Credit unions have been recording strong numbers in member satisfaction ratings. But there’s a sobering shadow looming: Nearly a third of members under 40 could be leaving their credit union in the next 12 months.

The reason? Fees.

For years, credit unions have pondered the graying of their membership. Now new research from J.D. Power suggests that they could lose whatever ground they’ve gained among Millennials and Gen Z.

The company’s 2025 U.S. Credit Union Satisfaction Study found that fees have become an irritation for members in general, but especially so for younger members. The study reports that 31% of members under 40 say that they “probably will” or “definitely will” leave their credit union in the next 12 months because of a fee they were charged. By contrast, 25% of members 40 and older indicated they were likely to leave.

Another reason for growing dissatisfaction among younger members concerns mobile apps — paradoxically even as credit unions have been laboring to upgrade their mobile offerings.

“For credit unions, digital services are so important, because many don’t have the extensive branch networks that many traditional banks have,” says Dann Allen, senior director of banking and payments intelligence at J.D. Power. “So any time you tamper with that convenience, it can really mess things up.”

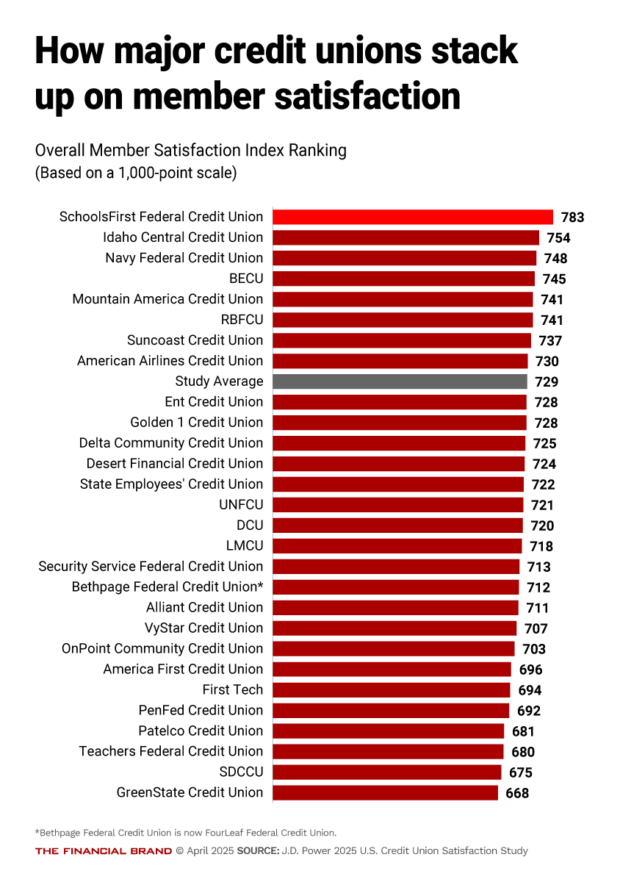

Ironically, these issues are playing out against a backdrop of favorable overall member satisfaction for credit unions. As shown in the chart below, the average rating is 729 for overall satisfaction, out of 1,000 points.

The credit union average in this study is 74 points higher than the average rating for banks in the company’s 2025 U.S. Retail Banking Satisfaction Study. Driving this difference is the superior performance of top-ranked credit unions, in providing member support and convenience. Credit unions as a group outperform banks in all facets of satisfaction measured by both studies.

The firm’s credit union study is in its first year of publication, with a limited first round effort having been conducted in 2024. Allen says a key reason for launching the new survey is that other J.D. Power research has found that 60% of the U.S. population has relationships with both a traditional bank and a credit union. At the same time, consumers will likely have greater credit union options as the industry eliminates legacy membership group requirements, Allen points out.

Why Are Gen Z and Millennials Talking About Leaving Credit Unions?

Allen, a retail banker by background, says that credit unions have a reputation for charging lower fees and paying higher interest than do banks. However, recent events may be eroding the first perception, especially troublesome when other J.D. Power research has found that two thirds of the population is financially unhealthy, particularly for under 40s.

Allen points out that when particular types of fees are examined, credit unions are not always the better deal. Examples are overdraft fees and non-sufficient funds charges. In these areas, in his experience, credit unions are charging such fees to more of their customer bases.

“Overdraft and minimum balance fees are factors that drive dissatisfaction,” says Allen. “They are the last thing that under 40s need, because they’re often struggling to get ahead already, and boom! They get hit with fees.”

Big banks began changing their policies on overdraft and related charges in recent years, even creating account types that didn’t permit overdrafts. Others came up with policies giving customers multiple ways to avoid overdrafts or cure them before fees were charged. Alerts have become a commonplace safeguard.

Allen says that credit unions didn’t react as quickly.

Over the course of the first, unpublished study and the 2025 edition, Allen says the credit union industry has begun catching up to what those large banks did. “Credit unions are not charging overdraft fees as much, but it’s still more than among the banks,” he adds. “I’ve talked to quite a few credit union executive teams and they know that this is something they need to address. Thus far they’ve been a follower.”

Among the metrics J.D. Power uses to measure customer satisfaction is how well an institution communicates on how to avoid fees and how easily members can find information on their provider’s fees. Allen says that among the under 40s, neither factor has been strong — especially notable because banks showed overall improvement in this area in the retail banking satisfaction study.

“So that’s an opportunity to improve,” he says.

“People are still going to be charged fees and they fully expect it when they know about it. But the worst thing you can do is have them get an unexpected fee because that has an enormous negative impact on satisfaction,” says Allen. He suggests that more personalization in communications about fees could also be helpful to both banks and credit unions.

Read more: How Personalized Financial Services Can Bridge the Generational Divide

When Redoing Mobile Apps, Familiarity Can Breed Contempt

With digital channels becoming more important to consumers, many credit unions have upgraded their apps or have upgrades underway, often partnering with fintechs, says Allen. In the long run, this may help many of them come up with revisions or enhancements that will make their offering more appealing to younger customers.

“One thing that surprised me was that credit union members, especially those under 40, showed a significant increase in completely understanding the mobile app. Usually when you understand the mobile app better, you are more satisfied with it,” says Allen.

But that’s not the case with younger customers. “They say now that they understand it more, they like it less,” says Allen. He thinks the cause is what he calls “app regression.”

Allen explains that when a credit union decides to upgrade an app to keep up with large banks’ offerings, there’s a time of reset. To the member, sometimes this means that in modernizing the app, valued features of the earlier offerings get left behind. Some functions that used to be available disappear. Typically they will be reinstated as the new app’s features are enabled.

In client meetings at credit unions, Allen says, he now stresses communication.

With all the expense of tech upgrades, there’s no point in building something to better satisfy members and then leaving them unhappy.

“Make sure you communicate the heck out of it,” says Allen. “Tell your members what’s coming and when it’s coming, and talk about the features and benefits. Don’t let them stew in a poor experience and think nothing better is coming.”

Source: THE FINANCIAL BRAND

Recent Comments