Through extensible capabilities, community banks and credit unions can punch above their weight by connecting to modern third-party apps and features, without swapping out their core systems.

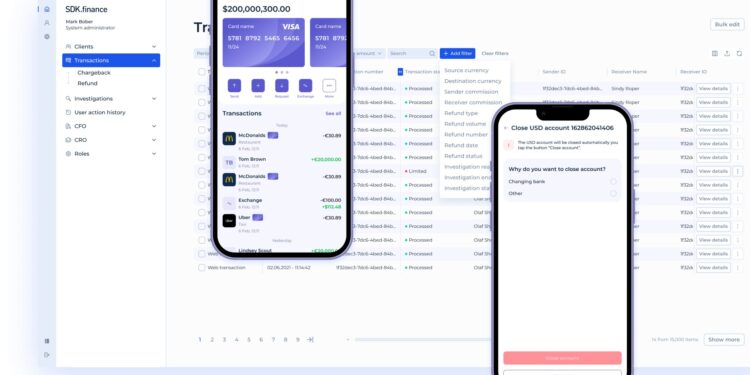

With the proliferation of slick fintech tools, consumers are demanding smooth digital experiences from their banks and credit unions. That includes easy access to account data, seamless app integrations and user experiences that don’t feel clunky. Nonbank financial apps have raised the bar for user expectations, leaving many legacy financial institutions rushing to keep up.

Traditional FIs, however, need to walk before they can run.

Their rigid core systems may make it difficult to connect to third-party apps. As a result, many FIs are focusing on strengthening the foundation of their technology systems before attempting to roll out eye-catching new capabilities. Executives say they’re building infrastructure for extensibility, which allows core systems to easily integrate with third-party apps through APIs.

“Extensibility has been the number one focus for us,” says Christian Ruppe, SVP and chief innovation officer at Fitzgerald, Georgia-based Colony Bank. “We’re not trying to pick the big winning technology. We’re trying to build an architecture that allows us to move quickly…or we can test something without it being a huge investment.”

Extensible systems allow FIs to integrate with third-party apps with minimal friction, enabling easier access to account data and quicker pivots, says Ruppe. It lets banks and credit unions add modern apps and features — including quicker onboarding and transaction capabilities — without changing their core systems. Yet despite these benefits, many are falling behind on adoption.

“They’ve been talking about it, and there have been a few who have made progress on it, but it’s still very early days,” says Dan Latimore, chief research officer at The Financial Revolutionist. “Executive will or culture is a necessary—but not a sufficient—condition to do this, because when you do it, or decide that you’re going to start the journey to become extensible, that’s something that’s going to touch the whole bank.”

The Journey to Becoming Extensible

Latimore suggests the complexity around extensibility is intertwined with the challenges around changing core systems. It’s no secret that many bankers are frustrated by the limits of their cores. In a 10x Banking survey last year of more than 200 global bank IT decision makers, 55% of respondents said they faced limitations with their current core solution. Among the top day-to-day challenges of managing the core system, 47% identified “integrating key technology with a core solution” and 39% “implementing new software” — key limitations of many legacy cores.

The banking ecosystem includes three broad stages along the trajectory toward extensibility, according to Ryan Siebecker, a forward-deployed engineer at Narmi, a banking software firm. These include closed, non-extensible systems — typically legacy cores with proprietary software that doesn’t easily connect to third-party apps; systems that allow limited, custom integrations; and open, extensible systems that allow API-based connectivity to third-party apps.

“The difference between the second category and the third category is really speed and ease of integration,” says Siebecker. “You create API credentials and you flip a few settings…and you have a new user experience.”

Build vs. Buy

The route to extensibility can be enabled through an internally built, custom middleware system, or institutions can work with outside vendors whose systems operate in parallel with core systems, including Narmi.

Michigan State University Federal Credit Union, which began its journey toward extensibility in 2009, pursued an independent route by building in-house middleware infrastructure to allow API connectivity to third-party apps.

Building in-house made sense given the early rollout of extensible capabilities, but when developing a toolset internally, institutions need to consider appropriate staffing levels — a commitment not all community banks and credit unions can make. For MSUFCU, the benefit was greater customisation, according to the credit union’s chief technology officer Benjamin Maxim.

“With the timing that we started, we had to do it all ourselves,” he says, noting that it took about 40 team members to build a middleware system to support extensibility.

“The reason we chose to do this culturally was so we could be responsive to our members…comparing ourselves to industry peers, we would always have higher employee costs and lower capital cost or software costs,” he says.

Other FIs that work with vendors — including Colony Bank and Grasshopper Bank — say using outside partners with capabilities that stand on top of existing core systems allows them to maintain lean internal operations without sacrificing the quality of the integrations.

Luther Liang, SVP of product at Grasshopper Bank, told The Financial Brand that by working with a vendor, the bank didn’t have to hire additional staff to manage software integrations enabled by extensibility.

“I don’t think you really need to hire anybody to manage those [vendor relationships] from a technical perspective. It’s more of a relationship management play,” he says. “We’ve been able to do releases with a very small development team — sometimes two engineers and one quality assurance [employee].”

The Long Game

Colony Bank is starting to see results two years after it began its extensibility rollout. It’s enabled three major use cases: a modern account opening solution; an app that improves call centre efficiency by allowing call centre reps to co-browse with customers, and a client data visualisation tool.

Colony’s core provider “charges us per integration, and so now we’re not having to pay per integration — we have one integration, and we pay for that,” says Ruppe. “If you do it right, you can make it make sense immediately, but the long term is where you really win.”

While Colony Bank might not be looking to compete with the top megabanks, “we know our communities better than they do…we can then provide technology that is specific to those customers,” he says.

David Benavides III, VP and head of digital at Alliant Credit Union, agrees that the benefits aren’t always immediate. Alliant stood up its extensible capabilities through both in-house and vendor tools.

“There is quicker time to market, increased revenue and increased satisfaction … the flip side of that is you have to maintain what you build, so it’s definitely a trade-off,” he says. “We’re probably at the point where we’re breaking even.”

While some community banks and credit unions view extensibility as necessary for their survival, others — including Grasshopper Bank — say it helps them compete more effectively with offerings from nonbank fintechs.

“Historically, fintechs do an excellent job on the user interface and experience — that’s who we view ourselves competing against,” says Liang. “We want to be right there with them on functionality, and this allows us to do it.”

Source: The Financial Brand

Recent Comments