that fire.”

Sameer Samana, the senior global market strategist at Wells Fargo Investment Institute, said it will prove difficult to keep that fire lit.

“Unfortunately, along with rising stock prices, you have rising expectations as well,” he said.

For months, market sentiment has strained under the weight of an economy beset by a stark imbalance between supply and demand. A surge in demand followed a pandemic-induced flood of economic stimulus that combined with a widespread shift toward goods instead of services. Meanwhile, that stimulus brought about a speedy economic recovery from the March 2020 downturn, triggering a hiring blitz.

But the surge in demand for goods and labor far outpaced supply. COVID-related bottlenecks in China and elsewhere slowed delivery times and infection fears kept workers on the sidelines. In turn, prices and wages skyrocketed, ultimately prompting sky-high inflation that had not only endured for many months but had also gotten worse, even as economic growth slowed and recession fears grew.

Taken together, the near-historic inflation and sluggish economic activity drove away stock market investors over the first half of the year, said Samana, the senior global market strategist at the Wells Fargo Investment Institute.

“People, to a certain extent, had been throwing in the towel on equities. They were worried about the Fed, worried about China, worried about commodity prices, worried about a recession,” he said. “There was no shortage of worries.

“What often happens when you get that level of concern is that everybody is on one side of the boat,” he added. “Then what happens is you get a piece of data that isn’t as bad as feared, and people shift to the other side. It causes a herd mentality.”

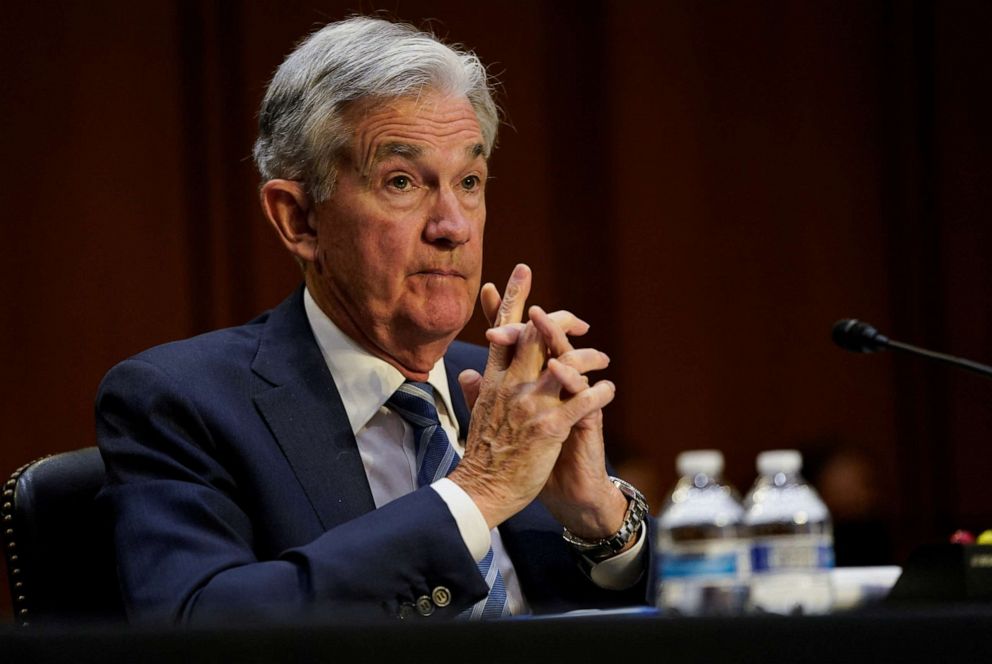

Market strategists largely attributed the July turnaround to the Federal Reserve signalling it would raise its benchmark interest rate by 0.75%, which it ultimately did on Wednesday — a significant hike but less than the 1% increase that some observers had originally feared. Plus, investors seized on comments made by Fed Chair Jerome Powell on Wednesday that the pace of rate hikes would eventually slow.

“People think the Fed will have to change its mindset sooner rather than later,” Mike O’Rourke, chief market strategist at JonesTrading, told ABC News.

Over the first six months of the year, the S&P 500 plummeted 20.6%, marking its worst first-half performance of any year since 1970. But the index added back 9.1% last month alone.

The blistering pace from July isn’t sustainable, the strategists said. Further, investors should expect volatile highs and lows for the remainder of the year, they added.

O’Rourke, of JonesTrading, said investors should expect a volatile market for the next six to 12 months. Other strategists echoed that view, including Detrick, who warned that investors shouldn’t treat July as a turning point. That said, he urged them to stay the course.

“This year has been historically volatile and disappointing for investors,” Detrick said. “To panic and sell when everything is darkest, that’s the worst time to do it. Hopefully, this bounce back in July reminds investors of that.”

“But the truth is, we’re not out of the woods,” he said.

Source: abcNEWS

Recent Comments