The top buy now, pay later providers in J.D. Power’s latest satisfaction survey are legacy card issuers. But fintech players have growing advantages — and smaller issuers are struggling to fend off both.

Banks and credit unions that haven’t mapped out their route into the buy now, pay later fray are running out of time.

The risk goes far beyond losing share of traditional credit card volume to buy now, pay later fintechs like Klarna and Affirm and payment powerhouses like PayPal. In Cornerstone Advisors’ “What’s Going On in Banking 2025” study, Ron Shevlin, chief research officer, points out that nonbank competitors hit the industry with double trouble.

First, banks and credit unions lose an indeterminate piece of credit card volume and outstanding, plus associated interchange income. Shevlin also points out that many BNPL users’ demographics suggest that they would use debit cards for purchases absent the instalment plans, also a source of interchange income. (And community banks and credit unions receive a higher interchange fee on debit card transactions than do larger institutions.)

“In addition, banks lose [even more] interchange fees when users pay their BNPL bills directly from their bank accounts, or with bank checks, prepaid debit cards or Venmo,” Shevlin writes. “This threat, if not reality, of lower interchange revenue is too much for banks to ignore.”

Statistics from recent research underscore the risk:

• Over one in 10 Americans — 12.6% — had outstanding fintech-based buy now, pay later debt in December 2024, according to a Morning Consult survey.

• As of fall 2024, 56% of U.S. consumers had used some form of pay-later finance, according to Pymnts.com research. In that study, “pay later” included fintech buy now, pay later, general purpose credit card instalment plans, and instalment plans tied to merchant store cards.

• Contrary to the historical stereotype that instalment payments are tapped mainly by lower-income consumers, Morning Consult has found that households with income under $50,000 are actually underrepresented among BNPL users.

• Multiple studies find that Millennials and Gen Z are twice as likely to use some form of pay later program. J.D. Power’s “2025 U.S. Buy Now Pay Later Satisfaction Study” found that younger consumers were twice as likely to use BNPL in some form — 42% versus 21%, respectively.

• In the J.D. Power research, the final wave of the study occurred during the 2024 holiday shopping season: “More consumers from Gen Z said they used BNPL instead of credit cards, which was the first such occurrence in the study’s history.”

BNPL Drives Buying Behavior, But Who Gets the Payments Volume?

Sean Gelles, senior director of banking and payments at J.D. Power, and an American Express alumnus, says his habit is to pull out plastic. But that’s not the case among his younger, Generation Z friends.

“They make all of their purchases over a certain amount on buy now, pay later products,” says Gelles. “When they hit their threshold, they say, ‘I used Klarna to buy this. I used Affirm to pay for that.’ I’d put it on a credit card, myself, but that’s not the way the wind is blowing.”

Morning Consult’s research has found a connection between young people’s use of BNPL — which is essentially a digital update of old-time layaway service (except you get the merchandise immediately) — and an age-old preoccupation: keeping up with the Joneses.

Both are tech-fueled. Morning Consult analyst Claire Tassin notes in her research that BNPL users frequent certain social media channels, notably Instagram, TikTok, Snapchat, Pinterest and Twitter. They buy into the lifestyle they see there.

Keeping up with trends means buying stuff. “BNPL offerings are tempting to spread out payments for that coveted pair of jeans or a living room makeover,” writes Tassin. “They’re less likely than average to say they tend to choose the more affordable option, so these small loans help them to spread out payments for their upgraded lifestyles.”

The Pymnts.com study found that clothing and accessories were the leading pay-later spending category — 42.1% of users tapped the services for that. The others in the top five: are groceries (35.1%), appliances (29.6%), consumer electronics (29%) and home furnishings (28.5%).

Jumpstarting Sales and Payment Volume with BNPL

BNPL stimulates sales volume and tempts consumers to spend more than they would have otherwise. That’s been a selling point of fintech BNPL lenders to merchants for years. Research released late last year in the Journal of Marketing analyzed the spending behaviour of 275,000 consumers shopping at an unnamed major U.S. retailer. In all, 75,000 people used a buy now, pay later option offered by the retailer, and 200,000 did not.

Researchers Dionysius Ang and Stijn Maesen found:

• Shoppers who tapped BNPL made a purchase more frequently.

• Those who did on average spent 20% more.

• BNPL’s attraction had staying power: Increases in buying lasted for nearly six months, “showing that BNPL drives lasting gains rather than short-term spikes in consumer spending.”

However, there can be a price to pay. The Pymnts.com research found that higher income can also breed higher spending and more debt difficulty. In the highest income demographic in its study, it found that 75% of people who “live paycheck to paycheck with issues paying bills” had used a pay later plan in the past 12 months.

An Edge for Traditional Players, But for How Long?

Interestingly, the Pymnts.com study found that pay later programs based out of general purpose credit cards— AmEx’s Plan It, Chase My Plan and Citi Flex Pay are examples — drove higher volume than fintech BNPL among surveyed consumers, more than 25% higher. The greatest impact was seen among Gen Xers, who used card pay later 36% more, and Gen Z, who used it 42% more.

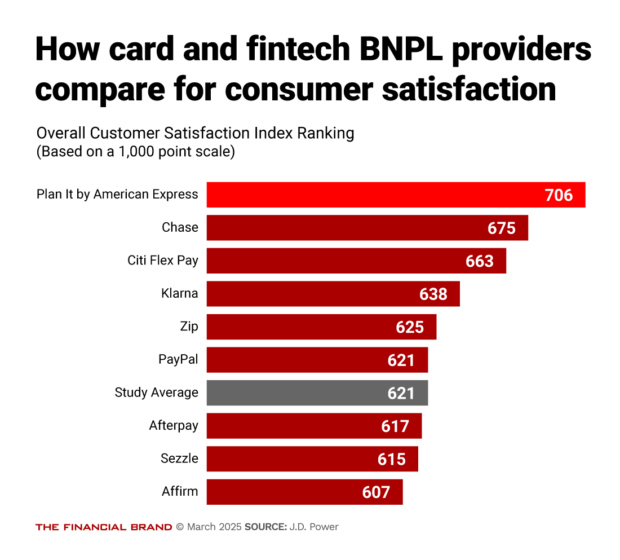

In fact, the J.D. Power research found, for the second year in the study, that traditional players, starting off with top player Plan It by American Express, led the satisfaction rankings.

J.D. Power’s Gelles says part of the reason these brands score higher on satisfaction levels is brand recognition.

“They’re going to have an advantage because they have customers, a captive prospect pool, and these folks are probably already leaning toward using something from their bank,” says Gelles.

But that advantage will erode, he believes, as Klarna, the top-ranking fintech in the list, and its fellow fintech players become a bigger part of the payments business and continue to broaden their services.

Further, Gelles says, part of the advantage for the higher-ranking players are the terms and conditions of the instalment plan. Customers who feel they were duped come away with a bad taste in their wallet. He believes clarity in the structure and offers is essential.

“Convenience is just table stakes,” says Gelles. “You’ve got to have a competitive product.”

A big part of the appeal of the fintech’s classic offerings — they have branched beyond no-interest pay in four plans — is that as rates went up, people began to have trouble managing interest on credit cards. Programs from all player categories have to be understandable.

The Journal of Marketing study found that managing money is a motivator: “BNPL’s ability to divide the cost of purchases into smaller instalments gives consumers a sense of greater control over their budget.” The idea of “bite size chunks” rather than a lump payment, even with extra time to make it, has more appeal, the study said.

Recent Comments