After 30-plus years in financial marketing, Daniel Darst shares trenchant advice on getting the job done – and winning a seat in the room where stuff happens.

Daniel Darst is a big fan of the human brain.

While he was listening to a major session at The Financial Brand Forum 2025, Darst was taking notes on an iPad. The marketer sitting next to him said, “You know, you could be doing that with Microsoft Copilot.”

True, said Darst. “But then I wouldn’t have been typing it through my brain.”

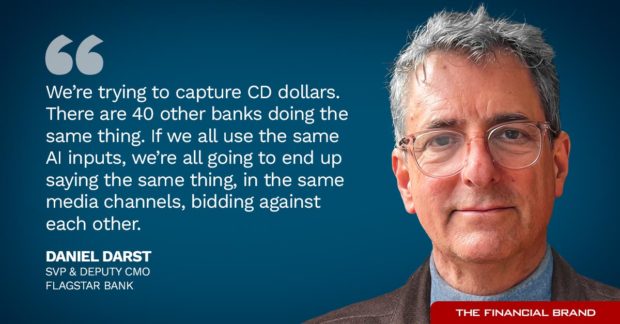

His feelings about GenAI in marketing go further than conference note taking. Darst, SVP and deputy CMO at Flagstar Bank, isn’t a fan of this technology. After more than three decades in financial services marketing, he’s convinced that the successful marketer is a hands-on marketer.

To him, that includes hands on a keyboard.

“If you injected me with truth serum, I would say don’t bother going into marketing if you’re not a very talented writer or a very talented designer,” says Darst. “You’d just be fooling yourself.”

Darst says he writes a “ton of stuff” in his work for Flagstar and he gets on subordinates’ cases when they lean on GenAI to do their jobs. He has people who use AI to write headlines and tells them, “Take an extra 15 minutes and come up with these on your own.” Better yet, he says, take 35 minutes more and come up with something really good.

“I use the word ‘patience’ a lot,” says Darst, who backed into financial services and marketing after starting out in management consulting with a degree in classical studies from Yale. He tells staffers not to sell themselves short. “Write the stuff out of your brain,” he insists. Even if the first efforts aren’t that good, they can be honed.

“I’m not a Luddite by any stretch, but if you are in obeisance to thinking what GenAI produces is best, you’re going to miss other things,” says Darst.

But his biggest fear is launching his bank into a sea of sameness.

How so? Think about the point of marketing: Make your institution stand out. Flagstar, in the midst of a major revamp of its balance sheet and business lines, and a comeback from near failure, needs to maximize that advantage.

Case in point: “We’re trying to capture CD dollars. There are 40 other banks doing the same thing. If we all use the same AI inputs, we’re all going to end up saying the same thing, in the same media channels, bidding against each other.”

In a fireside chat at the Forum with host Eric Fulwiler, co-founder and CEO of Rival, Darst shared often frank advice for bank and credit union marketers. The following account extracts some of his key points, beyond the first one, to use your own brain.

1. Understand the business you’re marketing.

Marketers often speak about having “a seat at the table” where decisions are made. Darst says you can’t get that seat, nor keep it, if you are a banking ignoramus.

“To work as a marketer in this industry, you really need to know how finance works,” Darst insists. “There are so many who don’t know the difference between spread income and fee income. They don’t know what a bank does. They don’t understand what the Federal Reserve is. They don’t understand the bond market.”

How can such marketers do their jobs, he wonders.

“You’ve got to be able to be part of the conversation your management’s having, that the product group is having,” says Darst. “If you work for a publicly traded company like I do, you’ve got to be able to understand the earnings call. If you don’t, you’re just a nine to fiver.”

Darst says respect at “the table” must be earned. That comes by adding value to the conversation, and not just by piping up with the marketing angle. Get known for “adding value to the bigger picture.” If the job involves marketing for a specialized slice of the organization — much of Darst’s own career was spent in marketing to the affluent — “know the vertical that you’re in.”

One more thing: Remember your job is to grow the bank, not to polish up the marketing function.

In meetings large or small, says Darst, “I’m not on a campaign for myself or my boss. I’m there to understand what’s going on at the institution so that when I’m out of the meeting, I can direct my activities and energies towards the right things.”

2. Don’t throw away good ideas that didn’t come in first place.

Too many people in financial marketing have become servants to the testing of concepts and campaigns.

“You put a bunch of stuff out there and one performs six basis points better than the rest, and everyone goes nutso,” says Darst. “Everyone exclaims, ‘Oh, man, this is so great!’ And then they discard everything else.”

What a waste, says Darst. Some of the other ideas may still be worth developing. “They didn’t fail, they just didn’t do as well as number one,” he says.

3. Don’t let others get taken in by marketing agency glitz.

One situation where the marketing person’s expertise can help everyone else is when a new agency is being evaluated. Darst says executives in other parts of the organization can be wowed by presentations that demonstrate no comprehension of what the bank or credit union does.

The agency will show a demo reel stuffed with campaigns for the likes of major food chains, behemoth sneaker makers and other clients that all consumers easily identify with.

“Maybe there’s one little thing from an insurance company campaign, and, suddenly, everyone else is in love with this agency,” says Darst. But when there’s no match “that’s a false positive.”

4. Remember why you’re meeting with a prospective new agency.

Darst told the story of an agency pitch from his early career that he thought had gone disastrously.

In the late 1990s, Darst was number two in the marketing function for a specific part of Smith Barney. The company’s house agency told him bluntly that his wing of the company was too small for it, and advised him to take his work to a smaller agency.

Darst met with a team from the smaller firm and felt like he’d stepped into a sit-com where the dumb dad is surrounded by clever 16-year-olds. The team exuded cool, and treated Darst like a bore.

He came back to his boss and confessed that he thought the meeting was a flop. He didn’t think the agency understood his company’s business.

But his boss thought things hadn’t gone so badly. “We’re not hiring them to be strategists,” he explained. “We’re hiring them to be creative, and they are.” Darst had severe doubts.

“I was sure they didn’t have a clue,” he says. “But they came up with a great campaign.”

The promotion zeroed in on the firm’s mutual fund managers, bringing out their personalities. It was so successful that the campaign ran, without significant changes, for about three years.

The lesson: Focus on why you are looking for outside help, not on the entire big picture.

5. Listen to the front-line troops.

Marketers tend to put great weight on what other marketers in their departments say about campaigns that are out in the field. But over the years Darst has found that listening to the front line is critical.

“If someone in marketing says, ‘Daniel, I hate this,’ well, that’s a bummer,” says Darst. “But if someone in the field says, ‘Hey, Darst, this thing is off,’ I would freeze in my tracks and I’d be, ‘Man, I’ve got to rethink this’.”

Source: The Financial Brand

Recent Comments